- Credit Questions: A cards inquiry requests credit history information from a card bureau. Economic groups perform borrowing questions to decide whether or not to agree a good borrower for a loan. The financial institution works a difficult credit assessment just in case a debtor applies to own a property equity loan. A boost in comprehensive borrowing from the bank issues results in a credit rating elizabeth style of mortgage contained in this 14 so you’re able to a month is regarded as just one query, lessening new influence on fico scores.

- The newest Borrowing: Brand new credit describes the fresh borrowing from the bank membership on the credit history, such as for instance new playing cards and you will home collateral financing. A property security mortgage is a unique credit membership regarding the credit report. The fresh credits impact the FICO credit score of the affecting 10% of credit score while recovering over the years because mortgage ages.

- Borrowing from the bank use: Borrowing utilization try a dimension you to definitely means exactly how much of good debtor’s available borrowing is actually explore. Credit usage is crucial within the calculating the financing score, creating more than 31% of FICO rating and you may a life threatening adjustable immediately after commission history. Credit file need to screen a varied mix of loans and you will borrowing from the bank notes, whilst affects ten% of the FICO rating. A home collateral financing facilitate improve the borrowing blend and surely affects credit ratings.

- Variety off accounts: Range from membership refers to the certain borrowing profile provided with the the credit declaration. An assortment of credit levels support the credit score, showing loan providers you to definitely a borrower protects more borrowing responsibly. Property guarantee financing advances the diversity out of levels from the credit reports, improving the financing score.

The distinctions between a home collateral mortgage to help you HELOC was financing disbursement, interest stability, installment structure, and you can independence. Household guarantee fund and you can Domestic Security Credit lines (HELOCs) allow it to be property owners to help you borrow secured on the house’s collateral. Home equity money provide a lump sum upfront, repaid through repeating installment payments more a set name, putting some loan predictable and you will steady having high, singular expenditures eg high family restorations or merging bills. An effective HELOC loan qualities such as for example a charge card, offering a good revolving personal line of credit having varying rates and you may higher versatility to ongoing expenditures otherwise not sure strategies for example studies otherwise crisis finance.

A lender grants a borrower a predetermined-title financing in line with the residence’s guarantee. Borrowers get a set count and receive the money upfront, having a predetermined rate of interest and you will payment agenda. A moment financial works particularly a conventional repaired-rates mortgage but needs sufficient equity in the home in order to meet the requirements. The first home loan must be reduced sufficient.

Property Security Credit line (HELOC) loan spends a good homeowner’s house given that collateral, making it possible for the fresh debtors so you’re able to use doing a specific amount facing the house’s well worth. Debtors pay only the attention toward number borrowed and you may pay off the rest contribution in the event that loans appear.House guarantee finance has repaired interest levels, repaired money, and you may a lump sum payment, the change out of domestic equity mortgage to help you HELOC. HELOCs has variable minimum commission amounts. Family guarantee finance need instant installment in the normal installments, whenever you are HELOCs allow it to be attention-simply payments inside the borrowing from the bank months. HELOCs create numerous distributions from an optimum number and you may request cost in appeal-merely payments, whenever you are house security fund offer lump sum disbursement.

Why does a home Guarantee Mortgage Functions?

- Family security loans promote all the way down rates of interest than personal loans otherwise credit cards, ensuring that monthly obligations is actually predictable compared to the most other financing.

What are the Conditions getting Home Equity Fund?

- Indication the fresh new closing data. Indication new closing files outlining the fresh conditions, interest, cost schedule, and you may fees. The mortgage cash is given to this new borrower from inside the a lump contribution shortly after finalizing the newest files.

- 3rd Government Offers & Loan: Third Federal Deals & Financing try an ohio-based financial providing domestic equity money and you can personal lines of credit which have no undetectable charges, closing costs, and a straightforward on line app processes. The financial institution promises to conquer any lender’s speed otherwise afford the borrower $1,000. Third Government Offers & Loan now offers family equity funds that have a minimum Apr of seven.29% for five-12 months family guarantee financing. An payday loans Bogus Hill effective 10-season home equity loan features at least Annual percentage rate of 7.59%, eight.79% having an effective fifteen-seasons, and you can seven.99% getting a beneficial 20-year, allowing debtors so you can borrow ranging from $10,000 and you may $three hundred,000. 3rd Government Offers & Loan doesn’t in public disclose the minimum credit score needs, despite loan providers requiring at least get of 620.

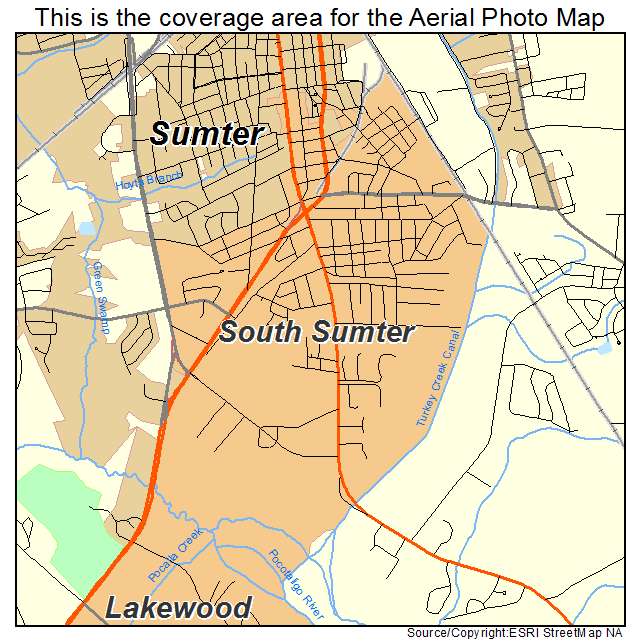

- Geographic Items: Geographic venue influences the brand new prices, as the lenders bring additional costs predicated on condition rules and you can market criteria. Verify that the lending company works in the debtor’s area and you may knows state-particular restrictions. The new recognition procedure comes to evaluating creditworthiness, home really worth, and other monetary what to determine ount.

Figuring monthly installments having family equity becomes necessary having cost management, loan assessment, focus cost, loan title commission, and you will amortization schedule. Budgeting allows consumers to learn just how much of its income try used to pay-off the mortgage, guaranteeing cost versus overspending. Payment per month computation facilitates mortgage review, just like the different lenders give differing rates of interest and you may terminology, allowing borrowers to find the most competitive loan option.

Property guarantee loan was a secured loan, and thus the house is employed just like the guarantee, and failing to generate repayments punctually throws the property from the risk. Lenders haven’t any direct limitations toward playing with funds yet provide specific standards having giving property guarantee loan, eg the very least credit score, a max loan-to-value proportion, and you will a particular money.