- Proof online installment loans Kansas of income (elizabeth.g. a position price, bank statements, payslips, tax returns)

- Current financial obligation info (elizabeth.grams. other mortgage loans, student education loans, borrowing plans)

- Newest investment info (e.grams. assets deeds out-of any country)

- Copies away from ID and you can wedding permits (in the event that relevant)

- Copy out of a short price or presale agreement

- Property taxation ideas (evidence of up-to-big date commission)

Many of these data have to be translated with the Language of the a good accredited judge translator and you may considering an enthusiastic Apostille stamp so you’re able to approve their legality. In the event an international bank welcomes files in other dialects, the latest Spanish notary probably won’t, very you might wanted translated versions to complete the purchase regardless.

You might want first off strengthening your own financial app document ahead, preparing general documents into your life needed even before wanting the house or property we wish to get. You don’t need to has finalized the offer and you can notarised the new deed so you’re able to pre-get a great Language mortgage.

You could potentially examine that it bring together with other loan providers to obtain the better mortgage available. If you find yourself proud of words, you can indication the loan offer and you can unlock a free account.

The bank plus the notary tend to liaise along with you to finalise you buy, which can capture from a few days to a few weeks immediately following signing the borrowed funds contract. If you’re unable to otherwise don’t need to go to Spain in order to indication such records, a great solicitor in Spain which have electricity out-of attorney can do it to you.

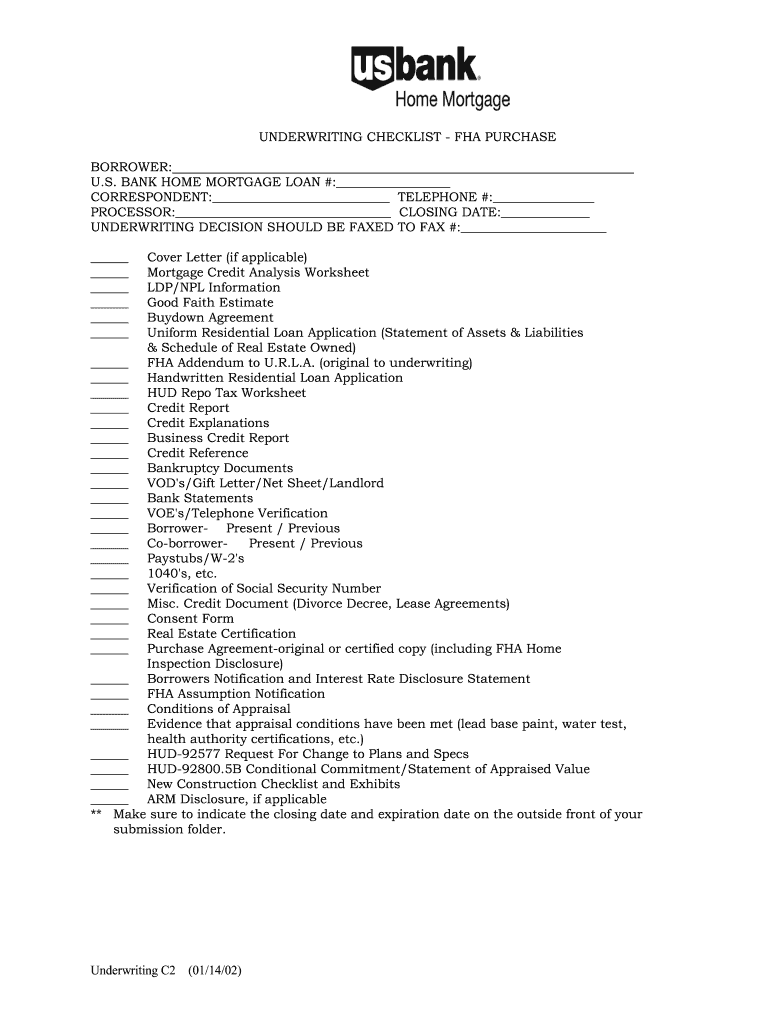

Once you assemble the fresh files required by the particular financial, which include but are not restricted to those listed above, you might submit your entire financial document as examined from the their underwriters

Overall, we offer the borrowed funds procedure when you look at the Spain for taking six-2 months to-do. When the everything is better-waiting and you will goes effortlessly, it could take as little as thirty day period. It might including take more time for people who spend more big date bringing your files under control or comparing more home loan even offers.

As mentioned significantly more than, discover related will set you back which can push up the price of good Language property get, which include certain taxation. These are generally control transfer taxation and you will stamp obligation. Pursuing the purchase, you can be a property owner inside the The country of spain, and thus you are accountable for certain Spanish taxation and state fees and you may regional taxes.

When you accept, the financial institution have a tendency to program a valuation of your house, and also make a last home loan render based on the results

To begin with, there’s the latest annual Foreign-language possessions taxation (IBI), that is just like council taxation in the united kingdom. You’re going to have to pay out to one.3% of the house well worth, depending on the cost set from the local power. Then there’s Spanish income tax (IRNR), which takes a cut fully out from 19-24% of every income obtained into the nation such rental money, for many who let out the vacation home while you are maybe not truth be told there.

In the event that you to offer your house inside the Spain, it’s likely that you will end up accountable for Language money progress income tax, otherwise 19% of your own earnings out of assets purchased in The country of spain. If you intend to exit their Foreign-language assets so you’re able to a loved you to once you perish, you will have to consult an advisor from the local series statutes and you will remember to keeps a valid Spanish tend to, or take Language genetics taxation costs to suit your certain relationships and value of into consideration.

Likewise, if you have multiple highest-value property in the Spain, you could be liable for Spanish money income tax. It is a modern tax one to relates to things such as houses, cars, opportunities, discounts, jewellery, and you may artwork over a certain value. Wide range tax cost differ anywhere between countries these include essentially doing 0.2% so you can 2.5% but may end up being more than step 3% into the elements such as for example Andalucia.