Borrowing freezes: Even if the loan is not expired, the lending company normally freeze their personal line of credit in certain situations, for example whether your residence’s worthy of falls below the matter it absolutely was appraised to have when you got from the HELOC. This means you might don’t make use of the HELOC currency you was indeed relying on.

Is an effective HELOC best?

Hell no! A great HELOC isn’t the fret-free means to fix begin a unique chapter of your life, and it’s perhaps not an excellent shortcut to leave regarding personal debt! And you may our company is hoping one to chances are, you to definitely HELOC-funded retirement or domestic upgrade otherwise anything you’d prepared doesn’t sound as nice as when you initially come discovering.

Just because HELOCs hunt prominent will not pull away regarding fact they can along with hold really serious effects. For many who default otherwise misstep in any way, the lending company could take your home! Is that brand new bedroom furniture you just have to possess otherwise one 10-day trips really worth dropping your house over?

2. HELOCs dont really create earnings.

Basically, good HELOC is actually debt. And financial obligation cannot make some thing circulate however, tears, since debtor is actually slave into financial. Do you have to begin pension, relationships, profession and other larger, high priced lifetime enjoy due money to some providers that is simply out making a buck at your debts? We failed to think so.

How to do cashflow would be to repay all of your loans using the loans snowball approach. You may also boost your income compliment of another work or wise cost management. That make additional money getting such things as renovations, expenses otherwise your child’s relationships.

3. Protecting and you may spending cash is ways smarter finally.

Using up debt of any kind robs your regarding true financial tranquility. When you put your mind on the support in the evening, what would you rather be thinking about: thought a party in your paid off-having kitchen area, or making costs on your own this new marble countertops . . . for another 30 years?

That have a beneficial Ramsey+ membership, you should buy all posts and you may devices you ought to save yourself for future years, repay debt quick, and build long-lasting riches. You’ll be able to have you to redesign project carried out in almost no time-however, it should be accomplished loans-totally free!

How to handle it As opposed to Delivering a good HELOC

Okay, therefore we secured saving cash and receiving off loans that have best products. Wish to know a different way to save? Decrease your monthly mortgage payment! Your mortgage is likely one of the most expensive debts, however it might not have to get so high priced.

When the too much of your revenue is going with the their home loan, you can imagine promoting your home and downsizing to just one which is economical. Fool around with the home loan calculator to find out if that one is great for you!

You’ll be able to speak with an experienced monetary specialist observe in the event that refinancing the financial suits you. The latest RamseyTrusted gurus in the Churchill Mortgage features helped millions of men and women bundle wiser and work out a knowledgeable financial decisions therefore they may be able live better.

Ramsey Selection might have been invested in providing people win back control over their cash, generate money, grow the management event, and you will enhance their lifetime by way of individual advancement while the 1992. Millions of people purchased our monetary suggestions through twenty-two guides (in addition to twelve national bestsellers) published by Ramsey Press, plus a few syndicated broadcast reveals and you will 10 podcasts, with more 17 mil per week audience. Get the full story.

The issue is, an effective HELOC try financial obligation. And that means you become investing in this new high priced material installment long term loans no credit check Hamilton AL in itself, also several thousand dollars most for the notice. To make some thing far more tiring, the debt would-be called in the once you do not have the money to pay it off-and that can house you for the a stack from dilemmas (more on one in a minute).

Instant pay: As soon as your borrowing from the bank title expires, you must spend the money for equilibrium entirely. A comparable is true for individuals who sell your home. When you reach the termination of the fresh 3 decades (or if you need certainly to offer your property) and you also owe $thirty five,100 on your HELOC, your top manage to coughing upwards you to $thirty five,one hundred thousand immediately.

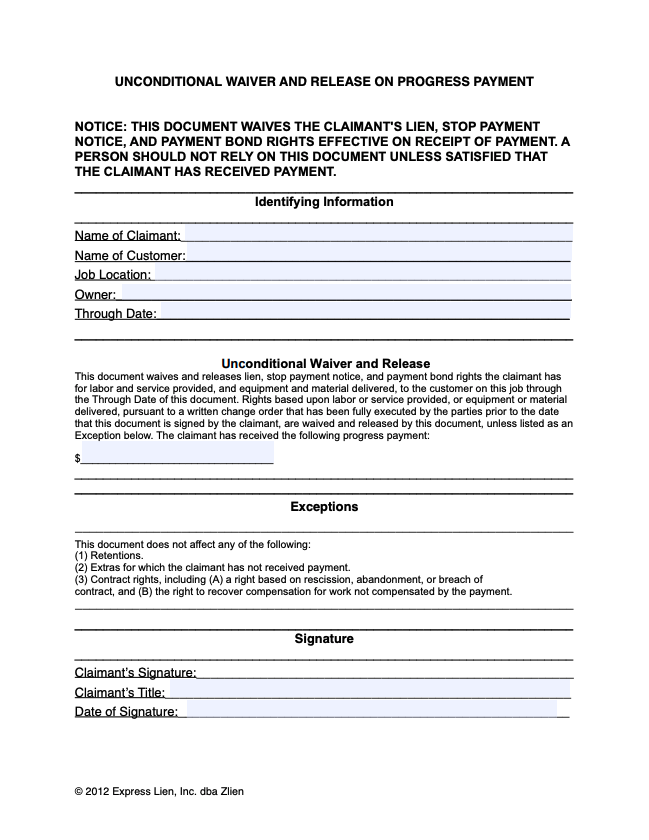

![seven.Judge Factors and Paperwork having Secure Obligations [Fresh Site]](https://murahkitchen.my/wp-content/themes/rehub-theme/images/default/blank.gif)