- For very first-go out or reasonable-income homeowners, a zero closing rates home loan can also be relieve most of the brand new monetary load at the time of purchase.

- Zero closing costs mortgage loans help you save money initial on the initial fees. But not, you can easily pay much more regarding a lot of time-run because of accumulated desire expenses down to good highest rate of interest.

- To lessen closing costs, you ought to discuss which have lenders and check all of the offered resource supply, like provider investment and you will county features.

To finance an aspiration house, people need to use out home financing. However, home financing doesn’t erase most of the initial costs. So you’re able to secure the offer, all the domestic get means people to spend financial closing costs. Even though homebuying could be expensive, these will set you back usually takes right up a fairly raised percentage of your own complete purchase price.

In the event the home buyers be threatened by upfront settlement costs, there can be a remedy-a zero closure prices home loan. To know whether or not it mortgage method of suits you, why don’t we fall apart everything you need to know about no closure costs mortgages.

Settlement costs 101

Settlement costs are a mixture of charges and you can taxation one to draw property just like the ended up selling or signed. Generally speaking, buyers spend this type of to your specialized time from income. According to house location and personal cash, settlement costs can include:

- Possessions fees

- Taxation company fees

- Name insurance coverage

- Homeowner’s insurance rates

- Flooding qualification

- Assessment costs

Normally, the latest closing costs getting good United states household add up to $4,876-they are able to even go up to $ten,000 in some cases. It’s not hard to observe how an upfront closing rates percentage get not be easy for particular homebuyers.

The name zero closure cost financial is a bit misleading. Ultimately, buyers always purchase settlement costs. Yet not, the method that you finance the fresh settlement costs is different from a consistent mortgage loan.

But not, below zero closure rates mortgages, a lender talks about this type of initial charges for brand new borrower. Then they use you to prices to the payment.

According to bank, certain mortgage loans won’t finance every closing charge you possess. Always check with your loan provider toward precise coverage info, and that means you never sense people treat fees.

Work at for each circumstances together with your potential mortgage lender to determine what solution you would like

At this point you know that lender paid off settlement costs indicate high month-to-month mortgage payments. Lenders enhance your own month-to-month financial price in two chief indicates:

Towards the top of monthly payments, loan providers might also put a beneficial prepayment punishment. This type of conditions end people from prepaying or refinancing their mortgage loans thus financing people don’t lose possible notice money. All loan providers need to reveal this type of punishment just before sealing a home loan deal.

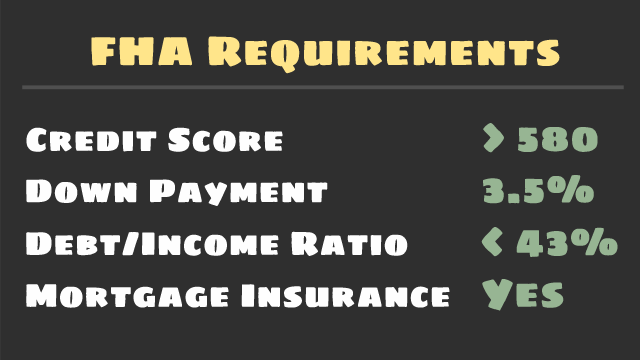

Like all mortgages, zero closing cost mortgages require some amount of financial trustworthiness. So you’re able to victory financial acceptance, customers should confirm a great standing on these areas:

Additionally, you will need to prove your ability to cover a top article down payment. Very home loans has actually a minimum step 3% down payment, although mediocre is commonly 6%.

And remember-in advance of buying a no closing cost mortgage, be sure to fatigue all of your tips. There are still a number of a method to lower your closing costs before credit money:

Mortgage loans aren’t that-size-fits-all. For almost all buyers, a no closure cost mortgage isn’t really worth the highest monthly payments. For other people, saving money initial you can expect to reduce the worry of first domestic get.

While you are into the mortgage loan barrier, why don’t we break down advantages and downsides of an ending pricing mortgage for homebuyers.

When it comes to choosing the right financial price, each individual’s condition is different. In the end, a zero closing pricing home loan relates to what you can do to help you manage an upfront fee-which varies with each homebuyer.

No matter the money you owe, do your homework and construct a strong budget data. This way, financial or otherwise not, there are the best possible property option for you.