Of a lot more mature residents normally think a few mortgage situations once the tools to supplement their old age, an excellent HECM or an effective HELOC. While each other products allow the debtor to steadfastly keep up ownership on their domestic and you can supply a credit line, there are certain trick differences borrowers ought to know regarding ahead of proceeding which have good HECM otherwise HELOC.

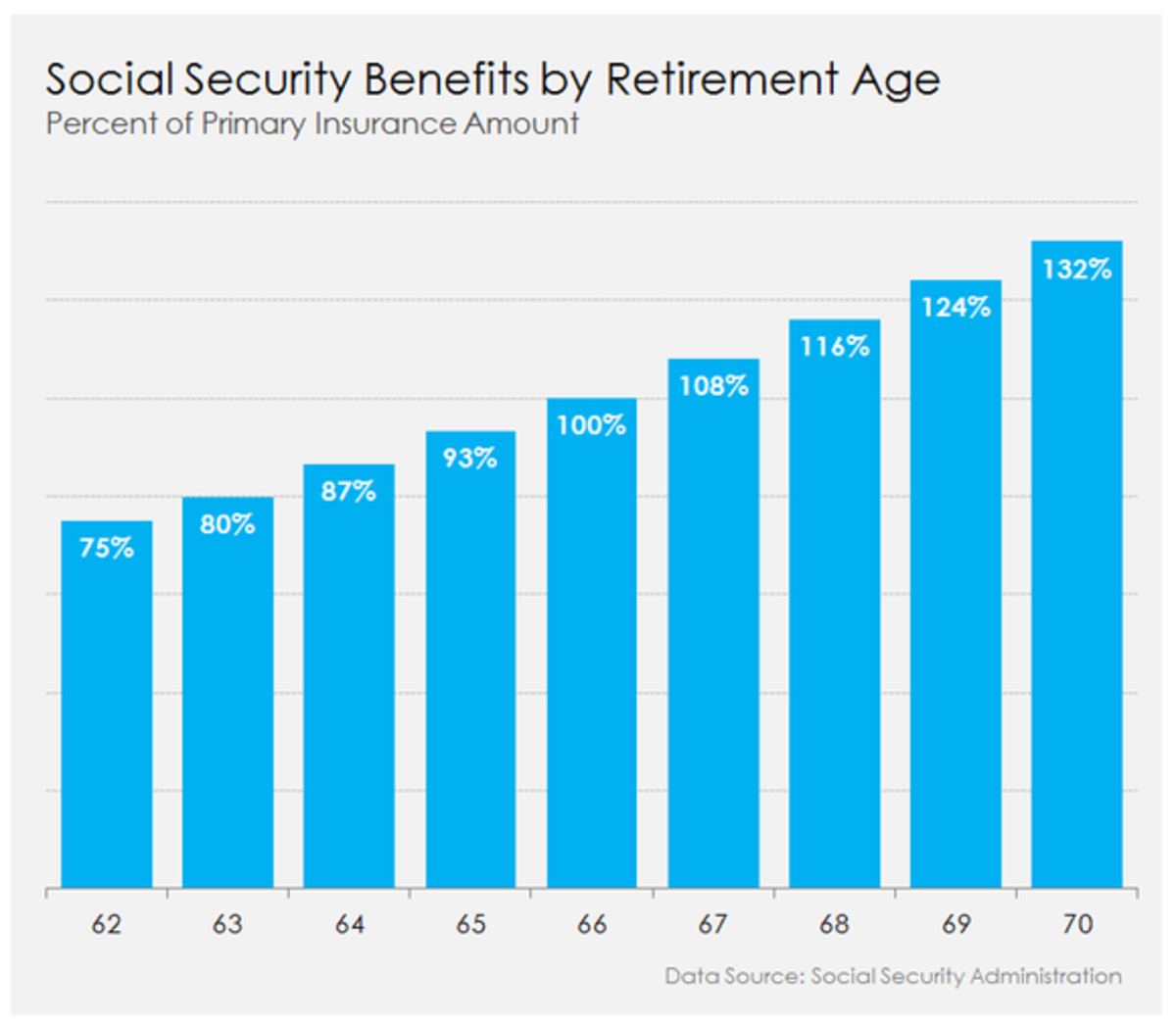

In advance of getting either a great HECM or a beneficial HELOC, borrower’s will be consider first exactly what goals he’s looking to reach of the making use of its house’s equity. Elderly borrowers seeking to retire, remain in their property, and/or meet its future living expenses should consider good HECM opposite home loan. This will be an adaptable selection for earlier (62+) consumers enabling these to retire which have financial security when you find yourself left the newest courtroom manager of its domestic. HECM reverse mortgages and create consumers to continue acquiring Social Coverage or Medicare benefits.

A house Security Conversion process Financial (HECM), otherwise contrary home loan, try a great federally covered financing built to render older people having availability to their house’s collateral sometimes because of a lump sum, monthly payments otherwise a personal line of credit

If the a borrower is within necessity of quick cash to own good short-label service and are usually nonetheless researching earnings, taking out a beneficial HELOC will be the best bet for them. In the place of a good HECM, a beneficial HELOC are the next lien on the house or apartment with an effective fixed matter on debtor to attract out-of. If your debtor does not have the money to repay on a fairly short-term base, a good HELOC could end upwards injuring them alot more on a lot of time-focus on.

HECMs are around for property owners decades 62 and over that happen to be seeking an other home loan on their top house. At the same time, credit history and you may money level are both considered when applying for a HELOC.

So you’re able to be eligible for a good HECM, new debtor doesn’t have a really strong credit score

Additionally, HECM individuals have to talk with a third-party HUD-recognized counselor just before they are allowed to progress regarding the HECM procedure. By doing so, the borrower begins the process that have complete disclosure and you may understanding of the borrowed funds product they are desire. Counseling is not required for HELOC individuals. While this is one additional action HECM individuals must take, it enables them to search access to their house’s collateral with believe.

The fresh new discover personal line of credit which is often provided with a HECM supplies the homeowner a lot more borrowing fuel than simply good HELOC. If you are HELOC individuals spend a yearly fee to help you withdraw restricted finance more than a predetermined age of 5-ten years, HECM individuals shell out zero yearly payment and will withdraw limitless financing regarding the line of credit if they consistently see its program loans. While doing so, when the a HECM borrower is able to maintain its resident obligations, its vacant credit line will in truth develop overtime from the current asked rate of interest without chance of being revoked or frozen. An excellent HECM credit line can in fact adult becoming huge compared to the genuine worth of our home someday. Hence, experienced individuals is also with confidence pay back their current, high-notice personal debt while you are preserving reasonable finance to use in a crisis, log off because of their heirs cashadvanceamerica.net 250 dollar loan, an such like.

Unfortunately, this is not the way it is getting a beneficial HELOC mortgage. Indeed, HELOC loan providers are recognized for quickly reducing, cold, or closing the newest line of credit with little notice with the borrower. So it commonly happens in case the debtor wasn’t positively withdrawing money. Thus, a beneficial HELOC is not an appropriate enough time-name back-up.