Devoid of the necessary money to fund every initially can cost you can be a beneficial dampener towards domestic purchase arrangements. That isn’t necessary to feel the whole corpus within the an individual’s bank account since unsecured loans will always be an option. But not, women who are just getting started inside their professions must not ensure it is by themselves to-fall as well deep to your a card pitfall.

Whenever they avail of a consumer loan to afford very first can cost you out of a home get, it ought to be on the minimal you’ll the amount in order for payment does not feel an issue on top of upkeep the home loan. It is always best to fool around with totally free and clear financial support because much as possible.

2. Certain from the monthly outgoings

Anybody eyeing a property pick is to basic ascertain the new monthly mortgage and you will whether or not they can manage they. Online mortgage hand calculators are a good idea, nevertheless they simply let you know the worth of the primary and related interests.

There are many more month-to-month expenses employed in homeownership, and these were insurances, fees, repair charges, power fees why not check here, an such like. Having operating single women, it is important that all of these number assembled dont surpass 35 in order to 40% of their net income.

Dont neglect to ascertain your general cost of living before carefully deciding about large a mortgage you could potentially properly services, and continue maintaining planned one property is maybe not the actual only real resource you have to make to your constant financial safeguards. You should also set at the very least 10% of one’s month-to-month money towards a pension package.

Often, a full effects of obtaining over-committed on a mortgage do not dawn with the debtor until the home loan has been serviced for many days. At that time, its too late to change new financial bundle. When it comes to a house buy, all the monetary direction need to be looked at far ahead of time.

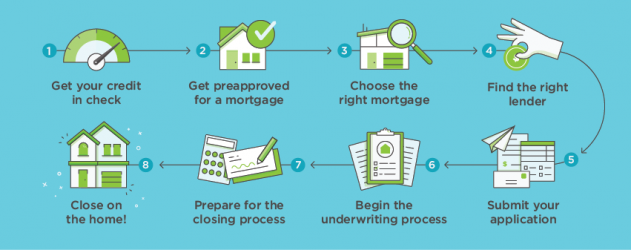

4. Check around widely for home loans

It’s very advisable to use a talented monetary planner or rely on the new advised pointers out of a family member, friend otherwise associate who’s experienced in such as things. The entire process of to order a dream family shouldn’t grow to be an urgent nightmare any kind of time section.

Homeownership is a superb step ahead inside a good female’s existence, and towards the independence on your own retirement age. But your first house is never the only house you is ever going to buy.

Keep in mind that you can always change afterwards if required otherwise wished, generally there is completely you don’t need to find the biggest you’ll apartment today. Never compromise your existing financial viability by purchasing a needlessly high priced home.

The house you live in now really does never have becoming the only you are residing in once you retire. In terms of a property, it usually is a good thing so you’re able to posting because the financial ability improves, however, this step can be and must feel arranged out over new entire span of a person’s doing work existence.

To own a woman who’s at the beginning of their profession, there is nothing more important than economic stability for each front side. So you’re able to policy for updating to a more impressive and higher house subsequent in the future, it is rather better to dedicate (and get spent) into the repaired places otherwise mutual loans and therefore send much more output than coupons account.

Direct stock-exchange speculation to the solitary business stocks and you will securities because a possible way to obtain a home money will be stopped, as a result investments aren’t good enough diversified to provide a safety web however if a buddies experiences a great downturn.