A special preferred Tx homebuyer system ‘s the TSAHC Domestic Nice Tx Financial program, hence has eligible average- otherwise reasonable-income consumers either a grant or an excellent deferred, forgivable second mortgage that can be used on the its advance payment. Because of the examining these certain solutions, you’ll have a far greater chance of shopping for what realy works ideal for you and gaining your perfect off homeownership from inside the Texas.

Real estate Actions

Begin by delivering a reputable look at the finances and you can choosing just how much family you really can afford, given just the price and in addition all aspects from homeownership. Some things to take into account on your own funds include:

- Monthly mortgage payments

- Advance payment

- Closing costs (generally speaking 2%6% of the property speed to possess customers, and additionally household check fees, title lookups, an such like.)

- Tx possessions fees

- Insurance premiums (each other homeowners insurance, which is necessary for mortgage brokers, and personal mortgage insurance coverage (PMI), which might be called for if your downpayment is actually lower than 20%)

- Maintenance expenditures (budgeting for one%4% of the home rates annually is a common suggestion, and having an emergency funds is definitely smart)

- You’ll HOA costs

Familiarize yourself with downpayment guidance found in Texas, including My personal Basic Tx Family otherwise TSAHC Home Nice Tx House, and keep an eye on financial rates of interest that will apply at your own monthly premiums.

If you have a concept of how big is out of a property mortgage you could potentially relatively deal with, the next step in the home-to buy procedure will be to begin shopping around to have mortgage brokers. When you’re prepared to pick a property next a few or three months, it is the right time to pursue a home loan pre-acceptance. But not, it is possible to discover a beneficial regional real estate professional very first.

Find the correct Real estate agent

When you can put on for pre-approval before you could correspond with a representative, then control a neighbor hood agent’s associations? A great Colorado real estate professionals can ascertain numerous reputable lenders one to obtained privately caused. A location home loan company has the benefit of your a bonus once the an excellent buyer-identical to a city real estate professional, a district bank knows your regional housing market.

That have a skilled local representative could also be helpful subsequent down the range, just like the they’ll possess contacts that have experts inside the relevant sphere, such as for instance local family inspectors, recovery designers, term enterprises, and a lot more. That have best preparation and help off educated advantages, to get a home in Colorado might be a flaccid procedure.

Finding the right real estate professional is crucial to achieve your goals within the new competitive Colorado housing industry. Work on somebody who has expertise in the fresh new neighborhoods you will be interested when you look at the and you can specializes in providing customers as you. Many agencies enjoys a niche they concentrate on, be it a form of household, a variety of customer (such real estate investors otherwise basic-time homeowners), otherwise a specific urban area.

Contrasting construction ple, get to know Austin’s business if that’s for which you are interested in order to learn whether it’s a very good time to blow truth be told there otherwise pick the median domestic price of communities you are interested in so you can thin down your options. Your own broker are certain to get experience in your neighborhood market’s models and can help you buy property during the right time so you’re able to save money.

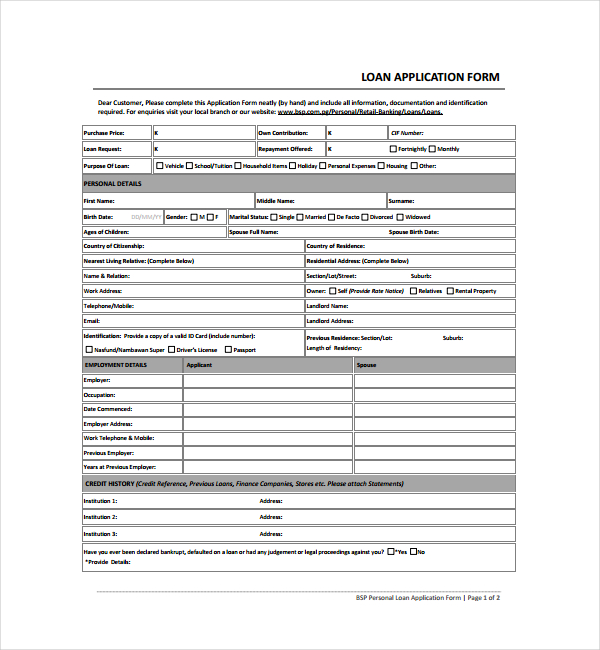

Pre-Recognition Techniques

Obtaining an excellent pre-recognition letter feels like that have a golden ticket yourself-to acquire excursion, whilst tells manufacturers your a https://cashadvanceamerica.net/loans/small-payday-loans/ significant and you may economically in a position to customer. The significance of pre-approval can’t be overstated, as it not just offers a plus over other potential customers vying for the very same possessions and in addition makes it possible to discover how much home you really can afford and you will refers to any potential hurdles so you’re able to qualifying to have a mortgage.