- Examine car finance prices. Borrowers has to take time and energy to evaluate more loan also offers and you may terminology and read the new conditions and terms. Vehicle car loan factors become auto limits, rate of capital, loan conditions, and you can lending costs.

- Finish the car loan. Accomplish the borrowed funds on the bank from the finalizing brand new price. The vehicle’s subscription have to be current on the borrower’s identity, as well as the title should be provided for the lending company.

Simple tips to Examine Auto loans?

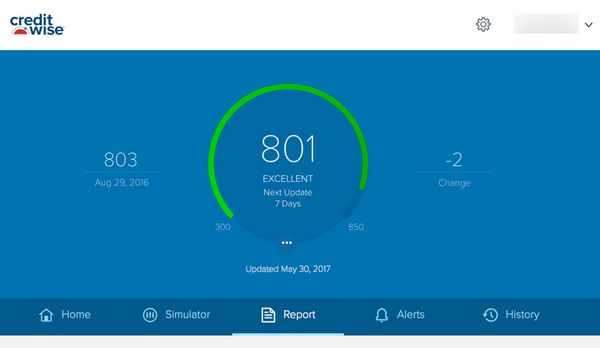

- Consider credit loans Madison score and you can qualification criteria. Lenders put rates of interest considering borrowing from the bank records and you will reviews. Know financial requirements and get conscious of mellow borrowing from the bank inspections. Having fun with prequalification lenders contributes to a reduced really serious credit check, to stop hard borrowing from the bank monitors which affect the credit rating.

- Look at loan amount and you will interest rate. Financing amounts are very different, which have highest pricing for the more critical amounts and lower prices to own shorter onespare quotes and apply to the reduced price, while the prequalification estimates commonly final. Vehicles lenders give fixed rates, making sure no price fluctuation over the years. Monthly obligations trust the brand new installment words.

- See the cost terminology. The size of the mortgage label influences interest rates and you will month-to-month repayments. Stretched attacks render straight down monthly obligations which have high interest levels, while faster conditions render down pricing but really highest payments. Along a car loan has an effect on the interest rate and you may monthly installments.

- Determine the fresh readily available savings. Lender discounts, dealer incentives, car-to invest in provider deals, and you can army associations help to lower mortgage will cost you.

- Thought extra costs. See charge to have file preparing, origination, beginning, and you may operating. Even more costs eg restoration, insurance, and you will taxation affect auto costs and you will interest rates.

What is actually a car loan Calculator?

A car loan calculator are a hack that quotes the price out of a car loan from the calculating the fresh new payment per month according to the borrowed funds count, interest rate, and you can loan identity. They takes into account the new downpayment, trade-during the worthy of, taxation, and you can label fees. A car loan calculator allows a borrower so you’re able to input some information, like the amount borrowed, interest rate, and you may financing name, and it following works out the fresh new projected monthly payments. Multiple hand calculators grab transformation taxation into account otherwise performs backwards in order to influence new reasonable restrict rates based on what the borrower are prepared to spend each month.

It allows consumers when deciding to take advantageous asset of useful financial support options and you can save time quickly. The auto online calculator assists see and that automobile are affordable and you may the latest monthly premiums, to evolve this new budget, and avoid monetary filters.

An auto loan allows individuals examine different also provides and pick one that most closely fits the finances. New calculator’s visibility facilitate consumers generate informed decisions and steer clear of financial pitfalls. It offers an obvious understanding of simply how much a debtor closes upwards paying in total, along with attract or other charge.

Where to get an auto loan?

Get a car loan thanks to finance companies, credit unions, on the internet lenders, dealer investment, peer-to-peer loan providers, and official auto loan company. You can find six particular creditors where consumers rating a keen car finance. First, banks promote gurus like built organizations, all the way down rates of interest, and you will numerous financing options. Delivering an auto loan as a consequence of a financial concerns numerous procedures, such as borrowing checking, shopping around, making an application for pre-recognition, choosing mortgage terms and conditions, and you can finalizing the loan. Financial institutions has rigid qualification conditions and you may longer recognition techniques. Multiple banking companies bring auto loans for new and you will utilized vehicles, together with refinancing options for decreasing monthly installments otherwise rates. Browse for every single bank’s standards and review the finances to be certain reasonable monthly premiums.

Furthermore, auto loans are available courtesy borrowing from the bank unions. Credit unions render all the way down interest rates than simply commercial opposition because they do not focus on earning money and provide personalized focus on individuals. Taking an auto loan by way of borrowing unions is carried out on line or really towards the requisite data files. Borrowing unions want subscription, which have varying requirements. Finally, on the web loan providers give competitive rates to have automotive loans and you can consider the appeal based on the business’s carrying out Yearly Fee Prices (ounts. The auto mortgage starts with examining the brand new customer’s credit and you may distribution the necessary records, as soon as accepted, the fresh debtor begins and come up with repayments.