Taking out fully the next mortgage may be an extremely of good use device to increase the money if it is treated safely and you may next financial rates of interest was advantageous nowadays. The next financial software has longer to give repaired price domestic security loans and revolving HELOC personal lines of credit.

There are many reasons that property owners remove next mortgages and money out mortgages, and many of those is going to be guidelines regarding the correct items. Get a couple of minutes and you may mention that it 2nd financial help guide to know the newest cash-out possibilities to spend less currency having the present next mortgage loan cost to have lower payments you to change your monetary problem. You could potentially select from repaired 2nd home loan rates and you will varying rate credit lines. Are you searching for mortgage loan getting 2nd financial to have quick cash or debt consolidation reduction? This new Refi Book helps you combine loans to own straight down month-to-month money having repaired second home loan pricing.

Make sure when you compare family security mortgage pricing which you consider the annual percentage rate or Annual percentage rate, because count items throughout the cost of the loan. This new RefiGuide makes it possible to find a very good second mortgage brokers which have aggressive cost additionally the amount borrowed you ought to to do your aims.

What is actually the second Financial?

The next home loan are good lien one homeowners may take aside on the house without having to refinance its present 1st mortgage lien.

Its scarcely a key you to definitely initially and next home loan rates of interest was stated close list low-membership. Read on an enthusiastic learn how to qualify for an educated second mortgages in 2024.

Like any loan that makes use of your property as guarantee, you can find risks inside it, therefore it is vital to weighing the benefits and you will cons from a moment home loan before making a big union and you may signing judge data.

The term 2nd financial applies to the order where in actuality the credit financial get commission in case of a property foreclosure.

In such a scenario, our home guarantee mortgage is actually settled simply just after repaying the balance of one’s earliest financing. For that reason, if there is decreased kept equity, the mortgage business might not completely get well their funds. Given the improved exposure regarding the next mortgages, interest rates for these fund are usually large compared to rates for first financial liens.

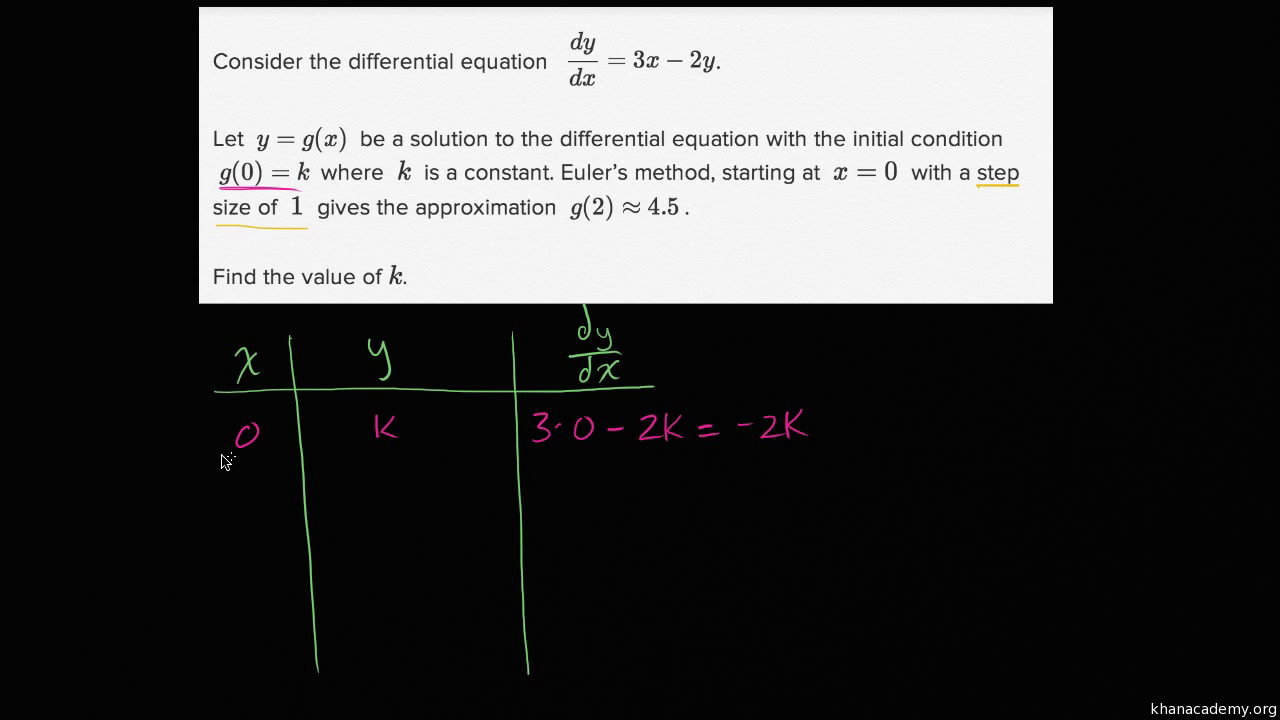

Why does a second Mortgage Functions?

In terms of a second home loan otherwise equity financing, the loan number depends on your property collateral-essentially, new gap between your property’s worth plus current financing balance. The chance is https://www.elitecashadvance.com/installment-loans-wi/augusta if you default to your repayments, your own next home loan company you’ll resort to foreclosures.

However, 2nd mortgages normally ability most useful rates versus options such as for example rotating bank card profile otherwise unsecured loans. Of a lot homeowners discuss next mortgages to access their accumulated family collateral, for combining personal debt, and work out a large pick or money house reine the attention costs to own 2nd mortgage apps for no. 1 residences and you can 2nd residential property.

Getting 2nd Mortgages regarding Top Second Mortgage brokers On line

The first step from inside the securing a 2nd-home loan relates to actions complotting the fresh collateral application for the loan and submitting their money papers, home loan note and you will monthly declaration to suit your first mortgage.

Regardless of if knowledge differ because of the home loan company, you are able to usually have to present this new files that underwriter means. The fresh brokers and you may lenders usually feedback your credit score and view your debt so you can money proportion. an assessment could be bought and that will ultimately calculate their financing in order to worth.

Very second mortgage lenders limitation the amount you could obtain, making sure a fraction of your security stays undamaged. The Refiguide will help you find a very good next-mortgage brokers that offer aggressive financial programs that have reduced security necessary.