Chairman within Joseph Wrobel, Ltd.

You can find form of mortgage loans for sale in in order to homebuyers immediately following a bankruptcy proceeding launch. Just after a case of bankruptcy release not as much as A bankruptcy proceeding otherwise Section 13 you could probably qualify for home financing earlier than your consider. In the event the personal debt to income proportion is perfect immediately after discharging particular otherwise all costs, you will be a better credit chance when you have even more throwaway money to save money and you may make ends meet. Immediately after your own case of bankruptcy release you really have a bit working into re-setting-up your own credit and you can spending less for off repayments and closing will cost you. If you are ready to initiate looking for home financing indeed there are a few choices to believe dependent on your own personal state and you will home ownership desires.

There are two brand of case of bankruptcy, Chapter 7 (complete discharge) and you will Part thirteen (partial release and reorganization). Most people that have Chapter thirteen bankruptcies try acknowledged to have government-recognized mortgages immediately after 12 months otherwise they could be acknowledged having a normal mortgage after two years. The new A bankruptcy proceeding bankruptcy filers might have to wait about three otherwise several years immediately following their discharge to-be acknowledged to own another home loan.

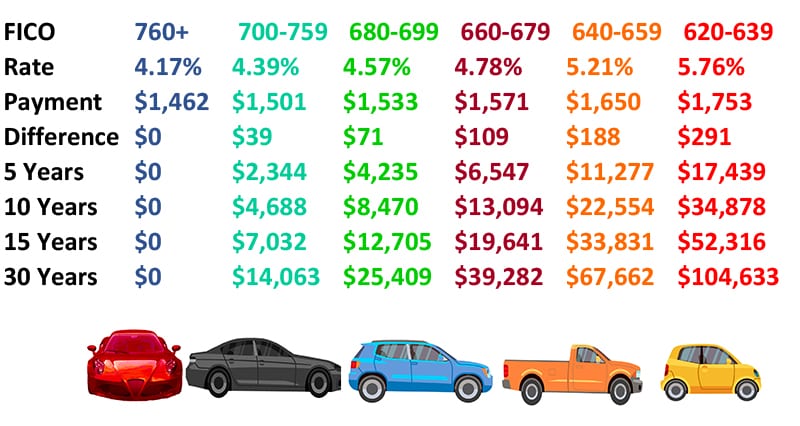

People decided to simply take no less than a couple of years or higher so you’re able to reconstruct the borrowing using safeguarded credit cards and you may small fund, whilst saving money on costs working in getting money off and closure towards a different domestic. The newest stretched you waiting, the better interest you could get. This is simply not usually genuine although not because rates of interest change.

S. Bodies is the economic guarantee on the financial, if the personal does not pay the mortgage. Traditional finance aren’t protected from loans in Ohatchee the national, and since they may not be protected, the customer need greatest earnings.

FHA financing supported by the brand new Government Property Management allow people in order to create down repayments as low as step three.5%. Buyers are needed to cover mortgage insurance and therefore grows monthly installments;

Va fund covered by the You.S. Agencies off Veterans Issues assist military provider people in addition to their family members get homes having 100% funding definition new consumer simply needs to afford the closing costs.

USDA finance is actually insured because of the U.S. Department off Agriculture and you can benefit outlying consumers exactly who fulfill money requirements also a steady middle-class earnings whom otherwise will most likely not qualify to own old-fashioned funds.

While you are acknowledged having a fixed-price mortgage when rates is actually reasonable you may be secured for the at that reduced home loan price for your label out of the borrowed funds and your payment does not alter. Additional types of loan is actually a varying-rates home loan (ARMs) having rates you to definitely move from every now and then dependent towards the interest rates. Specific Possession provide repaired prices for quite some time right after which go out the pace is actually subject to changes according to research by the prices from the the near future time. If interest rates is at the top of mortgages while implementing, you may choose an arm to be able to you will need to protect a better rate in the event the pricing decrease. You usually are able to refinance the loan and pick a fixed-speed financial just after that have an arm for a while.

Joe Wrobel

Throughout the all of us: Joseph Wrobel, Ltd., works together website subscribers to see if they qualify for Part 7 or 13 bankruptcy proceeding, as well as their selection and you can rights according to the rules. The business will additionally recommend and you will assist readers having inquiries and concerns about the newest collectors as well as their legal rights to pursue you.

Joseph Wrobel, Ltd. helps some one score command over the funds and you will a unique begin in the financial liberty. Brand new company’s web site consists of educational video on economic circumstances also as the case of bankruptcy cover for parents who are in need of an innovative new initiate.

Don’t forget to match united states into the Fb, Myspace, LinkedIn and you can Avvo, where you can discover visitors and you may peer analysis!