Qualification standards to possess FHA loan applications

Being qualified for a keen FHA loan is much easier than just being qualified getting a traditional mortgage. The fresh new HUD establishes the newest qualifications conditions to have FHA money. An element of the standards is actually:

FHA funds do not have earnings constraints, however you will you desire proof of constant work. You could potentially tend to implement having a great co-applicant even though they won’t live in your home.

Collecting papers such as for instance pay stubs, taxation statements, and you may bank statements beforehand helps you prepare to apply for an FHA financing.

The FHA makes you use skilled funds to suit your off commission. Gifted means it money is via individuals, like a family member, workplace, charity, otherwise regulators institution, and no obligation on the best way to pay them. You will want a present letter saying you don’t need to pay-off the bucks.

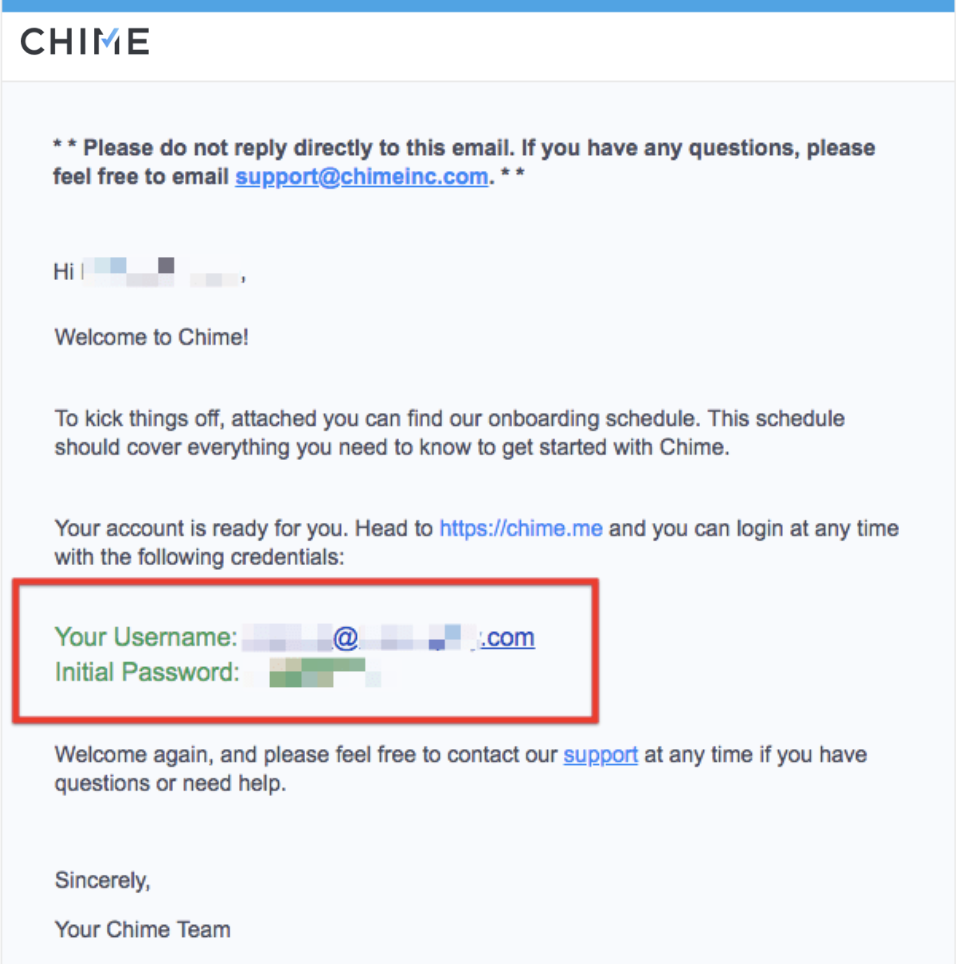

Ideas on how to apply for an FHA loan

Trying to get an enthusiastic FHA mortgage is like making an application for a normal mortgage. Their FHA-approved financial commonly show you from the procedure, which works out that it:

- Look at your credit history. If the rating are ranging from 500 and 579, you’ll want to save up to own the very least 10% downpayment. In the event your credit history is actually 580 or more, you will need merely 3.5%.

- Comparison shop to own FHA-approved lenders. The best FHA loan providers allow you to get preapproved, so you’re able to see what form of rates and you can loan amount you’ll be eligible for before you apply. You could potentially contrast the preapprovals front side-by-top to discover the best bank.

- Discover a house that meets FHA criteria. Along with your preapproval at hand, you can start finding services affordable. Run a representative experienced with FHA financing so you can choose the best possessions.

- Submit an application. Once you’ve discover a house you love, follow the measures on your chosen lender’s website to incorporate. This might be and additionally where you’ll promote all of the financial files expected accomplish underwriting.

- Wait a little for your appraisal. The fresh HUD need all qualities to undergo an enthusiastic FHA appraisal to help you determine the really worth and ensure it fulfill FHA conditions. You will additionally you need an inspection to identify any potential items.

- Get closing data files. If the all happens well, your own lender will send you the closing data to review from the minimum about three working days through to the real closure. Spend your time looking at which paperwork.

- Close on your own new home. From the closure, you can easily shell out your settlement costs (if you do not roll all of them in the financing otherwise feel the vendor pay them), submit your own files, and now have new secrets to the new put. Following this, you may be commercially payday loans Gordo a homeowner.

The key misconceptions was that one may receive a keen FHA loan for the any home and this zero advance payment required. Yet another misconception is that although the You.S. authorities backs the newest FHA mortgage, it does not suggest it can cover your credit rating otherwise report for people who miss otherwise make later repayments. Your house should be foreclosed toward. Of a lot citizens don’t realize your FHA financing shall be believed, meaning that another individual can take over the loan without an excellent household assessment otherwise using even more settlement costs. But not, the person incase the borrowed funds need to undergo a credit score assessment and gives its economic documents to prove he or she is dependable and you can in a position to afford the FHA mortgage.

Positives and negatives at your workplace with an enthusiastic FHA-recognized financial

You could meet the requirements having a credit score only 500 which have a good ten% advance payment otherwise 580 with an effective step three.5% advance payment. You can also be eligible for a keen FHA financing whether or not you’ve had a current bankruptcy or foreclosures.