Over the last one-fourth regarding 2023, mortgage rates and large domestic costs are adversely affecting the home improve world. That can end up in large expenses associated with building work your residence.

Bloomberg published an article in later 2023 listing one do it yourself investing hit significant levels when you look at the pandemic; Lowes, Home Depot, and other names could have obtained even more from the projects during lockdown, nevertheless number may be telling a separate tale blog post-pandemic. And costs are rising.

When renovations costs rise, particular borrowers just cut back the intends to by far the most requisite repairs. But even with a less bold plan, capital has been needed, specifically having Lowes and you can House Depot cost coming large to own intense product and you will equipment.

That have rates within levels i have not present in some time now, particular consumers could have believed choice choices for money home improvements. Financial support is available in different variations, yet not they are all the right systems into business, as they say.

Prior to now whenever cost had been straight down, a specific amount of people could possibly get think financial support loans in Our Town AL with no checking account required a remodeling job playing with credit cards.

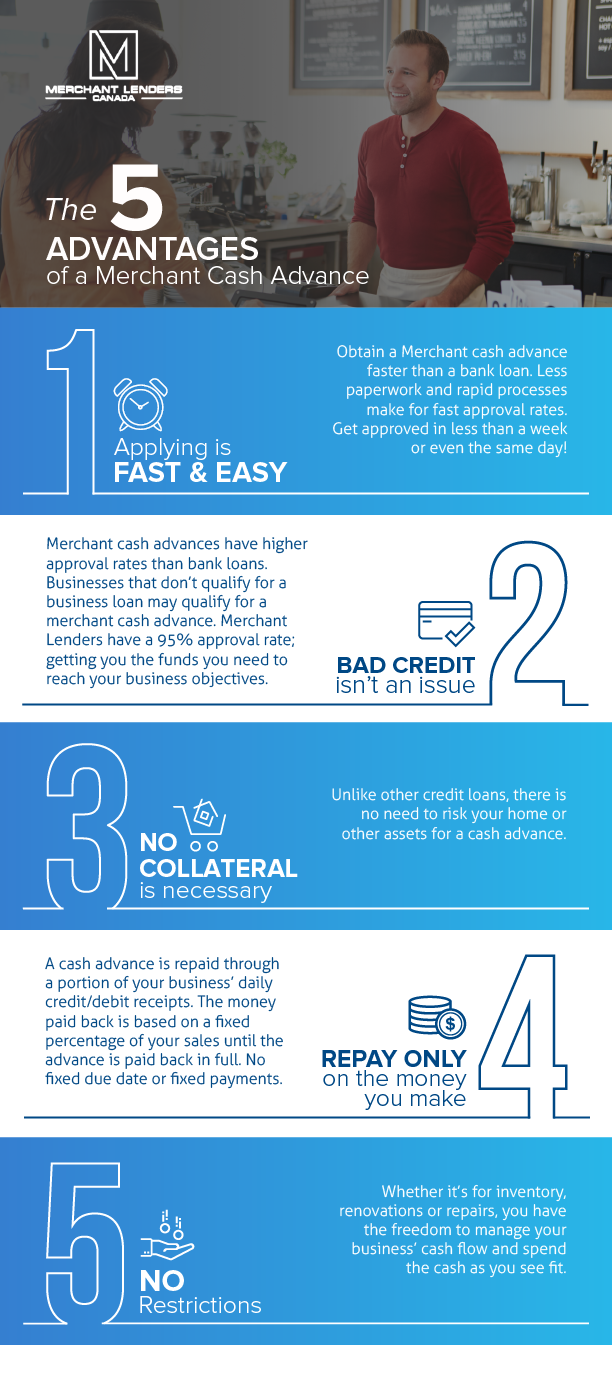

That’s normally perhaps not a services, depending on the size and scope of your own project, many borrowers don’t want people constraints precisely how they use their remodeling financing and that is in which using having a charge card will help. However it is not necessarily an educated monetary choice.

Mortgage Alternatives for Restorations Your house

For many who renovate a house using an FHA 203(k) treatment mortgage, their use of the funds is bound from what both you and the lender consent upon.

Performing this setting insights some important limits. You simply can’t developed a swimming pool or a barbecue gap, such as for example, since they’re sensed luxury developments.

Whenever paying that have a charge card, you don’t need a comparable limits. It is they the right choice across the FHA treatment financing solution?

Now, you to approach tends to be way more unrealistic because of raised interest levels. Specific be it is smarter to utilize a choice, such as for instance a treatment financing or cash-out refinancing.

You need FHA cash out refinance loan money as the a great answer to purchase those people renovations. You can find partners limits towards the utilising the currency, but there’s a good caveat. FHA cash-out refinance loan laws and regulations require that you enjoys lowest security into the the house before your application is known as.

For many who haven’t possessed the house long and don’t meet the requirements getting FHA cash out refinancing, you are able to sometimes need to prefer another borrowing types of or hold off to make the minimum quantity of payments before you can implement.

Particular borrowers could have currently terminated intends to put a pool or other luxury incorporate-ons as a result of high rates additionally the overall cost out-of borrowing cash in the modern home loan rate environment.

These people get restriction their home upgrade methods to people deemed absolutely necessary. A keen FHA 203(k) rehab financing will help in these instances. Its best if you speak about the choices with this particular financing.

Even after a restriction with the luxury issues and you may associated improvements on domestic, you to definitely essential requirement of a keen FHA rehab financing? The capability to like a smaller sized 203(k) rehabilitation financing to own faster methods and you will a much bigger type for those who you want big renovations.

Joe Wallace has been concentrating on army and personal financing topics because 1995. His functions have checked towards Heavens Push Tv Information, The fresh Pentagon Route, ABC and you can some print an internet-based products. He is a 13-season Air Force experienced and you will a person in air Force Societal Situations Alumni Connection. He had been Managing publisher to own valoans to possess (8) decades which will be the Member Editor getting FHANewsblog.

Archives

- 2024

- 2023

- 2022

In the FHANewsBlog FHANewsBlog was released in 2010 by knowledgeable home loan advantages trying to instruct homeowners concerning guidance to own FHA insured financial money. Popular FHA topics are borrowing requirements, FHA mortgage limits, home loan insurance costs, closing costs and much more. This new authors have written tens of thousands of content certain in order to FHA mortgage loans and the web site enjoys substantially enhanced audience over the years and you may has-been known for the FHA News and you can Viewpoints.

Brand new Va One-Big date Intimate try a 30-12 months financial open to seasoned borrowers. Borrowing from the bank guidelines are set from the bank, generally having good 620 minimal credit history demands.