Could you be facing quarterly taxation money or another semester out-of tuition debts, or perhaps require some cash to handle your company expenditures? You are inclined to make use of their emergency coupons otherwise sell expenditures to discover the currency you need.

Give yourself specific borrowing from the bank

The brand new Edward Jones Personal line of credit is actually a beneficial margin financing pulled against the worth of the brand new margin-eligible assets on the account. To the Personal line of credit, their financial investments can also be still help you work with the your aims while you are providing once the a supply of equity to own borrowing from the bank you may want to use around certain criteria.

- Aggressive All of our pricing are among the most acceptable in the business and you can derive from the qualified assets significantly less than care.

- Much easier You can access the newest credit line each time by using good “Develop Your Financing” look at otherwise by contacting debt coach.

- Private There’s no credit check otherwise financing committee.

Is it suitable for myself?

When you’re there are many different potential uses for the personal Distinct Borrowing from the bank, it is important to understand whether it helps make the extremely sense so you can utilize this option in place of almost every other resources of borrowing from the bank.

- Short-identity financing (age.g., bridge funding to possess a mortgage, or a preliminary-identity you want up until an excellent Video game otherwise bond matures)

- Working-capital for entrepreneurs

- Studies investment

- Guidance to own friends

- House home improvements/fixes

- Goverment tax bill

Of many account are eligible to the Personal line of credit. Ineligible membership brands include, however they are not limited so you can, advancing years levels and you can particular advisory profile, like Edward Jones Advisory Options profile. Delight contact your economic mentor for additional facts about qualified account products and you will financial investments.

Once the cost agenda try versatile, there is always the requirement to pay back the mortgage, including focus, and you should weigh the risks of employing margin since the a credit line against the potential pros.

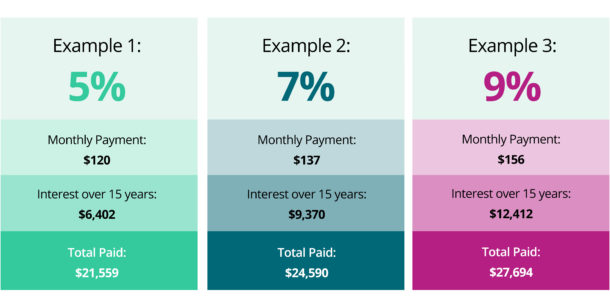

Dating size versus. loan dimensions cost

Very businesses base the speed into the measurements of the brand new financing, in our very own view this ignores payday loan White Hall the fresh breadth of your matchmaking i express. Edward Jones commonly ft your own rate of interest towards the sized the relationship you’ve got around. The more possessions you really have less than our worry, the low the cousin rate of interest for the a loan, regardless of the size of the loan was. Find out more.

Threats

An enthusiastic Edward Jones Personal line of credit was a great margin membership. Borrowing from the bank facing bonds has its own threats which can be not befitting folks. You could get rid of extra money than just your deposit about margin account. If for example the worth of their equity refuses, you might be needed to deposit dollars or extra bonds, and/or bonds on your own account tends to be sold to get to know the margin name without warning for you. You may not be eligible for choose which bonds or other property on your own account was liquidated or ended up selling to satisfy a great margin phone call. The company increases the maintenance margin standards any moment and/or not give an expansion of your energy toward a margin label. Desire will quickly accrue throughout the date of mortgage and become energized to your account. Available just into certain kinds of membership.

Our newest pricing

Get up-to-date details about our very own personal line of credit cost, in addition to the most current pricing into the licenses out-of deposit, All of us Treasury costs and other repaired-income investments. Find out more.

Exactly how we might help

Your Edward Jones economic advisor can help you see whether brand new Personal line of credit excellent solution to meet the borrowing from the bank means. Call your financial advisor today to learn more.