If you prefer money for house renovations or emergency expenditures, you may want to think a house equity mortgage during the The newest Hampshire. House collateral financing allows you to tap into your security and remove a secured loan.

With aggressive pricing and you can an easy software process, Griffin Investment helps make household collateral funds easy. See how The brand new Hampshire home equity fund makes it possible to obtain the cash flow you desire.

A home security financing is a type of protected loan you to spends the residence’s guarantee since the guarantee. You can utilize the money you have made out-of a property equity loan to cover something, plus family home improvements, school costs, and you may medical debts.

Family security loans normally have straight down rates of interest than just personal loans and you may credit cards, which means that obtaining a house collateral loan when you look at the The latest Hampshire can be an intelligent solution for those who have large costs so you can finance. Brand new Hampshire domestic guarantee loans can also be helpful when you find yourself seeking combine loans.

If you get recognized to own property equity financing, the financial assists you to utilize a specific percentage of the home’s collateral. Generally, lenders will allow you to obtain as much as 80 loans St Augustine Shores or 95 percent of equity you have got of your property. Your loan terms will vary with regards to the types of loan you select, but you’ll need to pay the loan out of ahead of promoting their house. For individuals who offer your home before you pay your loan, the money throughout the product sales will go on the the mortgage.

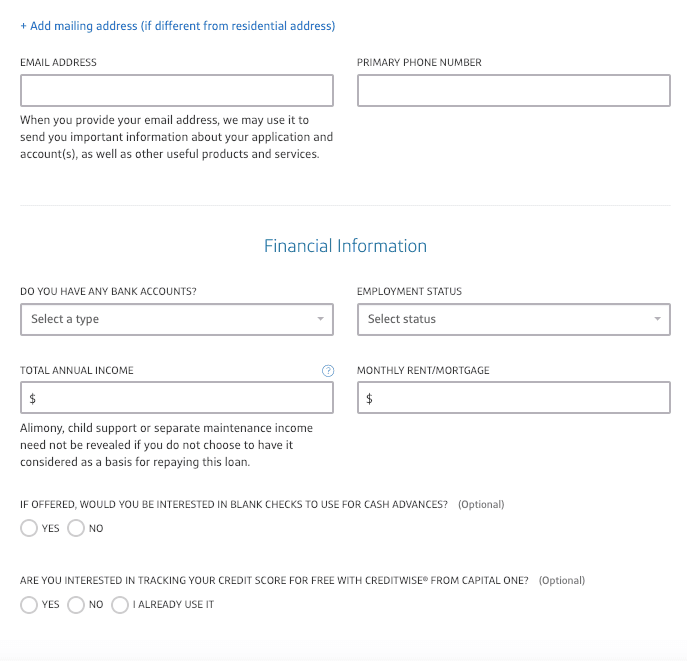

When you submit an application for a property guarantee financing, you’ll need to offer taxation statements and you may earliest information about yourself. We also offer a bank statement HELOAN to own mind-employed people who lack a W-2.

Types of House Guarantee Financing

You will find different varieties of family equity money with various words. It’s your choice to decide and that loan style of excellent for you. Griffin Funding even offers one another domestic guarantee fund (HELOANs) and you can family security lines of credit (HELOCs).

A vintage household equity loan is in fact like any almost every other loan you might apply for. While recognized, you are getting the loan when you look at the a lump sum payment that have an excellent fixed interest rate. Their monthly payment is the exact same monthly, and you normally have between four and you can 40 years to pay out of the loan. HELOANs are a good choices if you’d like a lump sum payment of money to have a huge venture otherwise expense.

Property equity personal line of credit allows you to availability a beneficial credit line utilizing your house’s equity because security. If you’re recognized to own a beneficial HELOC, your bank provides you with a having to pay maximum based on how far collateral you have got additionally the value of your home. HELOC cost from inside the NH is actually adjustable, therefore monthly obligations are very different dependent on your existing rate and you may extent you spend.

However some somebody e benefits. Just like the a borrower, it is important to understand how a good HELOAN really works as compared to an effective HELOC and you can what every type of financing is made for.

Positives and negatives of brand new Hampshire Domestic Collateral Money

Trying to get a property equity mortgage is a sensible disperse if you want entry to cash flow, however, you will find threats. Before applying getting property guarantee loan in the The fresh new Hampshire, check out positives and negatives you must know on the.

- You can purchase entry to bucks which you can use getting some thing

- Household collateral fund generally have low interest in contrast so you’re able to handmade cards and personal fund

- Griffin Investment has the benefit of competitive interest levels so you’re able to cut far more

- It’s not necessary to lose your own reduced financial speed

- You could potentially possibly deduct the interest paid down to your a good HELOAN regarding your own taxes

- Household collateral finance allows you to tap into the newest security out of no. 1 residences, next belongings, and you can funding services

- There’s a possible threat of overspending having a HELOC

- You could potentially reduce your house if you cannot repay your loan

- Taking out fully a beneficial HELOAN expands the debt load

The fresh new Hampshire domestic equity finance are going to be a simple way having residents to access cashflow for things such as home improvements, but it is vital that you make use of your financing responsibly and you may shell out they back timely.

The fresh Hampshire Home Guarantee Financing Certification Criteria

Before applying for a loan, you have to know just what loan providers are looking at to make yes your be considered. This is what you ought to bear in mind when you find yourself implementing to possess yet another Hampshire family security loan:

Qualifying to have a property security mortgage isn’t really exceptionally tough, however, that does not mean there are not any conditions. For individuals who have not featured your credit score has just, you can use the latest Griffin Silver app observe their credit score and make sure your bank account come in purchase.

Get a property Security Mortgage inside New Hampshire

Household equity funds offer many perks having borrowers who would like to tap into its guarantee and you will boost their cashflow. Providing you just obtain what you would like and you will shell out your loan from promptly, The brand new Hampshire family guarantee fund would be a good funding.

While you are considering tapping into their residence’s security and you will taking out that loan, the audience is right here to simply help. Griffin Financing now offers aggressive interest rates and you may loan terminology, and it’s really an easy task to apply on the internet . Fill in an online application otherwise contact us to get going together with your home collateral loan today.