Family collateral credit lines (HELOCs) was a well-known treatment for eliminate guarantee from your home. Because a mortgage loan, an excellent HELOC do impression your credit score; but not, the type of perception it can provides differs from homeowner in order to homeowner. Learning how HELOCs apply to credit makes it possible to prepare and keep proper credit history.

Just how a great HELOC could affect your credit score

- A HELOC is actually damaged to the a draw months and an installment several months which have huge monthly payments generally asked in payment several months.

- Perhaps not while making monthly premiums with the good HELOC could possibly get lower your borrowing from the bank get.

- Playing with equity out of an excellent HELOC to settle other loans get improve your credit rating.

HELOCs apply to fico scores in almost any implies, ranging from how you have fun with cash away from an excellent HELOC into credit combine after you romantic their HELOC. Having the ability an effective HELOC really works could be the first faltering step in order to help preventing one extreme bad affects towards credit history.

How come a HELOC performs?

A great HELOC works a lot more like a charge card than just a traditional home loan. Instead of a property equity financing, you don’t discovered a lump sum of money. Rather, obtain a personal line of credit which you draw off while in the the fresh draw months, which persists a decade but can disagree based on their bank. The financial institution typically needs borrowers to spend appeal only for the mark months. However, consumers tends to make money toward the main if they always.

While the draw period is more than, this new fees period initiate. The phrase to the installment months can vary ranging from loan providers, but it is generally speaking 2 decades. You are going loans Kirk to make principal and you will interest payments in the installment several months considering the outstanding harmony at the end of the fresh new draw period as well as the HELOC’s rates.

How come an effective HELOC connect with your credit score?

Such as, somebody who cannot make monthly payment timely will get a belated fee put in the credit report, that may adversely perception their credit rating. not, a person who can make at the least the minimum payment per month on time plus complete get an eye on one to placed into its credit report, and that may help enhance their credit through the years.

Something to note is that while HELOCs was a great revolving credit line, there’s a possibility that in some cases money removed having good HELOC may not perception your own borrowing from the bank usage.

Credit utilization is the overall borrowing from the bank make use of prior to brand new total borrowing you can access, portrayed as the a portion. Such as for example, when you have one or two handmade cards having a maximum of $twenty-five,000 within the offered credit therefore actually have $2,500 inside charges on your cards, in that case your usage could be 10%.

When you yourself have credit card debt which you pay playing with a good HELOC with this particular feature, your own borrowing from the bank application could possibly get drop-off. And if that you do not spend more money on people cards, having fun with a great HELOC in that way could potentially make it easier to boost your rating. Observe that while in some cases fico scores may not grounds HELOCs to the borrowing from the bank usage, good HELOC get feeling your credit rating in other suggests.

Do a beneficial HELOC hurt the debt-to-earnings ratio?

Since you draw throughout the account, a beneficial HELOC affects the debt-to-earnings (DTI) ratio. Yet not, if you haven’t stolen to your HELOC in addition to harmony are $0, your own HELOC will not more than likely affect your DTI proportion.

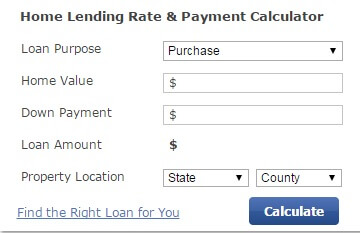

Finding out how an excellent HELOC influences your own DTI proportion helps you prepare if you are planning toward borrowing currency once again ahead of settling the HELOC. Particularly, when you find yourself searching for a different household certain decades after, preserving your DTI ratio reduced may help you safe a far greater home loan price.