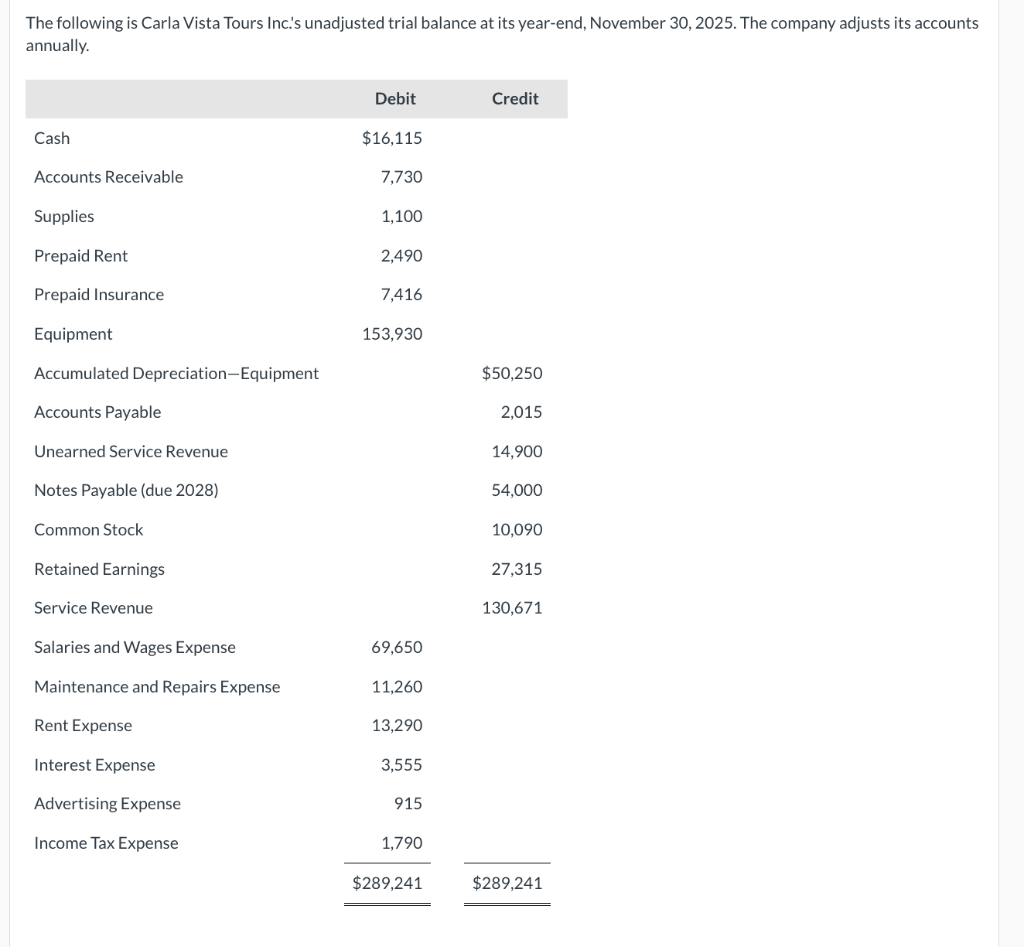

A houses loan try an agreement within debtor and also the lender, where lender supplies the mortgage, and the debtor intends to pay-off the same in this an effective pre-outlined period that have attention. In other words, a good borrower’s repayment effectiveness is a vital idea toward financial to be sure prompt recovery.

Once you submit an application for a home loan, the financial institution have a tendency to closely analyze your cost effectiveness prior to giving the fresh application for the loan. Your debt-to-income (DTI) ratio is one of the first devices used by the borrowed funds provider in this regard.

When you’re about to get a home loan, then here are 5 stuff you ought to know the fresh new DTI ratio-

1. What’s the Loans-to-Income Proportion?

Your debt-to-earnings ratio can be defined as a relationship or review between your own month-to-month money and current obligations. All of the bank lies a critical focus on the brand new financing you are currently repair to make certain even if you’ll be able so you’re able to on a regular basis pay the monthly EMIs of the home financing you go for about when planning on taking.

Individuals with a higher DTI proportion are usually thought a credit chance, in addition to chances of their application for the loan rejection was higher. However, the fresh new DTI ratio is just one the main acceptance procedure. The mortgage can nevertheless be acknowledged whether your borrower fulfils all the other conditions.

2. How ‘s the DTI Ratio Computed?

Brand new DTI proportion was computed by summing-up every monthly loans payments and you will isolating they by gross month-to-month income. Including, let’s think that Mr Navin features a browse around this web-site monthly get-domestic income away from Rs. step 1 lakh. He could be currently paying an auto loan and you will an unsecured loan. The newest shared EMI regarding one another fund try Rs. forty-five,000 per month.

Ergo, by the breaking up the newest month-to-month personal debt payment (Rs. forty five,000) because of the gross month-to-month income (Rs. 100,000), we have a worth of 0.45. Whenever we multiply this value by 100, following we are going to get a beneficial DTI portion of forty five%. As manual formula is pretty straightforward, you can also find on the internet DTI ratio calculators to see the DTI.

step 3. What is the Better DTI Ratio having Mortgage brokers?

Just like the asked DTI ratio can notably are very different ranging from financial institutions, the majority of the loan providers favor consumers which have an obligations-to-income ratio off 20%-40%. In the event the DTI ratio is actually anywhere between 40% to help you 60%, then you might nonetheless become approved to your financing however, from the increased interest.

The possibilities of acceptance are particularly reasonable for those with a DTI ratio away from above sixty%. However, as previously mentioned significantly more than, there are lots of additional factors one to lenders to consider prior to giving or rejecting a home loan software.

4. Might you Change your DTI Proportion?

- Postpone your decision to buy a property

- Just be sure to improve month-to-month EMIs regarding existing money to settle them faster

- It’s also possible to envision foreclosing a preexisting financing

- Prevent getting any longer funds until your own DTI proportion are significantly less than 40%

- Come across a means to generate additional money

- Believe getting a combined financing having a functional partner, young buck, or single daughter

5. Why should Borrowers Learn Their DTI Ratio Before you apply to possess good Financial?

Knowing the debt-to-earnings ratio is essential to confirm although your fulfil the fresh new eligibility criteria of debtor. Apart from affairs such as month-to-month money, years, and credit rating, the newest DTI ratio is also a crucial idea to have lenders.

In the event your DTI proportion is less than 40% while fulfil all the other qualification requirements, after that it will be easier to locate recognized with the financing. If you find away your DTI ratio are higher, up coming it’d getting wise to basic improve it before applying to help you prevent getting rejected to your mortgage.