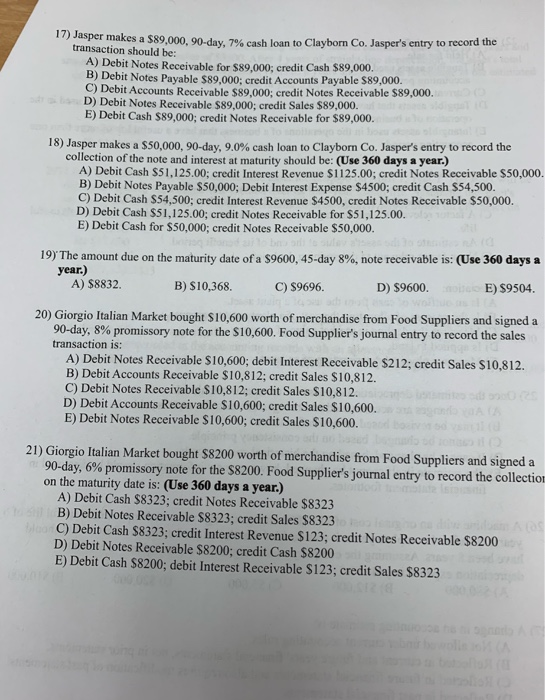

Exactly how much of money is utilized up expenses month-to-month debt costs? Our very own financial obligation so you can income ratio calculator the latest portion of your own month-to-month debt costs towards the disgusting monthly earnings. This will be a popular ratio utilized whenever qualifying for a loan but it’s really vital that you one to learn exactly how sensible the debt are.

Extremely loan providers suggest your debt-to-earnings ratio shouldn’t go beyond 43%. We believe a ratio regarding 30% or faster is really what you need to be economically healthy and you may some thing above 43% is actually reason for concern. When you find yourself up against a ratio of 50% or higher, you have to know talking-to a loans pro regarding the obligations recovery choice.

Obligations Proportion:

30% or reduced: A great. You are probably Ok. Debt payment is not sipping way too much your own monthly shell out, causing you to be room to increase your instalments adequate to pay off your debts oneself. Help make your budget, create a repayment plan, adhere to that bundle and almost certainly finish during the much better shape within this a year.

31-42%: In check. When you could possibly do with an obligations fees proportion it high, you are in the limit set of appropriate. If a great number of your costs enjoys adjustable rates desire (instance lines of credit) begin working to attenuate the debt now just like the ascending rates will mean more of your own paycheque could be heading for the debt payment subsequently. Whenever you are simply and come up with lowest repayments, next month maintain your costs a similar. Having increased, fixed, payment per month, will help you to step out of obligations fundamentally.

43-49%: Cause of Question. One version in the income otherwise attract can also be put you throughout the hazard zone. For many who only incorporated minimal payments, you do not have sufficient place in your money to increase your instalments sufficient to pay off your non-mortgage debts. We let we that have expense in this assortment generate an excellent winning offer for partial fees to their creditors.

50% or more: Risky. In the event the personal debt cost is actually trying out more 50% of one’s paycheque, you are against a loans drama which you most likely cannot offer that have yourself. It’s time to speak about alternatives for personal debt forgiveness, to lower your monthly payment in order to an even more affordable top.

In order to determine the fresh new express of one’s income consumed because of the financial obligation cost, submit the newest amounts in our easy-to-play with debt-to-income ratio calculator.

Include all the earnings source, together with a career money, your retirement, support payments, and you can regulators recommendations. Whenever you are care about-working, are your disgusting organization earnings online out of functioning expenditures before taxes and personal benefits.

Rent or mortgage payment Bank card repayments Car money Student loan money Financial or other loan payments Fees fund, rent-to-own Other debt money Complete Monthly Personal debt Costs

We is both rent and you can home look at these guys loan repayments within this formula. As to why? As home financing was a life threatening element of of many man’s loans difficulties, in order to make ratio comparable, those as opposed to home financing should substitute their monthly book fee.

You can also must add monthly spousal service repayments in the event that these personal debt take-up a serious percentage of your earnings.

Including, in case the overall monthly earnings was $2,800 along with your debt repayments totaled $step one,2 hundred your financial obligation-to-income ratio are:

Knowledge your debt-to-earnings ratio

A decreased debt-to-earnings proportion (DTI) guarantees you really can afford your debt your hold. Whenever you are applying for a different financing, loan providers consider your personal debt-to-money proportion included in the mortgage recognition processes concurrently toward credit history.

The sort of debt your carry is additionally a factor in evaluating the latest reasonableness of one’s DTI. A premier proportion motivated from the an excellent personal debt instance a home loan try a lot better than a high proportion due to good unsecured debt eg credit cards or payday loan.

- 30% or reduced excellent

- 31% so you’re able to 42% are down

- 43% to help you 49% try cause for matter

- 50% or higher are harmful

You will probably features a top personal debt-to-income proportion on your more youthful many years, particularly if you live inside a local with high actual house values such as for example Toronto otherwise Vancouver. As you strategy old-age, you ought to reduce your personal debt stream, so it will be affordable after you secure the straight down fixed later years income.

Reducing your personal debt stability

You could potentially alter your obligations-to-earnings ratio both because of the boosting your earnings or by detatching their financial obligation. For many people, the original option is maybe not feasible; yet not, people have to have an intend to escape personal debt.

- Make a spending budget and create an obligations fees plan

- Combine personal debt to lower appeal will cost you and you can pay back balance fundamentally

- When you’re struggling with too much financial obligation, talk with an authorized personal debt elite group regarding the alternatives that will help you dump loans sooner or later.

To make sure that you’re making progress, recalculate your debt-to-money proportion most of the couple of months. By viewing your own DTI fall, you are very likely to will always be motivated to carry it down after that.