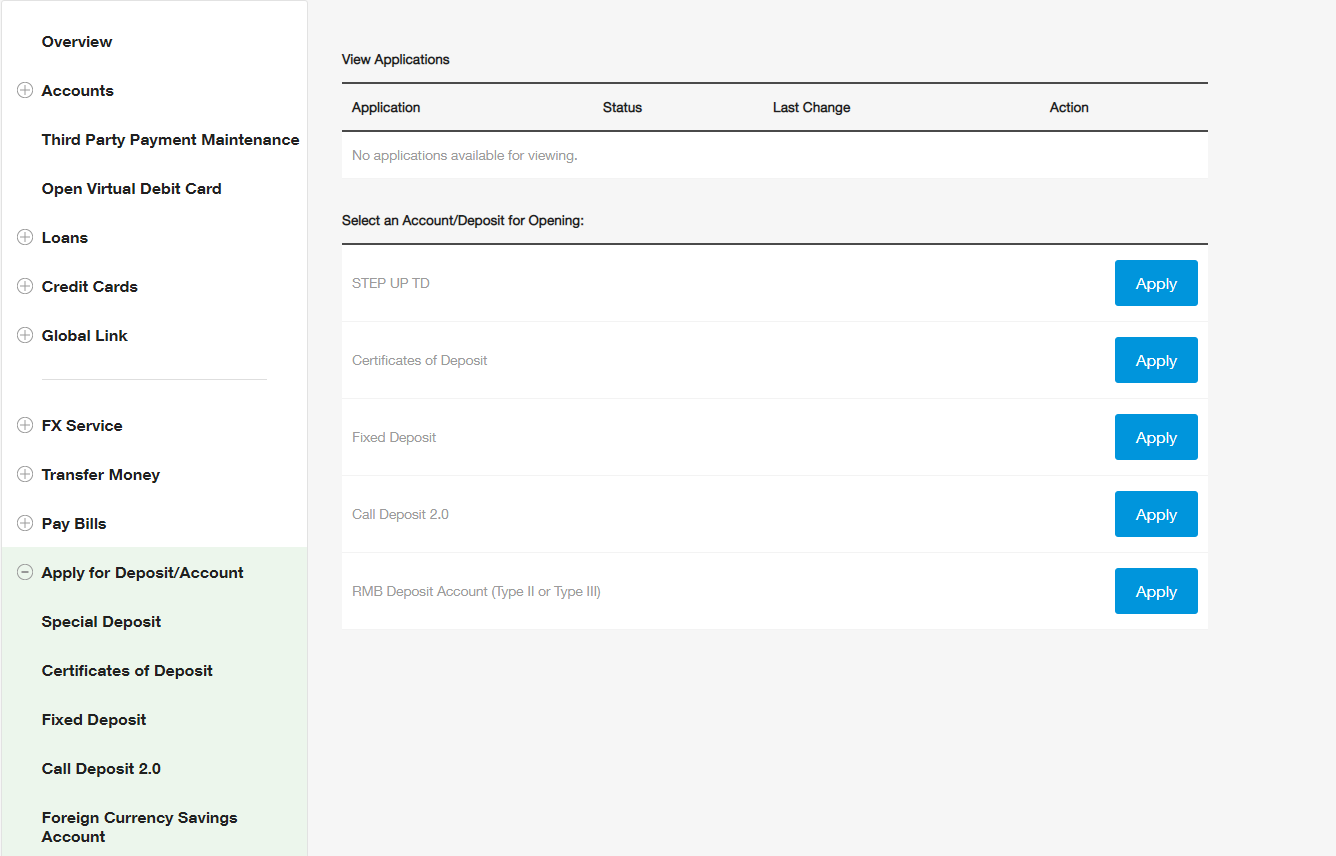

Listed below are some good reason why financial applications could be disapproved

- Duplicate connect

- Telegram

The real home marketplace is into the a roll over the past 2 years, as much regarding official staff identify safe and spacious property. Today, as the interest rates peak in India, you will find anticipation one a rate clipped can happen in the Asia next couple residence. The usa Government Put aside has recently clipped pricing by the 50 foundation circumstances.

In the event the RBI including initiate this new easing duration, home loan prices create slip and start to become more appealing. So, for individuals who secure that loan now, start paying the EMIs if in case pricing slide, brand new monthly instalment might be over the first EMI and you will might help within the prepayment.

But not, once you make an application for a home loan maybe, the largest obligations you are going to take in lifetime you need to be cautious to cease getting rejected of the application.

Here you will find the trick reason mortgage software is disapproved. I’ve noticed precisely the key monetary and personal grounds, and possess maybe not went into the paperwork position.

Financial activities

The initial key factor in getting rejected of a mortgage you will definitely feel the lowest credit rating. The credit get, while the dependent on all four credit agencies, is actually a numerical testing of your own creditworthiness.

Typically, getting consumers which have many lower than 750 and you will indeed to have those beneath 650 one another into the a size of 900 loan providers might not be easily impending to offer a big-violation credit particularly home loan.

You’ll be able to look at your credit report immediately following inside an effective seasons at the very least to make sure that there are no problems and you will your entire money produced and fees eliminated echo accurately throughout the declaration. Any mistakes or mistakes need to be taken up to on the concerned borrowing from the bank bureau immediately.

If your results is actually perfect and you will low, attempt to work with the get via punctual money over a period of big date. Non-payments and you may delays within the costs try seen adversely.

The second important reasoning is the large debt-to-earnings proportion. It ratio is absolutely nothing however the ratio of one’s EMI on the house mortgage brought to this new monthly earnings of the person.

Constantly, the product range acceptable from a financial wisdom viewpoint as well as an excellent component that is actually relaxing to help you lending banking companies is a proportion away from 35-fifty % reduce steadily the greatest.

Therefore, for folks who look for an enormous-pass financial with, state, ?1.2 lakh since the EMI along with your monthly income are ?step one.5 lakh, the new proportion involves 80 percent. The financial institution would without a doubt fret how would certainly be in a position to create other household expenses when including a big commission would go to month-to-month instalments and lower the mortgage size or reject the application.

You can attempt to choose a mutual loan which have, say, your wife or mother or father adjust the fresh new eligibility possibility this kind of times.

When you yourself have user, individual and you can car money running at the same time, and on top of these consume your primary credit limitation per month, then the lender would doubt your capability to take on extra load, especially some thing as huge as home financing.

The concept is when you currently spend a corner of your earnings toward maintenance these financing, how could a special financing who does pull away fifty percent of your own money every month be reduced.

Non-money points

You may earn a premier income and also have a relatively an effective credit history and you may payment record. But not, if you’re among those people who frequently alter work finding finest possibilities and you can monetary pros, it is a red-flag for almost all lenders. Most banking companies favor consumers with a reliable a career background people that spend significant lifetime with that employer ahead of shifting.

That have frequent employment-hoppers, the most obvious question to own lenders is when the new options avoid and you can the latest borrower is not able to find this new employment after quitting the brand new old office.

Reputations regarding enterprises worked and additionally play a role. Handling relatively-unknown businesses or initiate-ups versus really-understood creators, etcetera. actually believed favorably by the employers.

Even when sad, many years is even an option cause for choosing financial qualifications. The odds for those over 50 are usually way less than just for all quick loans Aspen CO those younger, state, those in its late-30s and early-40s. It is because because you near the retirement, there would be issues about what you can do to settle the mortgage. However, you may still have the ability to repay your loan totally upon retirement. Or you could service your loan despite advancing years, for many who discovered a generously high and you may in hopes your retirement from your workplace. However, that however need some detailing toward bank.