Antique funds is a popular replacement FHA fund. Unlike FHA loans, they’re not supported by the government, which means they can features some other criteria and a lot more self-reliance in the certain areas.

Like, traditional funds don’t have the exact same property restrictions just like the FHA loans, causing them to the right selection for men and women seeking spend money on leasing features otherwise get a second family. Although not, they often need a higher credit score https://paydayloansconnecticut.com/thompsonville/ and you may a larger off payment.

Va Funds

A good Va mortgage could well be a good solution if you find yourself a veteran, active-responsibility provider member, otherwise an eligible loved one.

Va financing, supported by the new Agencies off Pros Things, commonly give favorable conditions, such as no down-payment no individual financial insurance rates (PMI).

They also lack a certain code out of leasing income or buying numerous qualities, making them a whole lot more flexible for these seeking to circulate without selling the most recent domestic.

USDA Finance

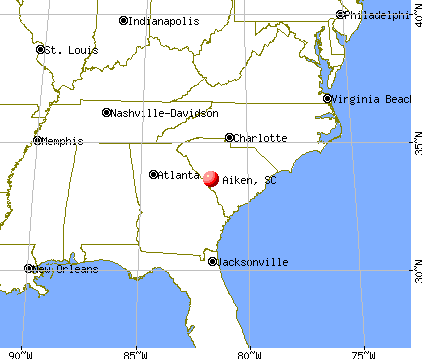

USDA loans is going to be a nice-looking choice for homeowners in rural components. This type of finance was backed by the us Company from Farming and tend to be built to offer homeownership inside the smaller densely inhabited section.

They supply advantages eg zero down-payment and lower mortgage insurance policies will set you back. not, they are available having particular qualifications requirements linked to income plus the property’s venue.

Portfolio Funds

This type of finance could offer significantly more freedom off underwriting criteria, leading them to a great fit having individuals with exclusive issues, eg a residential property people otherwise people with changing revenues.

HELOC or Family Collateral Financing

If you currently own a house and also accumulated equity, a home equity personal line of credit (HELOC) otherwise property equity financing you can expect to supply the loans necessary for your brand-new household get.

These types of possibilities allows you to borrow against the security on your own present assets. They may be particularly of good use if you sooner intend to offer your current domestic but need money.

Non-Qualified Home loan (Non-QM) Financing

Non-QM fund are designed for individuals that simply don’t fit the average credit criteria. Such you will is self-employed someone or people with non-conventional money provide.

Non-QM finance could possibly offer a whole lot more flexible income confirmation process but commonly include highest rates of interest and downpayment criteria.

To help clarify these types of subject areas, there is amassed a summary of Faqs (FAQs) that address a number of the a lot more nuanced aspects of this laws and its influence on FHA mortgage borrowers.

Must i rent my current house in FHA 100-Distance Laws as opposed to affecting my the newest FHA financing?

Yes, you might rent your existing home, in case it’s within 100 miles of your brand new home, the new leasing earnings is almost certainly not noticed on the the fresh new FHA loan degree.

Really does the fresh 100-Distance Code implement when purchasing one minute household just like the a vacation possessions?

FHA financing are mainly getting first residences. If you’re to order a vacation family, the latest 100-Distance Laws for having two FHA funds generally does not use, because the FHA money aren’t meant for vacation features.

Just how is the 100-distance point measured towards laws?

This new 100-mile length is normally counted in a straight line (“due to the fact crow flies”) from your own latest number one quarters into the the residence.

Can you imagine We move around in getting a career below 100 kilometers aside?

When your employment relocation was less than 100 far away, you might deal with challenges from inside the being qualified for the second FHA financing, given that 100-kilometer Rule carry out essentially not use.

Must i focus brand new FHA’s decision if the I am denied that loan considering the 100-Distance Code?

If you’re i don’t have a proper attention processes, you might check with your lender getting advice on your position. They could suggest choice documentation or loan possibilities.