Homeowner financing derive from the worth of your house, and the number Baton Rouge installment loan no credit checks no bank account of security available for you (guarantee is the proportion in your home you own outright, versus home financing). In terms of a homeowner financing, you need to take into account the loan count and you will payment terms. Furthermore essential you check the Fine print, to find out if they are suitable for your needs.

What’s a property owner mortgage?

Of the meaning, a homeowner mortgage is actually covered up against a possessed otherwise mortgaged assets, so getting a resident is important when it comes to taking out fully a home owner loan.

A resident loan may allow you to acquire more maybe an unsecured personal bank loan. It does up coming be distributed back over a period of day for your activities. This makes it an appropriate financing solution if you plan so you can bequeath prices with affordable monthly installments. But not, take note while you are not able to pay the brand new loan the lending company could have a straight to repossess your property.

From the Progressive Currency we’re a primary bank and have a great different method of almost every other lenders. We make sure to discover your situation to discover the absolute best credit services to you, without needing to support the money against your residence. We just require that you getting a homeowner and you may living on your own possessions.

What can I take advantage of since safeguards?

Home owner finance generally use your possessions since the a kind of safeguards. This is simply not simply for property simply, any type of version of land can be utilized, in addition to bungalows, cottages, apartments and you may renting.

It is possible to get an unsecured family owner’s mortgage having Progressive Money, for those who meet up with the following the conditions:

- A homeowner (either you spend a home loan otherwise very own a home outright)

- Aged between 18 and you will 70*

- Often functioning otherwise worry about-functioning

- Are now living in England, Scotland otherwise Wales

- Capable afford monthly money

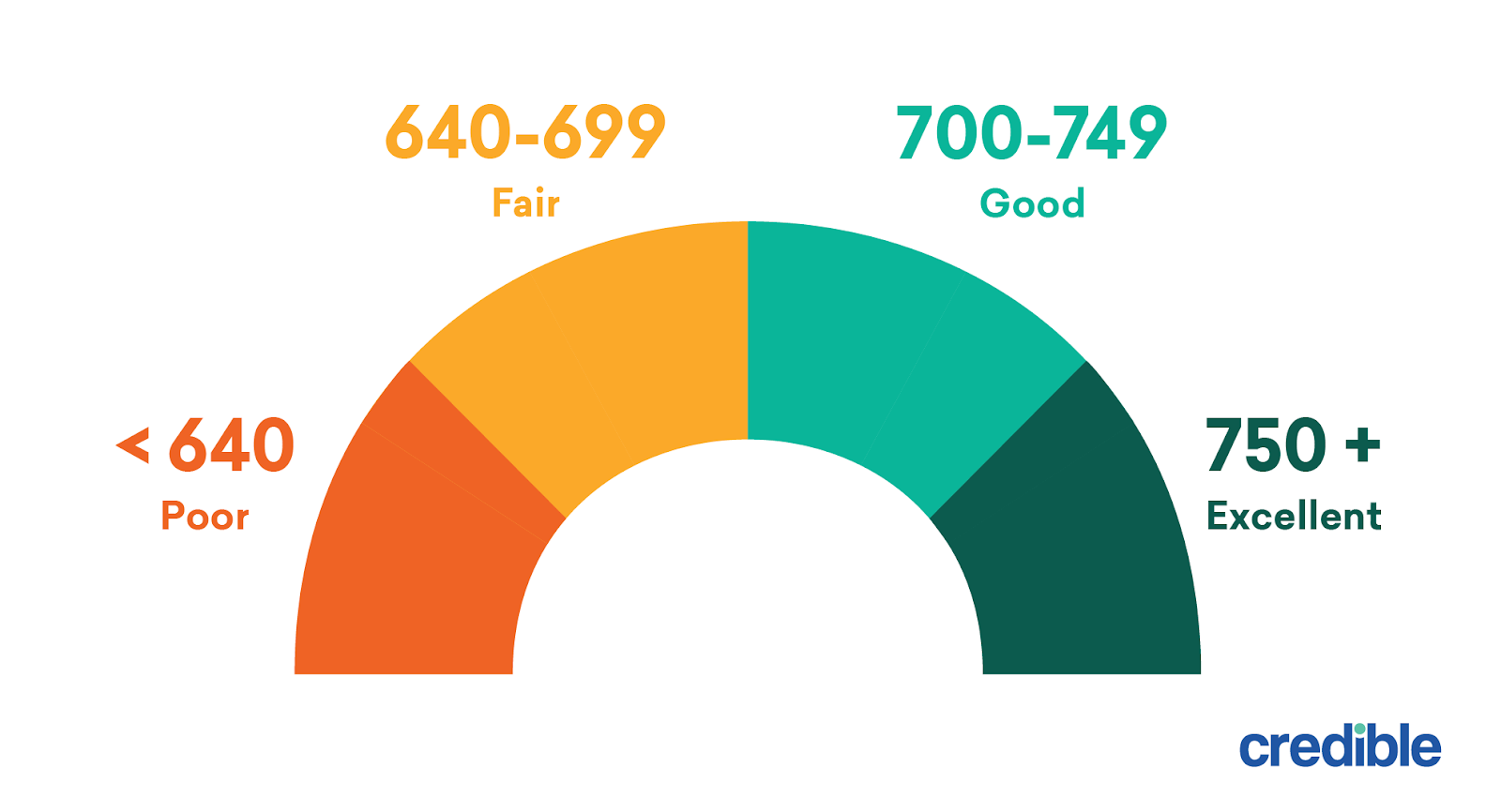

As well as your credit score we take your individual points into account to help you work-out a fees decide to match your income and you will situation. All of our qualified people out-of advisors are content to go over any queries you may have towards software process.

How much can i use?

Progressive Money render unsecured homeowner fund ranging from ?step 1,000 in order to ?fifteen,000 that have repayment terms off eighteen months to 10 years. Regardless if you are aspiring to make some renovations, combine your debts, pay for a married relationship otherwise beat yourself to another auto, we could possibly be able to let coverage the cost and you will arrange an easily affordable payment propose to fit your. Since an accountable financial, we make sure that every finance is actually reasonable.

Have fun with all of our unsecured resident loan calculator getting a no obligations offer to see simply how much you can obtain.

Typically, a resident loan would require you to definitely safe up against your own property’s well worth. The total amount you could potentially use all depends what you owe from security, extent leftover adopting the an excellent balance of your mortgage try deducted on the most recent value of the house or property.

Rather than other loan providers, Progressive Cash is a direct financial and simply inquire that you try a resident living in your property and certainly will prove your own qualification for 1 of one’s money. We possibly may be able to offer a keen unsecured homeowner mortgage, which is almost certainly not had a need to safe against your property.

Repaying your own homeowner loan

Very property owner loans is actually paid within the monthly instalments, usually as a result of Direct Debit. You need to use pay back the borrowed funds very early, however, please be aware one to into the settlement you are going to pay interest upwards into day, and one day more.