- Expert CIBIL rating (ranging from 750 and 900)I always suggest that you keep the CIBIL get anywhere between 750 and 900 since it shows that you made all of the payments promptly. Borrowers with sophisticated CIBIL score are believed reasonable-chance consumers – who pay-all the credit cards and loan EMIs on time. Additionally, they are eligible for an informed interest levels for the accepted amount borrowed. Essentially, an individual that have a good CIBIL score is acquire a good high matter financing with our company at an extremely glamorous interest rate or any other benefits for example limited paperwork, flexible mortgage period, etc.

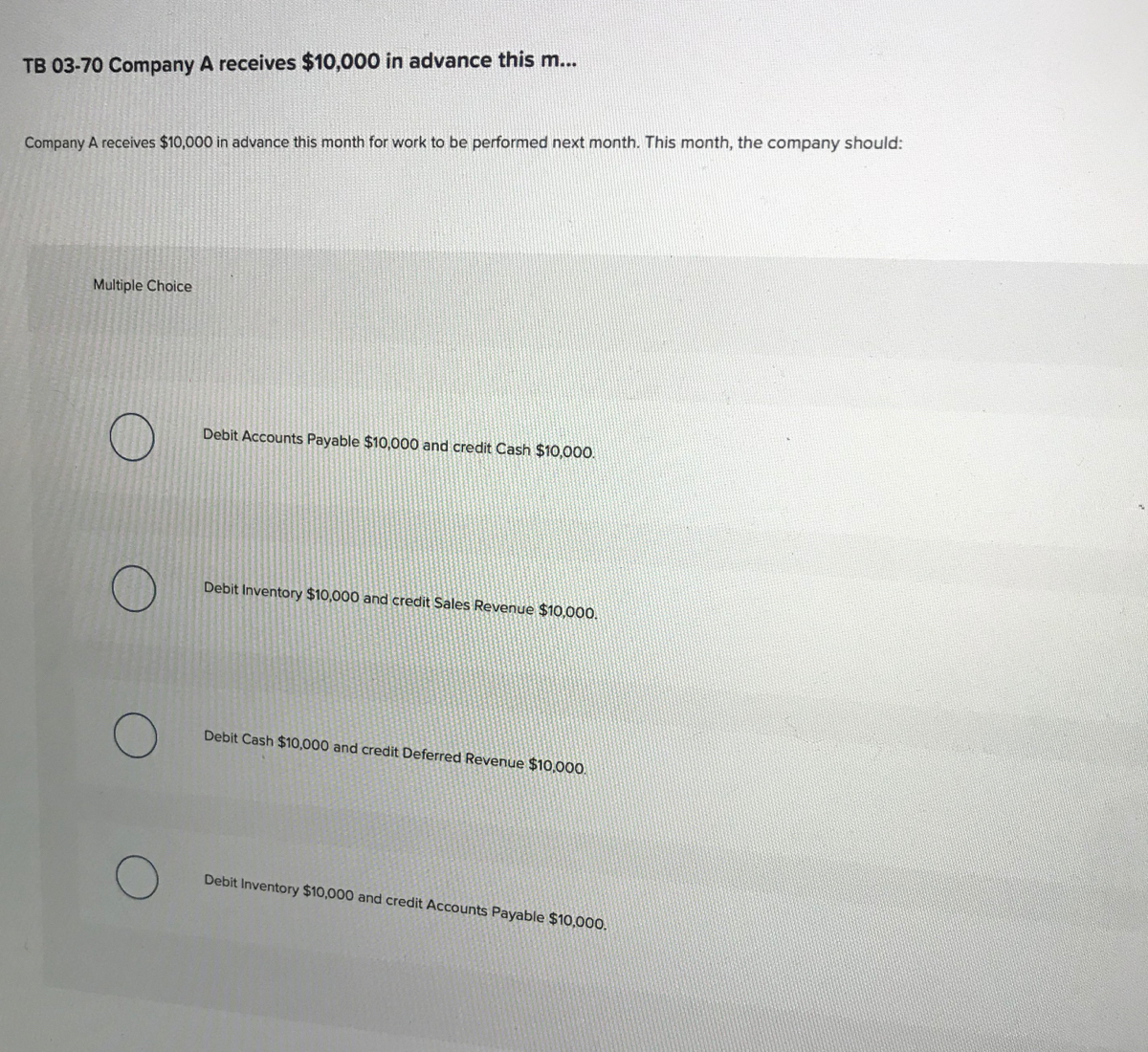

Exactly how is your CIBIL score determined?

CIBIL is one of the well-known borrowing bureau which is authorised to create the financing rating regarding borrowers. Its really managed by RBI’s (Put aside Bank out of India) Institution out-of Banking Functions and you will Creativity. CIBIL get are determined by multiple points and that determine the class or quantity of your credit score.

Items one impact their CIBIL score:

- Borrowing otherwise repayment historyWhen your get financing or borrowing card, you really need to have a beneficial credit or cost records. Which sets your own creditworthiness and you will lets us offer you a diminished rate of interest and other masters https://paydayloancolorado.net/cripple-creek/. Paying down the brand new finance punctually will allow you to enhance your borrowing rating and you may people standard in percentage or late money will reduce your credit rating.

- Credit UtilizationCredit utilization was majorly influenced by how much percentage of charge card limitation is utilized monthly. Overspending otherwise overutilization out-of credit constraints tend to hurt the financing rating.

- Credit combine and you can cost durationCredit sorts of is really what particular mortgage you’ve got applied or availed, based upon your preferences. Choosing getting a variety of secured and you may unsecured borrowing from the bank facts and credit card will help you to from inside the keeping a healthier credit score. A lengthier tenure out-of upkeep a cards tool definitely influences the credit score.

- Borrowing InquiriesCredit concerns is held to check on your credit report. For those who have applied for numerous money in the a short period, it can hurt your credit score. As well as, each time you make an application for a loan, it does think about the credit report. This will mirror credit-starving conduct, which is checked-out adversely by lenders.

As a result of the concerns away from lives, you can require that loan otherwise borrowing at some point in day. Whenever obtaining a loan, a debtor with high CIBIL rating can get small loan approval as compared to one to that have a minimal CIBIL get. This is one of the main good reason why the CIBIL get is important. A premier CIBIL get will help create trust when it comes to help you mortgage cost. It means you can get glamorous interest rates or other advantages.

CIBIL Rating Strengths and you may Importance

Why don’t we check out the ideal products one focus on as to why CIBIL get is essential. Such will help you to see the character and you may need for CIBIL to take control of your earnings consequently:

- Creditworthiness:A major factor that anxieties the necessity of a great CIBIL get will be your creditworthiness. A beneficial borrowing otherwise CIBIL rating establishes you while the an effective creditworthy borrower. A premier credit rating indicates that you’ve been really timely and you may self-disciplined on your borrowing from the bank conduct before. For this reason, chances are that this borrowing from the bank conduct will continue going ahead, undertaking a great feeling into loan providers.

- Financing otherwise Borrowing Acceptance:The necessity of CIBIL score grows way more at the time away from loan otherwise credit recognition because find the fresh new qualifications away from the fresh new debtor. The last turn to the mortgage matter is created with the CIBIL or credit score as a primary at the rear of basis. Good CIBIL rating assurances the fresh new recognition of the need mortgage at a favorable interest.