Pete Rathburn are a duplicate editor and truth-examiner which have experience with business economics and personal money and over twenty years of experience in the fresh class room.

What is actually an Assumable Financial?

A keen assumable home loan is a type of home financing arrangement in which a great mortgage and its particular terms and conditions is actually transferred in the current owner towards the consumer. Of the and in case the last owner’s kept debt, the customer can avoid acquiring their financial, that could feature high interest levels. Different varieties of financing can qualify once the assumable mortgage loans, although there are unique considerations to consider.

Secret Takeaways

- A keen assumable home loan is actually an arrangement where an outstanding financial and its words try moved regarding the current owner so you’re able to a great client.

- When interest levels go up, an enthusiastic assumable home loan is of interest to a purchaser which performs a preexisting loan having a lowered price.

- USDA, FHA, and you may Virtual assistant financing is assumable when certain standards are came across.

- The customer need not be a military member to imagine an excellent Va financing.

- Buyers need to however be eligible for the borrowed funds to visualize they.

Insights Assumable Mortgages

If you’re to acquire a home, you can also sign up for a home loan off a lender so you’re able to loans the acquisition of the property or assets. The contractual contract for paying the borrowed funds comes with paying the principal money and additionally interest for the lender.

If you opt to sell your home later, you will be able to import the loan towards the homebuyer. In cases like this, the first mortgage applied for are assumable.

An enthusiastic assumable home loan lets a beneficial homebuyer to imagine the current dominant equilibrium, interest rate, payment months, and every other contractual regards to the seller’s financial. Rather than going through the strict procedure for obtaining a home loan regarding a financial, a purchaser usually takes over an existing financial.

There is an installment-rescuing advantage when the newest interest levels is higher than the interest rates towards assumable financing. In a time period of rising rates of interest, the price of borrowing and expands. In such a case, individuals commonly deal with large rates of interest towards any loans wherein he could be acknowledged.

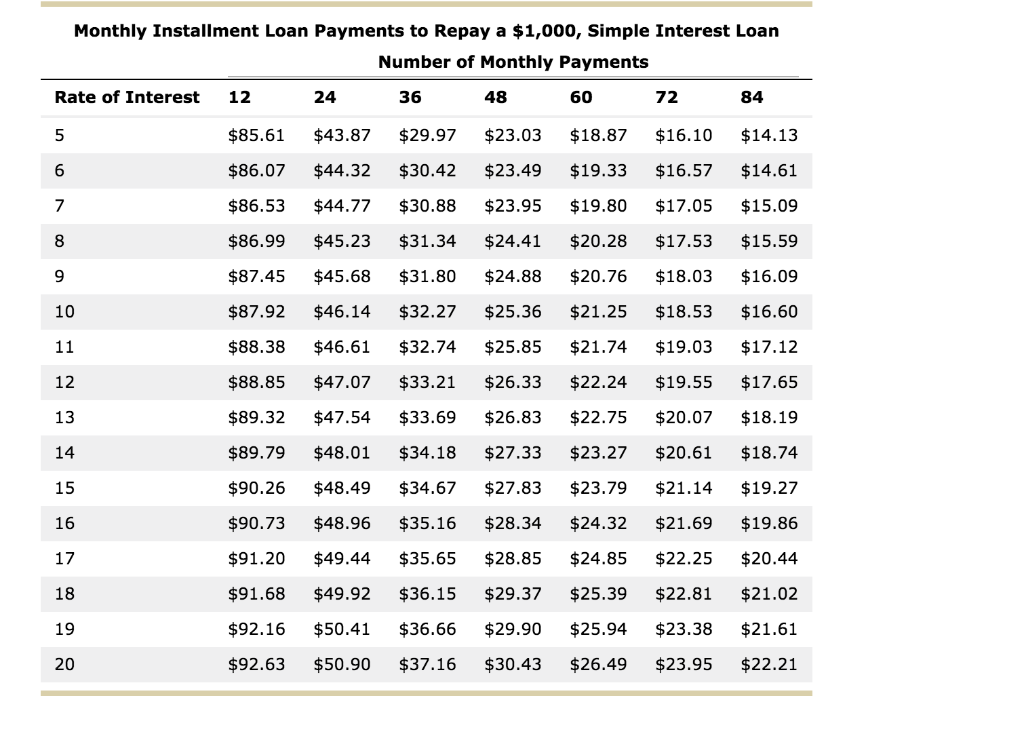

An enthusiastic assumable mortgage have less interest, a stylish feature to consumers. In the event the assumable mortgage keeps a predetermined rate of interest, it won’t be affected by ascending interest levels. A mortgage calculator should be a good funding to help you cover the brand new month-to-month price of your commission.

What kinds of Loans Is actually Assumable?

- Government Casing Authority (FHA)

- Experts Items (VA)

- You.S. Department from Agriculture (USDA)

If you’re a buyer who want to assume home financing off a seller, you need to fulfill particular requirements and you may discovered recognition regarding department supporting the loan.

FHA Fund

FHA fund was assumable when both sides be considered getting the assumption. By way of example, the house or property must be used by seller as their no. 1 quarters. If you were the customer, you ought to very first check if the FHA mortgage try assumable and you may following pertain as you perform for anyone FHA financing. Brand new seller’s lender have a tendency to find out if your meet with the official certification, also getting creditworthy. When the acknowledged, you will then guess the borrowed funds. not, up until the seller happens on financing, they are nonetheless responsible for they.

Virtual assistant Funds

The fresh new Department away from Veterans Points even offers mortgage loans so you can certified military members and you may partners out-of armed forces participants. Although not, to visualize an excellent Va loan, you need not getting a member of the newest army in order to qualify.

Just remember that , the lending company together with local Va loan place of work will need to accept you on the loan presumption https://clickcashadvance.com/payday-loans-wa/. Along with, the seller may want to undertake a deal regarding a professional military borrower so they can remain their Va mortgage entitlement for another domestic pick. If not, the fresh entitlement stays towards property till the mortgage was reduced regarding.