When you set up a deal and it is accepted, you will work at the financial institution to accomplish extra documentation to the loan

The government tends to make it easier for visitors to-be capable of getting that loan buying a property. They do this comprehensive an application called Government Construction Guidance (FHA). The application form ensures that people who want to pick good household have more off an opportunity for having the ability to rating accepted for a loan due to a banking facilities so they can get one. It boils down to knowing where to search for FHA finance for ex-felons while others which to help make the pick.

They probably cannot query if you have ever come found guilty of a felony, however, there are no statutes one keep you from to acquire an effective home because of your criminal background. Definitely understand anything you can to be able to make fully sure you get a knowledgeable financing opportunity for your situation and stay to purchase family.

Traditionally, if you purchase a property or take away financing to take action you had to own 20% off to be recognized for the loan. For most people they may not in a position to pick domestic, as creating 20% to get down could be more than just they can handle.

The common domestic speed in america to have a several-room, two-bathroom equipment is just about $360,000. It could be pretty much, based on in which in the united states you reside. Should you have to put 20% down to be recognized to own an interest rate you would have to make $72,000 to become able to choose the house. The majority of people might have issue having the ability to save one much profit purchase to find our home. Therefore the newest FHA program was developed by government bodies.

New FHA loan program tends to make they easier for an individual that has a lowered money otherwise credit score if you wish to locate a mortgage. This new FHA finance to own ex-felons and others will ensure that people who would like to buy property will do so. Since the fund are supplied as a consequence of traditional financial and you will lending organizations, brand new FHA system says to the financial institution that they can contain the financing unless you pay it back.

Since the bank knows that the us government will make sure this new loan will get reduced, he or she is very likely to make you financing into the family that you like to find. 9% so you’re able to 10%, according to exacltly what the credit rating was, and that you enjoys a fees which is simpler for you to blow straight back. You still have probably to spend home loan insurance policies, that is additional inside within your month-to-month rates.

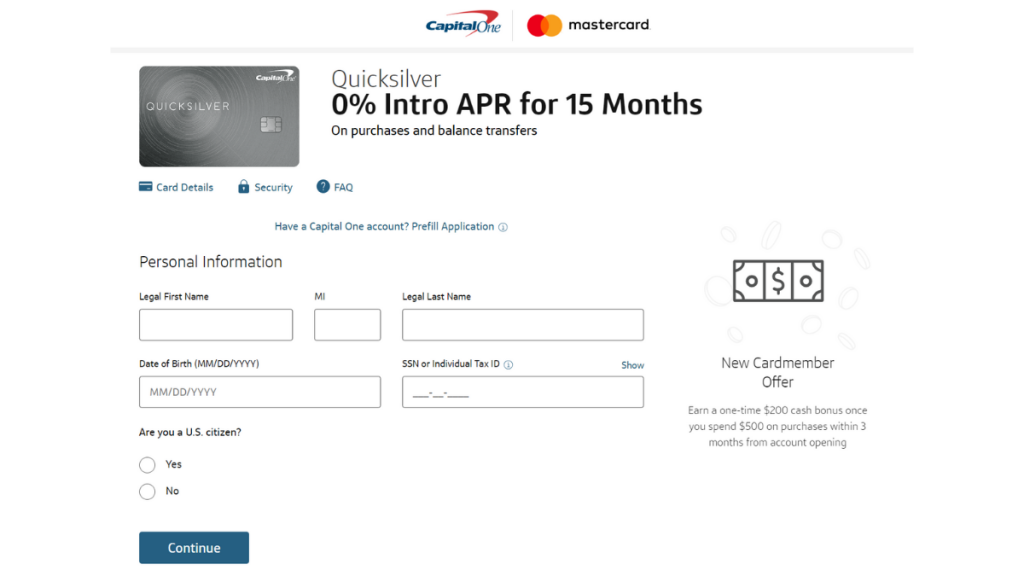

If you find yourself trying an effective FHA mortgage attempt to score accredited using a loan company or bank that provides home loan fund. Step one of your procedure is always to carry out what is actually called a good pre-certification. For this, you are going to complete the application with first records pointers and you will might tell you for people who appear to be a good candidate to locate a home loan and exactly how far you would certainly be acknowledged getting. They will certainly review your income, credit score, and you can ability to pay-off the mortgage. The higher your credit score this new reduced you will likely keeps to get off.

The brand new FHA mortgage helps it be to help you for which you will simply need to establish step three

The financial institution gives you a good pre-qualified page that is used when you are house google search. You may need to tell you it to be able to see into the property and you may have to $255 payday loans online same day Texas promote it to put from inside the a deal to get one to. You might have to over complete such things as money statements, taxation statements, credit history guidance, etc. If it’s for you personally to close toward financing, or create formal, there will be paperwork so you’re able to sign, saying that you invest in the fresh terms of the borrowed funds.

Check with your regional banks and you will credit unions if you like to work with a lender which is next to the place you alive. Another option will be to go with a nationwide financial. If you are getting a good rate of interest and you may terms, you will possibly not judgemental which lender you choose to go with. Certain may offer an incentive that can make it so much more appealing to decide them.

Lower than discover a listing of loan providers that provide FHA funds getting ex-felons while others who will get battle financially or features all the way down borrowing results.

Bank off The united states This can be a nationally recognized financial one does give FHA fund. It make the method convenient by permitting you do it on the internet. You could potentially agenda a scheduled appointment, have a chat example, as well as have prequalified from the absolute comfort of your pc. They give FHA loans that offer lower down costs, improve interest levels, and a lot more. To get more factual statements about its financing, view here.

Wells Fargo This will be one of many huge banking institutions in the nation and you will they are doing offer FHA financing getting ex-felons. Its financing program renders it easier for individuals score that loan. They give you them instead of doing an assessment, credit check, plus they range the process and then try to continue off payments down. For lots more details about the funds, follow this link.