step three. Everyday personnel

It can be burdensome for you to definitely qualify for a house loan whenever you are a casual worker, because the loan providers will find earnings stability because a problem. Lenders in addition to commonly think that whenever enterprises intend to put of staff, everyday workers are always the initial in line to go.

Everyday workers are will doing work in brand new hospitality world, universities, and you may hospitals. When you are an informal staff member, you have an everyday background in identical line out-of work or the exact same industry to boost your chances of taking acknowledged getting a mortgage.

4. Temp professionals or institution experts

Company otherwise temp gurus make up a life threatening portion of Australia’s doing work populace. They’re utilized in several opportunities but most are not within the the areas from it, hospitality, health care, and you will exploration.

These workers are rented into a short-term foundation. Agency workers are functioning thanks to a mediator muscles instance a Newark loans beneficial employment institution. The fresh new employer cannot shell out your directly — alternatively, the new agency you to definitely hired you will be the one so you can issue you a salary or salary.

Its difficult to get a mortgage if you is a company worker. A temporary worker’s business defense is a significant basis of these lenders. Agency gurus inside the higher-request areas might find it simpler to have its financing approved but also for specific, taking data who does tell you lingering a job is sufficient.

5. Probationary pros

You’ll find notions that when you are new to your work, you can not sign up for a mortgage. That is incorrect, as you’re able to nevertheless submit an application even if you is actually nevertheless good probationary worker.

Discover probationary workers in a number of specialities that are constantly favoured by the lenders. They are instructors, medical professionals, exploration business experts, and you may authorities staff. Addititionally there is a high probability that your software is recognized in the event your current employment suits your own track record of sense or informative history.

six. Part-go out professionals

A mortgage is a long-name financial commitment you’ll hold for around twenty years — its for this reason banking institutions dont basically go for part-big date experts. These individuals, in principle, try smaller secure than others with complete-day perform.

If you’re an associate-go out employee, your home-application for the loan continues to have a chance to get the thumbs-right up if you struck certain standards. Very first, you need to be in a position to prove that you has actually kept their part-time posts for around a-year before applying. It’s also advisable to submit up-to-date taxation statements and you may research to ensure your income. Constantly, finance companies only consider half of the income you have made off a part-date part. Other people is almost certainly not thus tough and you can consider your full salary.

Another way to boost your possibility is to obtain longer from works from your own manager. This can together with help you get a more impressive financial. However, it can sooner or later rely on the principles of one’s bank.

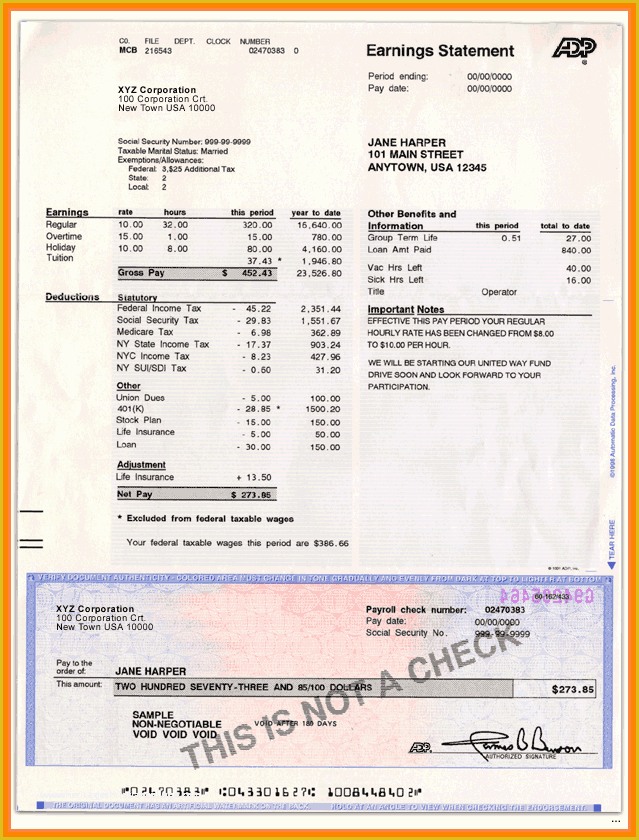

Together with the popular household-loan application requirements, you must offer data files that serve as evidence of your own employment and month-to-month earnings. You should present up-to-date payslips, category certificates, an employment page, and you can financial statements.

So what can you do to find approved when you find yourself the brand new into job?

There are a few steps you can take to ensure the application still becomes approved even if you was fresh to your task otherwise are about first off on a role.

The first thing you are able to do is actually use a diminished number. By now, you will want to already know you to definitely banking companies usually think about the dangers you show whenever examining applications. If you are new at your business, banking institutions could be reluctant to give you much — it’s always best to view your financial means very first and just acquire what you want.