Analysis

The capability to get an earnings withdrawal or loan from your U-Meters later years savings preparations relies on a great amount of circumstances as well as the plan type, how old you are, the cause of detachment, so if you’re a current employee, an old staff or U-Meters retiree. In some cases you happen to be at the mercy of taxes and you can penalties. Chat to a taxation elite or monetary mentor and inquire concerns which means you understand the limitations, criteria and you may effects before you take one action.

Just how to Begin a finances Detachment

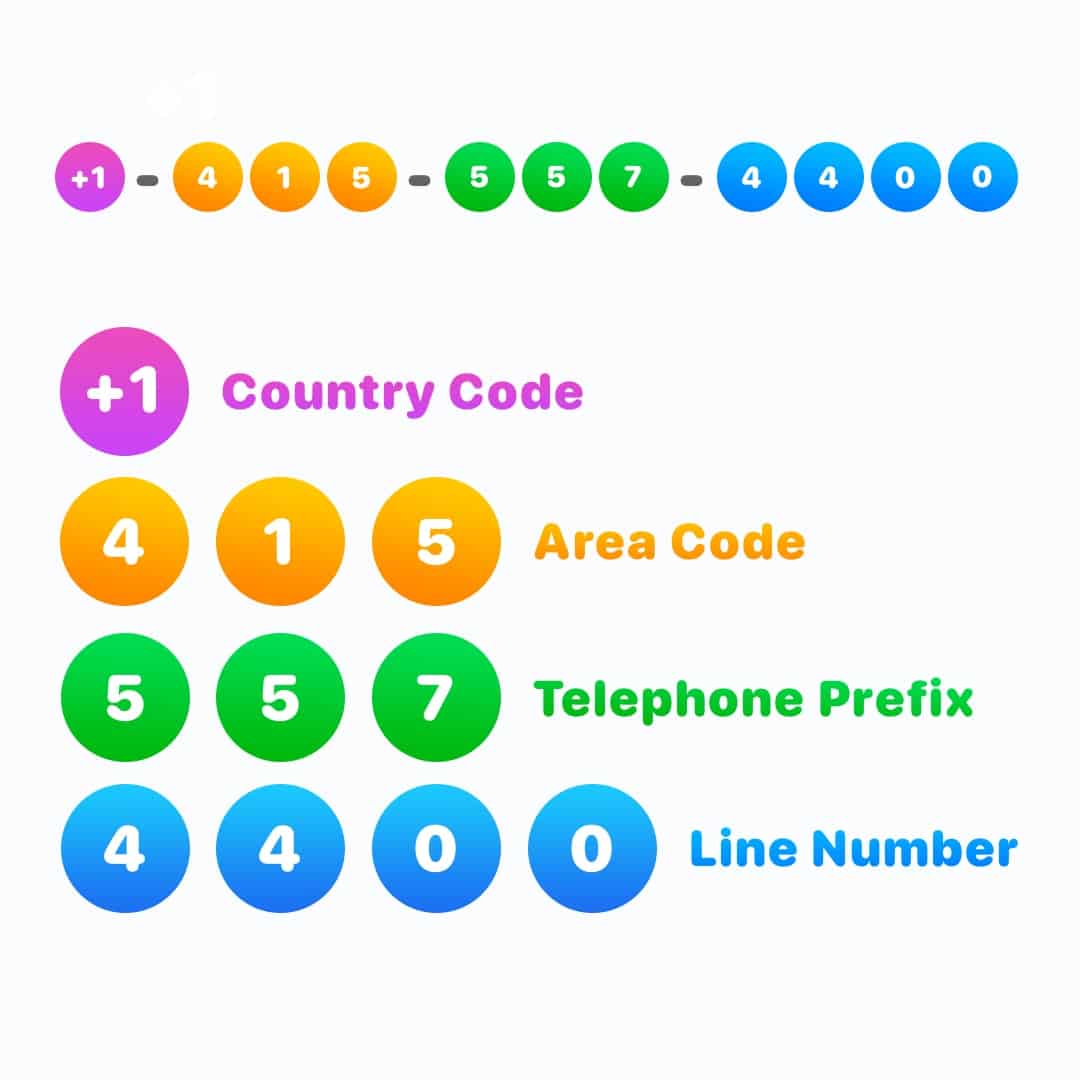

- TIAA: 800-842-2252, Friday – Saturday, 8 a beneficial.yards – ten p.meters. (ET)

- Fidelity: (800) 343-0860, Monday – Friday, 8 an effective.m. – midnight (ET)

dos. A telephone representative commonly opinion your bank account and find out the total amount readily available for a withdrawal, when you are eligible for you to.

step three. Render spoken advice more a noted range so you can initiate the fresh detachment. This is smaller and much more successful than finishing and emailing an effective report means so you can TIAA or Fidelity.

Pursuing the is overviews of one’s alternatives for making withdrawals otherwise acquiring finance from for each and every bundle style of. For details, discover Qualification and functions for money Distributions and Funds.

In the ages 59? otherwise earlier, if you’re rehired for the a position term that isn’t entitled to participate in the essential Old age Bundle

Next occupations titles commonly permitted cash advance in Alabama Slocomb join brand new First Old-age Package and may also capture a finances detachment otherwise rollover on ages 59? or old once the an effective rehired retiree otherwise rehired former faculty otherwise staff:

- Short term each hour

- Emeritus and you may emeritus having funding

- LEO I and you can Adjunct 44% work or reduced

The following business titles meet the requirements to enroll regarding Earliest Retirement Bundle and cannot simply take a finances detachment otherwise rollover within any age because the a beneficial rehired retiree or rehired previous professors or staff:

Qualification and functions for the money Withdrawals and you can Fund

After the is actually details about after you could possibly get qualify for financing out of your U-M old age plans, once you may qualify for a finances detachment, and the measures to consult that loan otherwise dollars withdrawal.

Eligibility

- Basic Old age Bundle Zero money are available when.

- 403(b) SRA You may use as much as fifty% from the 403(b) SRA at any time, for any reason, whether or not your work was energetic or terminated. not, financing aren’t supplied by TIAA once you have retired or ended work away from You-Meters.

- 457(b) Deferred Settlement Plan You can even borrow to 50% out of your 457(b) any moment, unconditionally, no matter whether the a position is actually energetic otherwise terminated. But not, finance commonly provided by TIAA after you have resigned otherwise ended a position out-of U-M.

Loan amount

Minimal loan amount was $step one,000 and restriction is actually $fifty,000. This is a combined loan restriction and you will pertains to each one of the U-Yards 403(b) SRA and 457(b) accounts having both providers. The latest $fifty,000 financing restriction was quicker because of the highest a fantastic loan equilibrium towards the most other plan financing into the early in the day one-12 months months. The most mortgage is also less because of the one a great money you enjoys which have TIAA and you will Fidelity.

Simultaneously, the utmost level of finance you have got having TIAA between the 403(b) SRA and you may 457(b) was three. Which maximum will not connect with loans that have Fidelity. It’s also possible to continue to be involved in the latest You-Yards Old-age Coupons Preparations if you take that loan of sometimes bundle.

Tax-deferred against. After-income tax Roth Fund

TIAA cannot provide 403(b) SRA or 457(b) financing to the shortly after-tax Roth numbers. Fund arrive simply toward tax-deferred amounts with TIAA. Fidelity does offer the ability to borrow money towards one another tax-deferred and you may just after-income tax Roth numbers on the 403(b) SRA and you can 457(b).