Authorities having GTE Financial couldn’t feel reached for opinion on the your order. An effective Stifel spokesman together with declined to comment on the deal, nor confirm if almost every other borrowing unions will work to your additional vehicles Abdominal muscles business.

Bargain genesisThe groundwork to your GTE bargain is actually a legal opinion on the NCUA, brand new federal supervisory institution and you can depository insurer to possess borrowing unions. You to letter was at response to a point of whether federal borrowing unions met with the power so you’re able to material and sell bonds (owing to asset-dependent securitization) under one another NCUA statutes plus the Government Borrowing Connection Act.

Whilst the FCUA doesn’t authorize borrowing from the bank unions to engage in securitizations, new thoughts letter mentioned federally chartered establishments manage to participate in products that may end up in the incidental efforts specifications of the work, so long as they fulfill a around three-pronged sample to get to know the newest passions and requirements away from players due to the fact well just like the address protection and you will soundness concerns.

The brand new letter, basically, offered brand new nod to own federally chartered CUs in order to just do it, however, spelled out you to credit unions is to really works directly and you may vigilantly into NCUA to be certain a securitization program is designed and you may accompanied successfully, predicated on DBRS Morningstar

There is absolutely no regulating pre-approval’ by itself the contract, said Cioffi, nevertheless the NCUA prompts borrowing unions to apply straight to the agency to do an effective securitization and run all of them towards framework and you will implementation.

Book objective and structureSo why did it get nearly several and you will a half many years pursuing the NCUA courtroom thoughts on first borrowing commitment Stomach bargain to arrive into GTE purchase?

Borrowing unions’ full conventional method to increases and brand new tips yes performs a member. On top of that, credit unions have not traditionally searched securitization in other elements particularly financial and you can commercial financing, as an alternative and come up with direct sales for other loan providers for the pub sale. All of which ‘s specific are nevertheless unconvinced the tide try about to turn in a critical ways.

It’s hard to see securitization displacing far or any of those info, considering borrowing from the bank unions’ traditional bent, the guy said

cuatro million in the possessions and you can a beneficial $24.5 million book out-of fund, at the end of 2019-told you borrowing from the bank on FHLB system, drawing deposits, and come up with entire-mortgage transformation and you may participating in loan swimming pools have been way more the latest much more typical investment pathways to possess borrowing from the bank unions.

I do not see a massive storm making when it comes to loads of credit unions bouncing towards the that it, told you Lord. (Given that a state-chartered organization, SECU is not protected by brand new NCUA court viewpoint that applied purely so you can government credit unions.)

From what the amount CU securitization tend to show a typical supply of car Abdominal muscles getting people remains an open question. However, vehicles Abs notes come in sought after within the present age, off sales supported by economically good sponsors (each other primary and you can subprime), and you can built with strong architectural buyer protections and you will fast amortization dates in comparison to most other arranged-loans investment groups.

GTE’s very first guarantee pool possess an effective adjusted mediocre borrower FICO of 727, that is solidly during the level out of fellow perfect Stomach transactions.

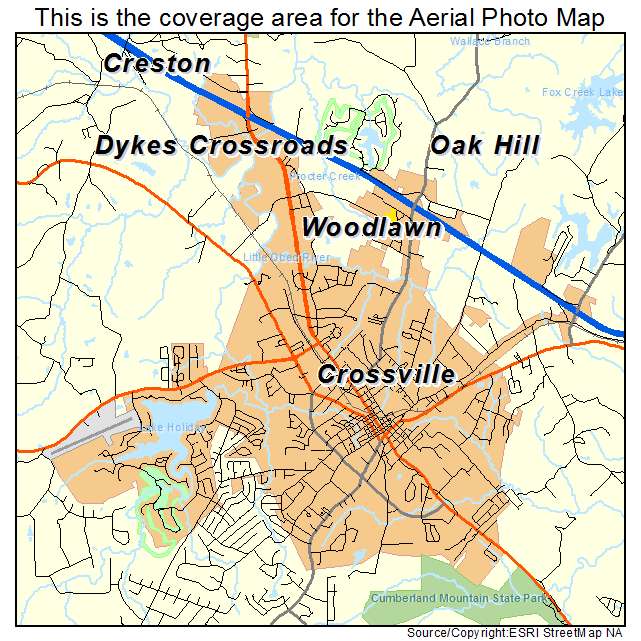

Such as for instance, as borrowing unions perform primarily into the regional-simply footprints, CU loan swimming pools is actually highly centered geographically. About 98% of funds inside GTE’s collateral pool are in Tampa town, the spot where the enterprise works 24 twigs, predicated on presale accounts.

Which might be hard for traders who need a lot more variety in the assets. Car Abs sponsors often generally create regionally diverse mortgage pools within the acquisition so you can payday loans Woodmont decrease the possibility of that have so many loans started from one town, where too many consumers tends to be subject to local fiscal conditions or one tragedy experience such as for instance a great hurricane.