You can purchase a mortgage shortly after Bankruptcy proceeding

Life goes! Your dump your work, you cure your residence, your car or truck try repossessed, and to keep the new financial institutions of hounding you after all circumstances during the day, you file a bankruptcy. Well, exactly what performed they expect? It is not instance you may be good deadbeat. It isn’t like you went to really works and you can questioned the latest boss to cancel your so you could go back home and you may eat Bon Bons. Zero, your forgotten your work with no matter simply how much you desire to expend your debt, there was virtually no way to do it. You never deserve are harassed. Nevertheless, loan providers hound you love a dog. Therefore, you file for bankruptcy.

Kind of Bankruptcy in australia

Area nine or ten Obligations Arrangement: A guy repays no less than a portion of its debts. Records getting Case of bankruptcy: A guy cannot pay off the debts. Case of bankruptcy stays on the credit history for up to 5 years.

Following Personal bankruptcy

Following personal bankruptcy, your credit ratings plummet. Your credit history declaration implies that you have been 30 days later, two months later, 90 days late, up coming 120+ days late spending your financial situation… then personal bankruptcy. Which record stays on your own credit rating declaration for around five years generally but not might be around seven ages for major offences. Your credit report try labeled as an effective less than perfect credit history. But, listen, you aren’t bad; your credit report are crappy. Therefore, why don’t we separate you from your credit score. Why don’t we check what we should perform to evolve a detrimental credit history in order to a good credit score. The type of credit rating that possibly enable you to get a beneficial home loan shortly after personal bankruptcy.

First thing for you to do try talk about their credit history. Today, I know you just had a case of bankruptcy and no you to definitely wants to help you loan currency on the best way to get a property… immediately. But that is merely a stumbling block. You could overcome it for the several implies.

Score a small, under control mortgage. Also a loan as small as $250 so you’re able to $five-hundred will serve an effective purpose. The concept we have found that you want first off building good good credit rating. One good way to accomplish that is to get a loan one you are aware you can pay back in monthly obligations. There’s two sort of finance one serve which purpose secured finance and you will personal loans.

Secured Mortgage: Secured loans are funds for which you place anything beneficial particularly a car and other property due to the fact collateral toward loan. This assets will be well worth sufficient to safety the value of the borrowed funds. This new creditor will say to you what they’re prepared to have fun with just like the security. Upcoming, if you should miss a cost, the newest collector can take the house away from you, sell it, and have now their funds straight back. Which is fair, proper?

Unsecured loan: Signature loans was fund that are not protected by the any possessions. He is harder discover. With this particular sorts of financing, the brand new creditor must believe that you will pay them right back, since if you don’t outlay cash right back, after that all of the capable do is actually remain sending your notices until you have to pay.

But, we all know you will pay your own funds straight back as entire concept of providing a loan, shielded otherwise unsecured is really so that one may begin producing positive statements on the credit history declaration. The better their borrowing from the bank talks about committed you make an application for your home loan, the better the risk is you would be accepted.

I’ve seen some body boost their get because of the thirty five so you can 50 issues within the an excellent year’s go out by just investing their latest obligations punctually each time. Thus, this means that all you have to carry out is make fast money and also you you will definitely raise a credit score from five-hundred so you’re able to 650 within three years.

For lots more details of exactly what score lenders find, see my personal post titled, What is the lowest credit rating having a mortgage from inside the Australia

How Lenders Price Fico scores

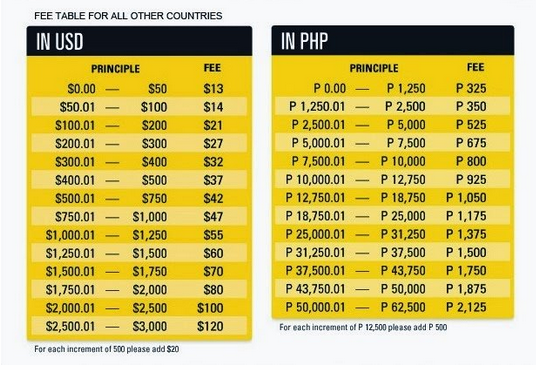

Warning! Lenders whom are experts in credit money to those that have bad credit provides large fees much less favorable words into borrower. Put simply, it’ll cost you your a whole lot more to find the loan. Just make sure you pay close attention on fees and you may the newest terms before signing to your financing.

What kind of Home loan Are you willing to Rating Just after Bankruptcy proceeding?

Really, according to your credit score, there are lots of possibilities. There are in fact on the web lenders just who concentrate on delivering home loans to people immediately following bankruptcy.

Works only with a reliable and you may knowledgeable Low Conforming Lender otherwise Agent. Query nearest and dearest, family unit members, and you can co-workers due to their recommendation in order to a large financial company. Get in touch with the brand new broker and ask regarding their experience with dealing with people with poor credit. Listen to the response to listen to whether they promote hope for a great result. Dont work at anyone who makes you feel crappy throughout the your credit report. Lenders that a great ideas are able to try to find possibilities and ways to help you to your the objective of bringing a mortgage.

How In the near future Can you Submit an application for a mortgage after Case of bankruptcy?

Essentially, you must wait about 2-3 ages once a case of bankruptcy before you apply for a loan because of a vintage lender. The alternative, simpler loan apps, such a less than perfect credit Financial have less big date degree standards. Such as, you will find mercy for people who have started put through the newest recession and missing its operate, therefore we features extra economic incidents to your selection of extenuating things. You can now claim extenuating circumstances to spell it out their lower credit score. With that since the a conclusion, the wishing time for you to submit an application for home financing just after bankruptcy proceeding was faster out of 24 months to a single time from release.

Minimal certificates getting getting a mortgage after bankruptcy are:

- Steady Employment

- Put of five% including can cost you required in highest populace section

- No further borrowing circumstances while the declaring bankruptcy proceeding

Yes! You can purchase a mortgage After Bankruptcy proceeding!

Don’t let a bankruptcy prevent you from having the Australian Dream. Run increasing your credit score and initiate considering on obtaining financing to buy your household.