An excellent Va jumbo financing try a veterans Factors (VA) financing one is higher than the conforming financing restriction of $766,550 and up so you’re able to $step 1,149,825 during the highest-cost areas such cash loan Murray as Alaska and you can Hawaii. When you are a dynamic-obligation service affiliate, experienced or qualified thriving spouse, and you meet up with the earnings and you may credit standards, a good Virtual assistant jumbo mortgage might possibly be an option for your.

What is a supply loan?

An adjustable-price home loan (ARM) was a mortgage who has a first fixed-rate period of four, eight otherwise a decade and you will a changeable speed after the repaired-rates months concludes. After the basic rate label ends, the fresh new estimated commission and you will rates get changes. A growth otherwise disappear hinges on the market industry criteria within time of the transformation for the adjustable price and you can inside modifications period afterwards. An arm financing was a good option if you plan to market inside many years.

How come an arm financing performs?

Having a keen (ARM) loan the original interest is restricted to possess a-flat period and gets varying, changing sometimes on the left lifetime of the loan according to ple, a good jumbo ten/step one Case have a predetermined rate toward earliest a decade and you can a variable price to the remaining duration of the loan, modifying each year. An excellent 7/six Case possess a fixed price on basic eight years and you may a changeable rates for the rest of the mortgage, modifying every six months.

Do you re-finance an arm financing?

Yes, a preexisting Case financing shall be refinanced on credit approval. The many benefits of mortgage refinancing , consist of replacement the regards to your existing loan with terms that will be a lot more favorable for your requirements, minimizing monthly payments, providing the means to access dollars to possess biggest commands and cutting your desire price. Your mortgage loan administrator makes it possible to find the correct selection to your requirements.

Quinn Romolo

Mortgage acceptance was susceptible to borrowing approval and you will system assistance. Not absolutely all loan software can be found in all says for everyone mortgage wide variety. Interest rate and you can system conditions was subject to transform without warning. Mortgage, house collateral and you can borrowing from the bank goods are considering thanks to You.S. Financial Federal Relationship. Put products are given courtesy You.S. Bank National Relationship. Affiliate FDIC. Equal Construction Financial

Hand calculators are offered of the Leadfusion. This calculator is being sent to educational objectives only. The outcomes is actually rates that are according to advice you considering and may even not echo You.S. Financial equipment conditions. What can’t be employed by You.S. Lender to determine a consumer’s eligibility getting a certain tool otherwise solution. All the monetary calculators are given of the 3rd-group Leadfusion and are usually perhaps not associated, controlled by otherwise underneath the control of You.S. Bank, their affiliates otherwise subsidiaries. You.S. Lender is not accountable for the message, overall performance, or the accuracy of information.

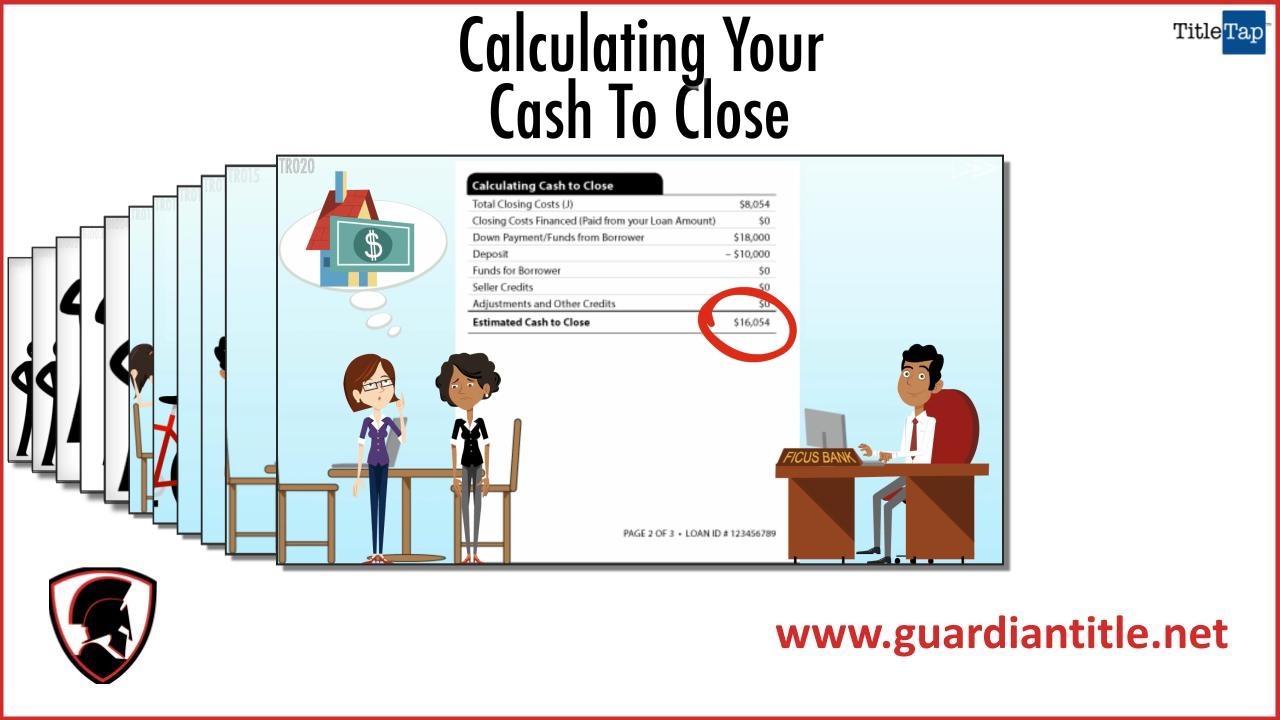

step 1. New costs above guess you have got a down-payment, otherwise guarantee, with a minimum of twenty five% to own a traditional fixed-rates financing, a changeable-speed mortgage (ARM) mortgage or a good jumbo mortgage, at least 3.5% for an enthusiastic FHA loan and you can 0% to have an excellent Va loan. Go back to blogs, Footnote 1

Compliant fixed-price estimated monthly payment and you can ount which have a 30-seasons term from the mortgage of six.500% having a lower-payment, or borrower collateral away from twenty five% without dismiss points bought carry out bring about a projected monthly prominent and you may notice percentage out-of $2,933 along the full-term of the loan with a yearly commission price (APR) regarding 6.667%.

Estimated monthly payment and you can Apr formula depend on a down-fee, or debtor equity of 25% and you will borrower-paid down financing charges off 0.862% of your own feet amount borrowed. If your down payment, or borrower equity is actually less than 20%, home loan insurance rates may be needed, that could improve monthly payment therefore the ounts for fees and you will insurance fees while the actual commission obligations might be better.