670 to help you 739: Good credit

S. consumer. Instance, from inside the 2022, an average FICO score in the country is actually 714. Therefore, most lenders consider this to be good rating, appearing your a relatively dependable borrower.

As the a debtor inside assortment, it is possible to command aggressive rates of interest, yet not as low as anyone having pretty good otherwise outstanding credit. not, it may also be much harder about how to qualify for unsecured money that have a favorable rate of interest, so you may must look around to obtain a lender prepared to provide you with a suitable price.

740 in order to 799: Very good Credit

In case your credit score is actually between 740 and you may 799, this will demonstrate to loan providers your an economically in charge, reliable borrower with a good credit score management skills. A credit history within this range carry out place you above the mediocre U.S. individual.

Hence, you’ll be eligible for both safeguarded and you will personal loans in the competitive rates of interest. On the other hand, most traditional lenders would be ready to approve your application to have a home collateral mortgage, as your credit score create demonstrate that your loan costs was typically generated promptly.

800 to 850: Exceptional Credit

Consumers within this diversity features displayed a long history of in charge credit administration and you can, ergo, are more likely to be eligible for financing on the reduced interest pricing. A credit history away from 800 and above manage place you within the the highest tier from You.S. borrowers, showing that there is little or no threat of your defaulting to the an agreement.

You would have to have a lengthy history of reduced credit application, loans in Hartman on-day payments, and you will in charge monetary administration to achieve a credit history in this range. However, using this get, possible easily be eligible for safeguarded and you can signature loans of conventional lenders at the really low interest rates and favorable financing terminology.

Factors which affect Your credit score

There are four biggest issues having an impact on the credit history. So, if you want to replace your get, it’s vital on exactly how to know what he is.

Fee Background

Bookkeeping for thirty-five% of credit score, this is the most important factor that you need to become spending attention to. They informs loan providers even though you may have a track record out-of paying off the funds loaned for your requirements promptly. In addition it shows although you really have any previous fees-offs, loans agreements, property foreclosure, or wage garnishments on the records, enabling possible loan providers in order to assume exactly how most likely youre to settle any coming finance.

Credit Combine

This is the smallest component of your credit rating, accounting for approximately 10% of one’s final result. They says to loan providers regarding various types of fund you take off to recent years, and additionally installment finance, mortgages, retail membership, and you can handmade cards.

When you yourself have different really-treated borrowing membership on your own reports together with fees financing that have repaired monthly premiums and you may rotating borrowing from the bank that have variable payments it suggests loan providers that you can effortlessly create different types of financial obligations without being overwhelmed.

Wide variety Owed

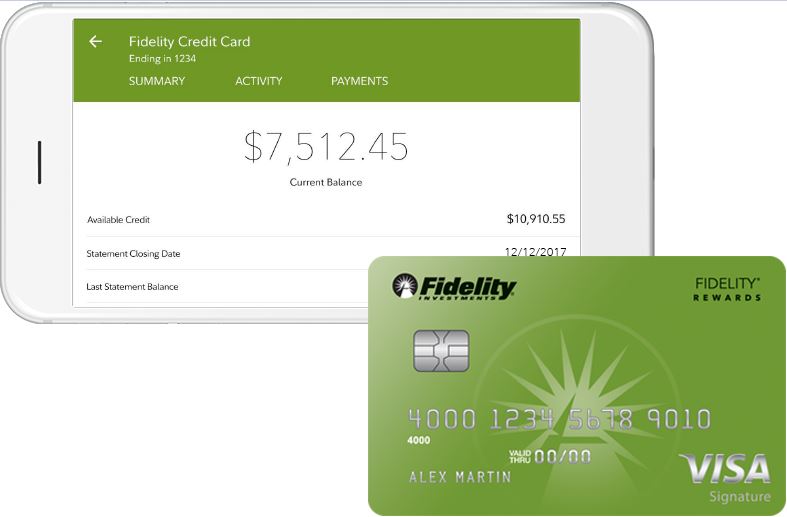

Accounting for up to 31% of your own credit rating, this might be fundamentally a means for lenders determine simply how much obligations you may be holding prior to extent you could borrow. This really is labeled as the financing utilization proportion.

You could assess the credit application ratio away from a certain credit credit by the breaking up the bill you will be carrying from the borrowing limit thereon credit. This can tell you exactly what portion of the brand new readily available borrowing from the bank you might be playing with. You should try and maintain the credit use proportion really less than 30% to help you alter your credit rating.