You may possibly have read you to definitely are made, mobile, otherwise modular homes aren’t able to feel funded with a vintage financial. Which is real! Although not, if you are searching to purchase a cellular otherwise are created household into the leased homes, you may need to consider chattel money. Chattel financing are a variety of financing designed particularly for are designed house which are not attached to a long-term foundation.

In this article, we’re going to take a closer look in the just what chattel mortgage try and you will how they functions, also a few of the advantages and disadvantages of employing these types of investment.

Preciselywhat are Chattel Money?

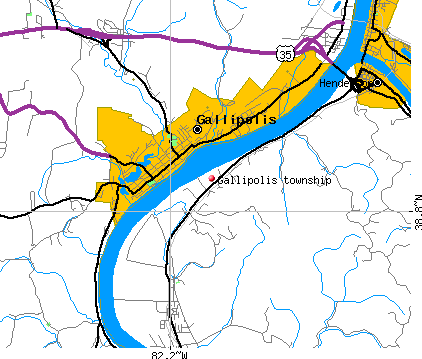

Chattel financing try a form of loan accustomed fund individual assets, such as for instance a cellular house, are formulated house, or Delaware payday loans modular home. In terms of are built property, chattel fund can be used when the residence is not connected to a permanent base which will be instead situated on rented residential property. It is because property that are not connected to a permanent base are thought private property unlike a house.

With good Chattel Home loan, the debtor retains advantage control since the lender keeps an effective lien up until the mortgage are totally repaid. Talking about very popular getting obtaining that loan to possess a property for the leased home or residential property that have a lot fee. Chattel mortgages can also be well-known operating and you can commercial lending, specifically for gadgets, vehicles, or any other movable assets (such an auto otherwise watercraft).

How can Chattel Mortgage loans Really works?

Chattel mortgage brokers functions much like other sorts of finance. The lender offers the money you need to purchase the are manufactured family, and you may pay back the mortgage over the years that have interest. The amount you can use therefore the interest possible spend is dependent on many activities, together with your credit rating, income, therefore the worth of your house.

You to main point here to remember is that chattel home loans generally include high interest rates than simply antique mortgages. It is because they are sensed riskier to possess lenders, once the home is not linked to a long-term basis and therefore may be much harder in order to resell for people who default on our home mortgage.

Due to the uniqueness of these mortgage points, there are some a bit other certification metrics. When you’re most the newest acceptance will be based upon the specific home that’s becoming financed, there are still certain general conditions and guidance expected by the borrower:

step one. Down payment

Minimal down payment necessary for a great Chattel Loan is actually 5% of your purchase price; not, you may need a top credit history and you will low personal debt to income ratio to do this. If not extremely advance payment criteria of these money was ten% of one’s price.

dos. Maximum Obligations-To-Earnings Ratio

Most old-fashioned loan software accommodate a much higher financial obligation to help you income proportion. Unfortunately to the Chattel Funds, the requirement is much more rigorous because the parcel charge can alter through the years and the financial needs to make up one added exposure. Really people need keep the front end personal debt so you can income ratio at the % and their backend proportion from the 43%.

You need to remember that the newest maximum mortgage title into a great Chattel Loan are 20 years that’s much different opposed so you’re able to antique mortgages making it possible for 29-year and you may forty-seasons words.

step three. Credit score Standards

In terms of credit history, i don’t have a miraculous matter on these as with any mortgage, the higher the new score the greater while the it’ll allow you to qualify for less interest. Yet not, you generally wish to be from the an effective 640+ to have the greatest attempt from the being qualified to suit your state. Chattel Fund is also commercially wade only a good 550 borrowing from the bank rating but it’s much, much harder locate an approval at that mark.