The school should be an organization eligible to be involved in bodies pupil assistance programs to help you be considered, with almost all certified universities, universities, and you will vocational colleges.

5. Military supplies

If you’re titled to help you productive duty for around 180 months, you could withdraw financing early from your antique IRA and other qualified advancing years package in the place of up against plain old 10% penalty. This can help reservists would funds while in the deployment.

As part of the Safe Act, for every single father or mother can also be withdraw up to $5,000 of an enthusiastic IRA punishment-free within one 12 months out of pregnancy or adopting a baby. When the for each mother provides a special IRA, the complete withdrawal should be doing $ten,000.

Moms and dads can also be decide to redeposit the new withdrawals without worrying regarding annual share constraints. This means, they may be able pay but still make an entire contribution on the IRA ($7,000 within the 2024, or $8,000 if the over age 50) in identical 12 months.

7. Passed down IRAs

Beneficiaries which inherit a vintage IRA may take penalty-totally free distributions in advance of age 59?. Indeed, they are necessary to: The newest Secure Work says these types of beneficiaries have to empty an IRA handed down immediately following , inside 10 years of unique owner’s dying.

So it just applies to non-spousal beneficiaries – children, almost every other relatives, and you may relatives. Husbands and you can wives whom inherit this new IRA and you will choose a great “spousal import” of your financing within their own IRA could well be susceptible to early withdrawal punishment (when they lower than 59?).

8. Roth IRA Distributions

If you are considering taking right out IRA currency, you may want to tap americash loans Kirk an excellent Roth IRA basic, since Roths was less strict of early withdrawals.

New Internal revenue service allows penalty-free withdrawals of the matter you to begin with provided (excluding resource increases) at any time and you may age. Because you contribute immediately after-taxation financing to help you a great Roth and get been taxed towards the the money your discussed, you may not are obligated to pay fees to your benefits you withdraw early.

However, one money your withdraw early regarding an IRA could be subject into 10% penalty if you don’t be eligible for among the hardship arrangements and are generally under age 59 step one/2.

9. Dramatically Equivalent Unexpected Costs (SEPP)

The new Internal revenue service allows penalty-100 % free withdrawals to own Special Equivalent Occasional Repayments (SEPP). Under these types of preparations, you can also need a consistent annual shipping for 5 decades or if you don’t arrive at 59 1/2, any type of happens afterwards.

Therefore, for individuals who begin the latest payments on many years 58, they would stop if you find yourself 63. For folks who start distributions in the many years forty-five, you’ll consistently found them annually to own fourteen decades if you do not strike 59 step one/2. End this new arrangement early contributes to your make payment on 10% punishment your money taken.

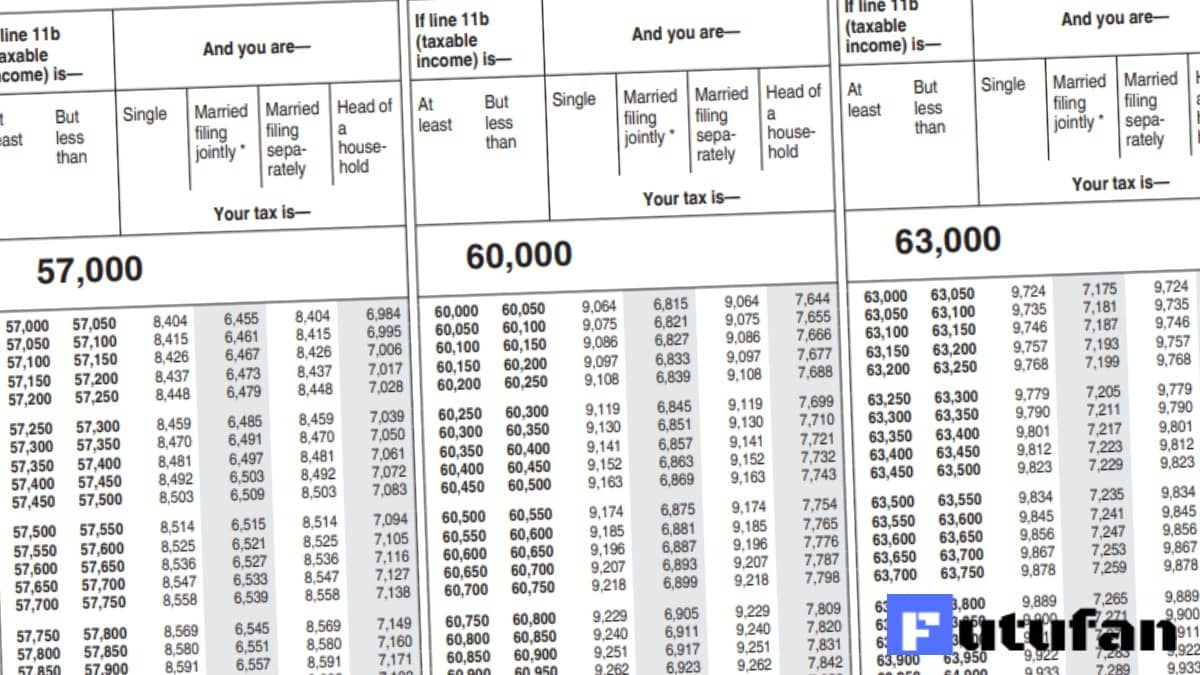

The degree of the latest annual distributions must be determined by one from about three Internal revenue service-approved measures. Figuring them shall be complicated, very you will likely require assistance of an economic otherwise tax top-notch.

Note: You may withdraw funds from an enthusiastic IRA to buy an enthusiastic annuity of an insurance coverage organization instead of taking on the fresh new 10% penalty or income taxes. This tactic is most effective if it’s an immediate rollover – the bucks gets moved right from the IRA for the annuity.

10. First-date homebuyers

You could prevent the ten% penalty for many who withdraw doing $ten,000 to order, create, otherwise upgrade a property. However need to be categorized as a primary-time homebuyer. The good news is, the latest Internal revenue service is generous with this specific meaning. “First-time” just function you haven’t owned otherwise created a primary residence inside the prior 2 yrs.

Furthermore, you should use the cash to assist youngsters, grandchildren, or mothers, considering they slip in the very first-date homebuyer rule.

Your spouse will add a different sort of $ten,000 from their IRA whenever they along with match the initial-go out homebuyer definition. Remember, but not, one $10,000 is a life maximum for each and every of you with the homebuying different. If the closing will get postponed, redeposit the money in this 120 days of new shipping to get rid of the penalty. Then, re-withdraw it when the time comes.