Rates of interest were rising prior to now year or so – for the handmade cards, mortgages, or any other financial products including house security money and you can family collateral credit lines .

Nonetheless, that does not mean these products try fundamentally bad suggestions today. Indeed, for almost all residents, taking right out a home security loan these days could possibly end up being a sensible circulate.

Is this a great time to get a home equity loan? Masters weigh-in

Some tips about what pros must state on the if this is actually the right time to obtain property security financing.

Sure… once the home guarantee enjoys most likely maxed away

“If you’ve had your residence for a few age and its worth has increased since your get, you have likely situated-right up collateral,” claims Hazel Secco, president away from Line up Financial Alternatives from inside the Hoboken, Letter.J. “This enhanced domestic well worth will bring a solid basis to own protecting an effective domestic equity loan.”

However, you to huge chunk out-of security will most likely not continue for enough time. With high financial prices driving down customer request, home values – and, by extension, domestic collateral – you’ll fall, as well. It indicates you might need certainly to operate in the future when deciding to take advantageous asset of their collateral during the their maximum.

“For anyone seeking to tap domestic collateral, now’s an enjoyable experience to seem in it, considering the fact that home prices may well not score much better towards the foreseeable future,” claims Michael Micheletti, master business officer home collateral investor Discover.

Domestic guarantee money are not wise if the you will have to promote the house soon, since if your house falls inside the well worth between on occasion, it could “cause a position known as becoming under water,” Secco claims, “where in fact the a fantastic mortgage equilibrium is higher than the fresh new residence’s economy value.”

When you’re under water in your financial, promoting your home would not websites your adequate to repay your own financing, and you will find yourself due their mortgage lenders to the kept outstanding stability.

If everything you need to pay for – house solutions, medical costs, or other debts – was inevitable and you will perform if not carry on credit cards, personal bank loan, or some other form of higher-focus obligations, a property guarantee financing is probable a better options. Since the Secco throws they, “Most other financing rates of interest aren’t very tempting at this time.”

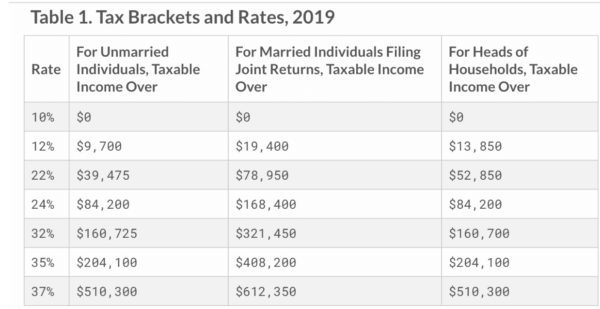

She actually is best: The common loans Axis AL bank card speed is more than 21% today, compared to 8 to ten% you can find on a property collateral mortgage. Unsecured loan prices has topped a dozen%.

“It will be the alot more financially advantageous possibilities as compared to taking out fully a good unsecured loan or depending on mastercard borrowing,” Secco says.

No… in case your credit’s not great

Like with very lending products, your credit score performs a big character in not merely qualifying having a property equity mortgage – but what rate of interest you earn using one, also. Of course, if your credit score try low, you’re likely to score a higher level (and you will after that, a top payment, too).

“When the another person’s credit does not qualify them to discover the best rates, money would be too much into homeowner’s funds,” Micheletti states. “We’re watching a lot more credit firming now, as well, which makes it much harder to possess property owners to help you be eligible for loan products and for the best pricing.”

You might usually look at the get throughout your lender otherwise borrowing card company. To find the reasonable cost, you will usually require a good 760 credit rating or higher.

Yes… for those who have a great amount of high-interest loans

While the domestic equity financing enjoys down rates than other economic circumstances, capable always be recommended to own consolidating obligations. If you had $ten,000 into the a credit card having a beneficial 21% rates, such as, playing with an enthusiastic 8% family collateral loan to pay off you to balance could save you a good deal in interest can cost you.

Bank card rates is variable, also, which means your cost and you may money can also be increase. House collateral loans you should never feature this exposure.

“Family guarantee loans render repaired rates,” Micheletti claims, “to make sure people the speed cannot rise when you look at the term of the mortgage.”

No… should your money is actually unstable

Fundamentally, for those who have erratic money and you will aren’t sure you could easily take on an extra payment, a house guarantee mortgage probably isn’t the better move.

Since the Micheletti places they, “Discover a threat of putting their residence into the property foreclosure if they skip money for the mortgage.”

Look around for your house security loan

You can purchase a house security mortgage or HELOC from many banking institutions, borrowing from the bank unions and you may lenders. To make sure you’ll receive a knowledgeable rate , usually examine at the very least a few options.

Evaluate costs and closing costs, too, and be careful to only obtain what you want. Borrowing too much can result in needlessly high payments, and therefore grows their risk of foreclosures.