Applying for home financing and buying a house is a huge step. Did you know when you submit an application for a mortgage normally impact the desire you only pay on closure? You will find a finest time for you make an application for preapproval and an excellent ideal time and energy to close, however in many cases, debt standing should determine the optimum time to apply.

When is the better time for you get home financing? Learn the advantages and disadvantages from peak seasons for home loan approval of course, if to make use of right here.

- Whenever Must i Get a mortgage?

- 1. See The money you owe

- 2. Browse the Present state of Housing marketplace

- Come across Every several Products

When Ought i Sign up for a mortgage loan?

You might apply for a mortgage anytime – there’s no incorrect time to incorporate. Consider the following the factors to day your own home loan for higher gurus.

1. View The money you owe

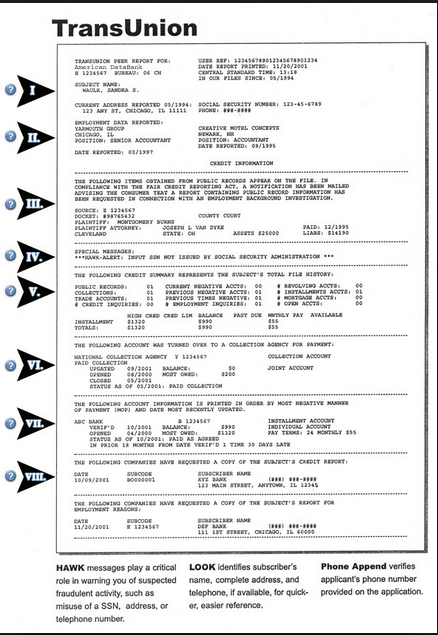

Personal time is much more crucial than simply field time when applying for a home loan. Determine whether you are financially steady and you may effective at taking up a mortgage. Create discounts, and look at your debt-to-money ratio and you may credit rating to determine pros and cons possible financial institutions may find.

Consider exactly how much down payment you can afford and whether your can also be create extra savings otherwise pay back obligations before applying. Brand new Federal Put Insurance rates Corp. (FDIC) also provides most information making an application for the first financial.

dos. See the Present state of Housing market

Construction styles transform daily. Local real estate agents can provide you with wisdom into fashion. You can keep a record of manner home based pricing, interest levels and you can access. Understand that houses areas are often neighborhood-certain, therefore you should look for a reliable real estate agent to get in touch your that have regional trend. It’s also possible to envision larger regional products for example occupations gains, new benefit in addition to regional real estate industry.

step three. Check your Personal Condition

Property is a big relationship of your time and cash. See whether you are ready in order to agree to property and payday loans Portland you will brand new duties that are included with they. Check out the date you’ll need to look after property and you may package having unforeseen costs. Regarding the financial front side, determine business stability, savings and you can if you want to stay in the room enough time-name.

cuatro. Check out the 12 months

The optimum time to try to get a home loan may vary based the year. Spring season and you can june are typically considered the newest most hectic to your housing market. Trying to get a home loan inside slide or wintertime will get result from inside the smaller race and better rates. You can enjoy shorter mortgage preapproval and you can closure times. Certain real estate agents together with recommend making an application for preapproval during the start of the week in order to speed up the process.

5. Talk to home financing Professional

Speak with a home loan professional to simply help dictate the best time to apply. Some masters suggest that you can easily pay reduced appeal for the closing in the the termination of the newest day, and you will score less acceptance from a home loan company on the beginning of the new times.

A mortgage professional can provide expert advice and you may information according to your unique financial predicament and wants and latest trends certainly one of local lenders. Get the best lenders having care about-employed benefits here.

Pros and cons regarding Obtaining home financing While in the Top 12 months

Spring season and you may june are considered the busiest to the housing industry. The elements are enjoying, days try expanded, vegetation have been in bloom and you can surroundings can create good first feeling. Hotter weather is including open house season, with additional properties indexed on these busy weeks. Here are the positives and negatives of buying into the times to choose when you should get a mortgage.

Advantages

- Choices: An important advantageous asset of applying for a home loan when you look at the spring and you may summer is the fact there are many homes in the market. Of several home owners won’t bother number their qualities up until spring season, which will make winter-house searches bleak. Spring and summer mean more list to select from.

- Best interest rates: Spring and you will june also can promote a whole lot more competitive interest rates away from lenders just who check out safer much more mortgages during these weeks. it may provide large interest levels, so make sure you comparison shop.

- Autonomy to maneuver: To possess household which have school-many years youngsters, june can supply you with more time to go and accept on a different sort of house before the newest college or university season begins. That alone is why summer the most prominent 12 months and come up with a shift.

Disadvantages

- Competition: Higher consult function way more competition. You will probably find on your own outbid or your dream house offered when you’re you get home loan pre-acceptance.

- Longer waiting times: Making an application for a mortgage may also take longer as the lenders process more applications on these days. You will need to waiting lengthened to own approval and closure.

- Higher costs: Highest year may also indicate higher prices. You can get caught in a bidding conflict, pay more than might expected or score priced off an effective property.

The length of time Does it Attempt Get approved to own a mortgage?

How long it will require to find approved for a mortgage would depend on your own finances, the financial institution while the markets. Financial acceptance usually takes between 30 days to a lot of days.

You might speed up the procedure by very first obtaining a home loan prequalification page. You could get home loan preapproval in as little as three days, nonetheless it might take-up to three days. Once home loan preapproval, last financial approval may take as low as dos? days. Because the a property consumer, you are advised to check your credit rating, credit history, and you may credit rating before you apply to have home financing getting faster recognition.

When to Apply for a home loan

Obtaining a mortgage if you have waiting financially could possibly offer best potential for the wanted home and you will community. You should buy a home loan in every seasons, even if spring season and you may june could be the busy year with an increase of options. It’s worthy of examining rates of interest and you can talking to mortgage lenders and you may realtors on markets trend to safe prequalification in advance of focus costs or prices go up.