- Proof of deposit assets income tax via receipts from Assets Income tax.

- Proof the address out-of providers away from low-salaried anybody.

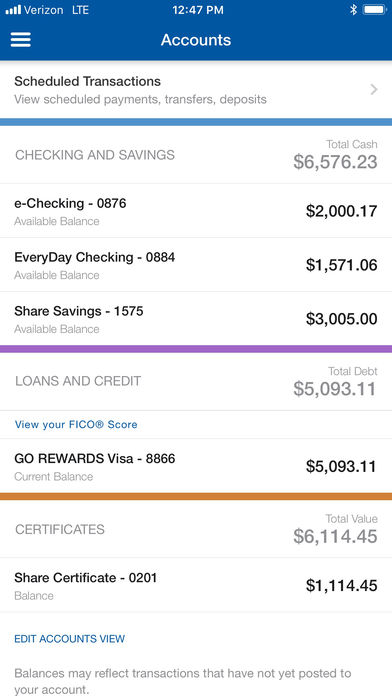

- Personal assets and you will obligations statement

- Declaration out-of property and you can obligations. Individual Assets and you may Obligations Statement

- Passport proportions photographs 2.

- Term evidence-Xerox of Voter id credit, passport, Operating permit or Pan cards

- Target Proof -Xerox off Domestic bill (Power otherwise mobile)

- Signature attestation regarding lender where he keeps the fresh membership.

It successful strategy gets to the simple management of documents necessary to possess a home loan , making the techniques far more available for customers

Mumbai, Maharashtra, India: Tata Investment, certainly one of India’s leading low-banking economic companies, lies away the attention for future years from family financing during the 2024 and beyond. Which have imaginative situations, digital initiatives, and you may a customer-centric means, Tata Financing aims to create to get a property much easier and much more sensible having many Indian parents.

Because 2024 begins, Tata Resource reaffirms its commitment to helping way more Indian families go the fresh dream of owning her house due to its attractive family fund. Individuals is acquire low interest rates, smaller approvals and you can limit money for the home loans to shop for, create otherwise upgrade their desired house in 2010.

Whether you want to buy an alternate household, build your dream household, or redesign your current home, Tata Capital also provides customised lenders doing Rs 5 crores.

As secured finance, their house money come with competitive rates of interest and flexible a lot of time fees symptoms all the way to three decades. This will make the newest financing sensible, allowing borrowers to settle their home inside the a soft payday loans South Woodstock trend instead of monetary be concerned.

Together with the data files positioned and eligibility conditions came across shortly after the borrowed funds is actually approved and you can acknowledged our home loan amount tend to getting paid on your own account

Which have large loan quantity and simple cost preparations, Tata Capital’s home loans make an effort to let individuals and you will family go their aim of buying otherwise constructing their top residence for the 2024. Its alternatives is actually tailored to meet varied homeownership requires.

Tata Investment stands out among the top NBFCs inside India, providing affordable construction loans fund. They show up packed with a beneficial bouquet off have, including:

Tata Financing advances borrower benefits by offering extreme loan wide variety, towards the possibility to extend doing Rs 5 crores. Which liberty is easily assessable through the Mortgage Eligibility Calculator , making certain individuals normally effortlessly determine its borrowing capability.

Mortgage consumers enjoy the versatility to decide an installment period as much as 30 years, leading to straight down EMIs.

Tata Resource assurances brief and you will dilemma-free mortgage processing having a watch limited papers and streamlined digital techniques, and this join smaller home loan approvals. By the leverage such as trick gurus, Tata Money has created alone among the primary team away from construction funds to possess home buyers all over segments.

Tata Funding brings customized funding possibilities geared towards strengthening new homeownership desires out of Indian family. Its sight is always to let most of the customers do the dream house.

Which have Tata Capital’s mortgage brokers, individuals can merely and obtain its dream residential property, if or not able-to-move-into the otherwise less than framework. The mortgage matter was flexible and certainly will also be used so you can pick a plot otherwise house for future framework.

Tata Financing allows borrowers to get home-based a residential property, cultivating long-name fancy and wide range manufacturing compliment of property resource. It is a chance to individual real assets if you are using genuine estate progress.

Current home owners can use Tata Capital’s home loan to remodel, change, or fix the latest properties. Whether it’s renovations your kitchen, revamping floor, or handling architectural circumstances, the house loan has got the way to increase and you can uplift life areas.