Many Generation-X and you will millennial homebuyers learn personal it may take some time to switch a loans-to-earnings ratio to have HELOC qualifications. Members of such generations often find by themselves in a tough location. Student education loans and medical obligations was biggest affairs one stop this type of years off racking up wide range and you can assets. It, because of the extension, could affect homeownership.

If you’d like a house security credit line but have plenty of low-home loan debts, you could bring certain tips to switch your financial facts. Perhaps you must secure good HELOC, that enable you to combine your loans that with your property since the equity. You can also play with a good HELOC and then make investments otherwise developments to your house. Performing this can also be elevate the worth of these assets which help you then become a whole lot more financially secure.

If you discover that you will be adversely impacted by your debt-to-earnings proportion having HELOCs plus don’t be considered, be connected. Our professionals have a tendency to take a seat along with you and talk about your own it is possible to pathways submit. I have together with incorporated some suggestions for tips alone prepare in advance of that have discussions throughout the merging personal debt.

What is the most useful DTI ratio?

You may be already well aware you to definitely loan providers look at your DTI ratio. They want to influence the probability of one debtor paying down their finance. Qualifying DTIs rely on the loan device and prominent count, but a good DTI proportion from below 36% is considered the most-utilized shape. With that in mind, some mortgage number or things might need deal with DTI rates due to the fact large as fifty%. If you aren’t yes if you may have a being qualified loans-to-earnings ratio having an excellent HELOC, give us a call. We can make it easier to pick it up.

Should this be a cause of concern, you can improve your financial obligation-to-income ratio having HELOC qualifications requirements. Specific a way to improve your DTI is actually by the:

Boosting your income: When possible, pick extra performs. It is possible to create an alternate applicant with the loan application. For individuals who co-signal, make sure the person fits yet certificates.

Lowering your costs: Start seeing where you can limit your spending monthly. It can help so you’re able to first tackle and you may cure faster and simply managed bills.

Conversing with a loan provider: Jumping suggestions out of a professional might help ease their load. You could potentially agenda a scheduled appointment which have a mortgage experts. Our very own professionals often answer any queries or remark your bank account to help you make it easier to learn your debt-to-income ratio getting HELOC qualification.

Utilizing a HELOC to manage expenses

Choosing to have fun with a HELOC to help you smartly perform most other loans is actually a big choice. Debt choices and you can certain need commonly Moody loan places influence whether or not you have decided to locate a beneficial HELOC or other version of financing. If you decide to go new HELOC station, then you’re already aware it works as the a cover-as-you-go proposal, instance playing cards. You can dip involved with it since you need so you can to own purchasing off their education loan, mastercard, otherwise scientific costs. HELOCs eventually promote so much more autonomy if you wish to equilibrium multiple personal debt money, or if perhaps an urgent situation comes up.

Boosting your loans-to-income proportion to have HELOC qualifications can benefit your into the numerous ways. If you have student loan debt, some professionals out-of taking out an effective HELOC is:

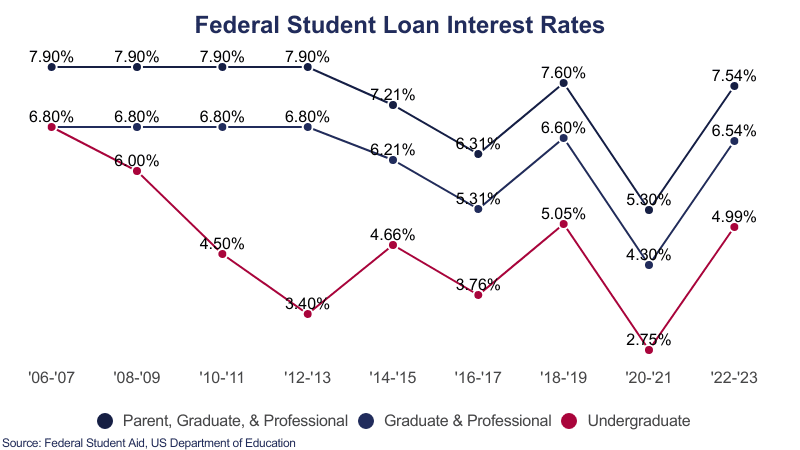

Opening lower rates: You could both get a reduced speed on a beneficial HELOC than just your student education loans based if they is actually private or federal. You might not help save focus for people who took away a national mortgage, however, previous youngsters which have a private loan will see particular advantages.

Combining your loan: If you are paying lenders independently, a beneficial HELOC can assist you to mix additional education loan repayments. Paying one lump sum can enable you to getting hands-on.

Getting straight down monthly installments: Cutting your loans-to-income ratio for HELOC qualifications can help you supply lower month-to-month money. You will only need to pay new HELOC notice in the initially mark several months in the 1st ten years. That rough period will give you more time to bolster the financial condition.

Prospective cons of employing a beneficial HELOC

Since the beneficial as you may discover HELOCs getting paying these brand of expense, you must know both the benefits and drawbacks. Definitely consider every you can easily monetary implications. A number of the a lot of time-label cons can be:

When you ready your debt-to-earnings proportion to own HELOC software, you may be signing off toward making use of your family once the guarantee. Utilizing your house in this way is actually risky whatever the gurus. Our consultants will directly opinion your finances to ensure that you result in the most readily useful decision. You can even play with all of our mortgage hand calculators to test when the now it’s time to find an effective HELOC or if you is to keep enhancing your DTI proportion.

How does the lowest DTI count?

You will possibly not boast in the DTI percentages at the food activities, however, less DTI will allow you to ultimately. People who bring faster personal debt is focus on potential assets and prepare for an anxiety-free old-age. Several certain advantages of reaching a decreased debt-to-earnings proportion for HELOC qualification try:

You will find concrete reasons why a reduced DTI positives homeowners, but you don’t lay an amount on the assurance. As you progress with your much time-label preparations, gaining a lower life expectancy DTI can be expand your financial options. Additionally present cover by creating asked and you may unexpected monetary demands a lot more manageable.

The original methods into the providing a great HELOC now

Navigating debts and qualifying to have fund are the areas of adulthood one so many individuals be ill-supplied to possess any kind of time many years. It is vital to remember that you’re not by yourself whenever dealing with such products. Suitable bank, such Western Resource, can assist you to see favorable terminology as you prepare so you’re able to pull out a great HELOC loan. Sharing an educated an effective way to decrease your debt-to-income ratio to have HELOC eligibility will allow you to finest learn what’s requested on your stop and steer clear of people problems.