After you pick property, you prefer shelter to go right along with it. Home loan Life insurance coverage step one might help protect what’s more than likely certainly the family’s key property by paying from otherwise reducing your real estate loan in case of their passing.

Home loan Coverage is actually underwritten of the Canada Life Assurance Business (Canada Lifetime). Acquisition of that it insurance policy is elective and is not essential to help you obtain people CIBC product or service.

Your Home loan Coverage advanced is dependent on your actual age on go out of one’s insurance rates software, the first covered quantity of their home loan while the appropriate advanced price regarding speed dining table less than.

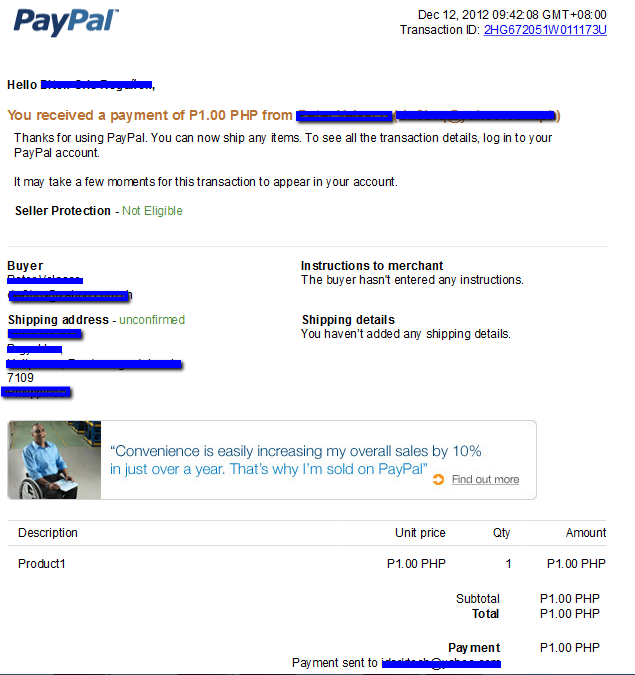

Financial Insurance monthly premium prices for each $step one,000 of one’s 1st insured quantity of your own mortgage (relevant taxes was put into the premium):

The monthly Mortgage Term life insurance advanced = the first insured quantity of their financial ? step one,000 ? relevant premium speed.

Crucial files

Your Certificate of Insurance coverage often hold the complete information on your own visibility, together with benefits, prices, qualification standards, constraints and you can exclusions.

Tip: Download the form by right-clicking the latest file and you will wanting Help save hook given that. You may then open they playing with Adobe Acrobat Viewer.

Facts about CIBC

CIBC obtains fees about insurance provider, This new Canada Existence Promise Company, for taking attributes on the insurance company regarding so it insurance coverage. Plus, the danger beneath the group rules can be reinsured, in whole or even in region, to an effective reinsurer associated with CIBC. The newest reinsurer brings in reinsurance income significantly less than which plan. Representatives promoting this insurance rates for CIBC will get discover payment

Frequently asked questions

- You’ve got answered No to applicable health concerns on the software; and

- Their CIBC Mortgage loan has been approved.

Throughout most other items, the newest insurance carrier (The fresh Canada Lives Guarantee Organization) commonly review the application. If for example the software program is approved, new insurance carrier often help you on paper of your own big date your insurance policies initiate. In case the software is maybe not accepted, the fresh new insurance company will provide you with an alerts of refuse.

Coverage could stop for many almost every other causes. To have a complete a number of reasons, relate to the brand new Certification of Insurance for CIBC Mortgage loans (PDF, 310 KB) Opens up inside a separate windows.

A life insurance policies work with are not paid off if the:

There are other restrictions and exclusions. To have an entire number, make reference to the Certificate away from Insurance policies having CIBC Mortgages (PDF, 310 KB) loans Nectar AL Reveals within the a new screen.

30-date opinion several months:

You may have a month in the day you receive your own Certification away from Insurance rates to review their publicity and determine if this meets your position. If you terminate your own visibility in this 31-big date feedback period, you are going to discover a full reimburse of every premiums repaid.

Start

For more information regarding the device terms and conditions or after that direction, label CIBC’s Collector Insurance Helpline in the step one-800-465-6020 Opens up their cell phone software. .

Fine print

step 1 Home loan Coverage are a recommended creditor’s group insurance underwritten because of the Canada Existence Warranty Company (Canada Existence) and you may administered by the Canada Lifestyle and you can CIBC. CIBC receives fees regarding Canada Life getting getting features so you can Canada Lifestyle off which insurance policies. Including, the risk in class insurance plan is reinsured, in whole or perhaps in area, so you’re able to an effective reinsurer affiliated with CIBC. The fresh new reinsurer produces reinsurance income lower than it arrangement. Representatives creating which insurance on the part of CIBC will get found compensation. It insurance is susceptible to qualifications criteria, restrictions and you will exclusions (which happen to be issues when benefits is restricted or perhaps not repaid). To your complete small print, opinion new take to Certificate out-of Insurance rates (PDF, 275 KB) Opens up from inside the a unique windows. . You’ll be able to get in touch with Canada Existence from the step one-800-387-4495 Reveals their mobile software. . O roentgen you can travel to canadalife Opens in a new windows. . What in these profiles is general simply. Services their has actually could possibly get alter when. In the event of difference within pointers and you will advice considering on the this page plus Certification off Insurance coverage, their Certificate away from Insurance policies is present.