The overall obligations-to-money ratio is determined on 41%. Most of the borrower’s month-to-month financial obligation repayments, along with the recommended family commission, may not go beyond 41% of your terrible monthly money.

Like, by using the previous example of a family just who produces $66,700 annually, its monthly income would be $5,558 ($66,700 split up of the 12 months).

Therefore, this will signify the fresh new proposed family commission, in addition to escrow quantity, can not be higher than $step one,612 ( $5,558 x 0.30 = $step 1,612).

Additionally, it means that the fresh new advised household fee placed into all the present day debt repayments could not end up being a lot more than $dos,279 ( $5,558 x 0.41 = $dos,279).

Besides the assistance that cover the latest home’s location, the latest borrower’s money, and you will financial obligation percentages, there are other guidance one to possible individuals must be alert away from.

Every individuals who want to utilize the rural creativity program so you’re able to purchase property will be able to prove their annual money. Generally, based on the way men brings in earnings, next suggestions was Fayette loans expected

- Complete resident of the United states

- National low-citizen

- Accredited alien

The lender have a tendency to require your own evidence of citizenship prior to getting the borrowed funds accepted. You can even be required to deliver the research once again within the full time out of closure.

Not only having First-time Home buyers

This new USDA mortgage is a superb way for visitors to purchase its first house. However, there is no restrict in the advice. People who find themselves looking to purchase the 2 nd household or also their 7 th family get apply if they meet with the other standards.

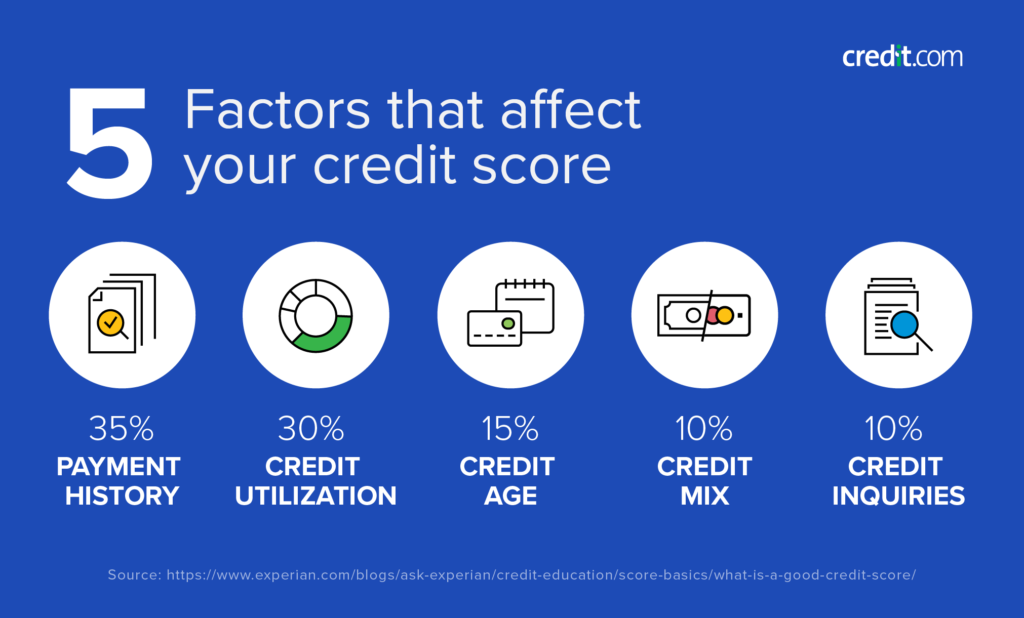

The financing statutes you to definitely determine if you’re accepted to possess it mortgage be a little more everyday when comparing to antique mortgage loans. Of many lenders provides reported that the fresh new informal credit requirements always accept FHA applicants are extremely exactly like USDA loans. Those with struggled before with regards to borrowing from the bank is today able to make its money on time and really should be good about their chances of delivering accepted USDA.

With all of mortgages, indeed there comes a threat that the borrower may possibly not be able to repay the loan at some stage in the long term. If this happens, your house is actually foreclosed and also the financial loses cash on the newest deal.

In order to decrease several of one exposure, this option means borrowers to expend a month-to-month premium called personal financial insurance policies.

- If the mortgage is actually signed in addition to debtor is able to simply take palms of the property, a charge of just one% of your own unique financing equilibrium try placed into the borrowed funds. This enables the fresh debtor to invest the cost over the years.

- The following advanced are calculated annual. 0.35% of the outstanding financial equilibrium is split towards the several money and you will put into the month-to-month financial obligations.

Who isn’t a great fit because of it financing?

The initial group ‘s the area partners. Any person or members of the family you to dreams of living downtown when you look at the good biggest city, that have pleasant opinions of one’s skyline, entry to parks, and you will smoother travel to looking and amusement via public transit would be to maybe not consider this to be financing. Areas inside the and you can immediately as much as the downtown area parts do not generally speaking be eligible for the newest rural designation.

High earners must maybe not implement. Individuals who have often become a pals you to output all of them a six-shape private income, otherwise is extremely paid back pros, often normally have an annual money that’s greater than USDA’s allowable advice.

Summing-up The fresh new USDA Financing Program

In general words, the new USDA mortgage system is an excellent option for of several potential property owners. Its particularly popular with those who desires to purchase a home without the need of developing a large down payment.