No deals are needed. The lending company entirely cash the acquisition of your new home. What you need to worry about is the monthly home loan repayments. Music higher, doesn’t it?

These money have the potential to enable it to be customers so you’re able to secure good property you to other banking companies won’t envision offering them that loan toward. Along with Cayman’s most recent market, it is sometimes the cash advance Gainesville Gainesville AL only method somebody log on to the fresh assets ladder.

Additional Bills

The reason being the interest rate from which the bank have a tendency to charges you attention is a lot high. So what you wind up make payment on financial overall desire (the amount of money paid in addition price over the term of your financing) is a lot higher.

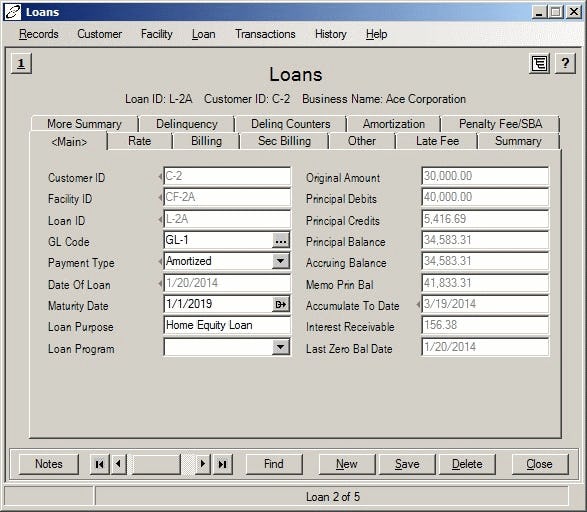

Less than is actually an area by the front testing from 100% money and you can a fundamental mortgage. This case is dependant on previous rates to invest in an enthusiastic Isabela Locations property parcel, indexed in the CI$30,700 regarding the Cayman Brac.

The bank try whenever greater risk whenever giving 100% capital. As a result, they fees a high rate of interest to be certain they make the cash return. Therefore while you don’t have to offer funds initial, you at some point shell out much more towards the property.

The pace and also the full attention along the financing name are merely a couple points you really need to think when you compare investment options. Getting general information regarding mortgage loans, I encourage one to comprehend my personal past blogs: Mortgage loans in Cayman.

Extra Time and Stress

To me, the latest institutions giving 100% money mortgages find yourself postponing possessions sales. The length of time anywhere between in the event your Give is recognized in order to the fresh new Closing go out was much longer and sometimes much more exhausting – for everyone parties on it.

If it is not a local Class A bank on Cayman Islands, even “pre-approvals” dont always be certain that your financing. Your loan app need mix several desks, and in some cases, come-off-isle before they can prove the loan.

Ugly Proposes to Manufacturers

Suppliers will be contrasting your own Render to order to help you anybody else. However, rate may be the largest choosing grounds, however the amount of standards, the fresh timeline to close, and types of investment can be dictate whether or not a merchant welcomes an offer.

The time and you will worry that is included with 100% financing mortgages you will definitely dissuade sellers away from taking the Promote. In short, the lending company you choose can be put you at a disadvantage.

As the a purchaser, this may become discriminatory. Why must the vendor proper care where you are getting the financing away from? Lay your self regarding Seller’s boots. If they execute the newest profit of their property within two weeks in the place of five days and prevent unforeseen affairs, delays, and you will fears, upcoming without a doubt, they’ll stick to the most easy Render. They should draw their house from the industry as you sort out your requirements go out which are often lost in the event the financial isnt approved.

Put However Necessary

A deposit, otherwise just what certain may telephone call serious money, is where people inform you vendors they are certainly not merely throwing away time. It is similar to a security put to the income alone – in the event the selling knowledge, you get your money back while you are approved to possess 100% money. But not, you still need to obtain the money on the membership, willing to lay out after you build your Offer into the provider. These finance is actually upcoming held inside escrow (an alternative holding membership) up until the assets exchange is finished. Regrettably, this is not unusual, especially for earliest-time customers, enticed by the 100% capital throughout the bank, to overlook wanting finance towards deposit.