Aren’t able to find a home which is checking your packages? Next it may be time and energy to build your own. Creating a house on floor upwards is going to be an exciting venture, however, resource it is a little distinct from taking out an effective traditional financing. One of the recommended a method to make sure you get the latest very from your own framework venture will be to understand the variations between a conventional loan and a property financing, plus the subtleties that come with for each.

Design finance and you can antique fund may sound equivalent initially since they are each other home loans, but they have been utilized a little differently.

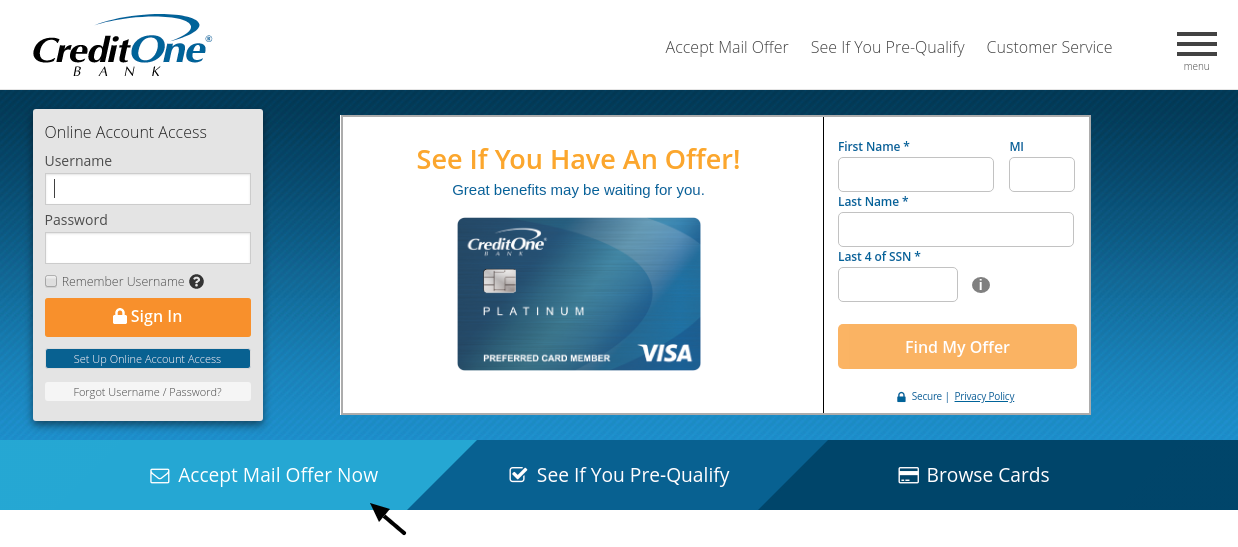

Arkansas Government Mortgage now offers construction loans and you may conventional fund. Correspond with one of the financial experts to find out more concerning your mortgage options, and apply on the internet today to secure your rate of interest.

Build vs. Traditional

Construction funds and you can traditional money is one another financing which are used for family orders, however, there are crucial differences in how they truly are utilized.

A conventional loan is normally what pops into the mind once you remember a timeless mortgage. Mortgages is an agreement anywhere between a borrower and you may a loan provider (think a financial or borrowing from the bank union) where the bank provides the debtor financing purchasing a great home, understanding that the borrower tend to pay back the loan together with notice charges through the years. Structure loans functions similarly but are instead familiar with finance structure ideas, improvements so you’re able to a house, otherwise structure with the an alternative domestic.

While the two types of fund are one another used to finance your perfect domestic, they form a small differently, both in their fool around with plus the process of getting for every single.

Loan Name

One of the major differences between traditional and build fund try the loan was given out and just how long the loan name is actually.

Which have a conventional mortgage, a citizen gets the totality of one’s loan fund at once to get our home. Old-fashioned loans generally have expanded financing terms often doing 30 years long where you pay-off the primary and you will focus.

Build finance possess a blow several months where you could use the funds from the loan to invest in the build investment in the grade. Mark periods having design financing can vary according to your lender, but they are generally speaking anywhere between about three and 9 months, or even the timeframe it will take to accomplish structure..

When your mark months is more than, your loan will be changed into long lasting investment, making it so much more similar to a timeless mortgage. The newest payment several months for the a property mortgage might be up to three decades it is usually less.

Financing Costs

Loan prices can differ centered on enough factors, together with your financial. Typically, construction financing tend to have highest rates of interest than just Atlanta savings and installment loan antique loans while the loan providers accept a bigger level of risk with an excellent structure loan.

Individual credit organizations lay loan costs. They are computed in person according to research by the borrower’s creditworthiness. Arkansas Federal offers low, competitive costs to your all the funds.

Acceptance Techniques

To obtain acknowledged to have a timeless mortgage loan, lenders usually want your credit rating, debt-to-income proportion, fee record, and you can a deposit. Structure finance provides comparable conditions, nevertheless they also require more info.

Discover a casing loan, you happen to be required to possess a high credit score than will be necessary to getting approved having a traditional loan. The building financing acceptance process can also require you to currently enjoys a creator, a housing bundle, and you can a construction funds that the bank is also review.

New recognition processes having a housing mortgage are going to be shorter than just the fresh acceptance procedure to own a conventional loan, but it can also be so much more total. When applying for a property loan, the lender often inquire in the-breadth questions about their arranged framework venture.

Coping with a builder who is used to the method can be help you to get acknowledged to have a homes loan quicker, because they generally speaking already have this new documents in a position having individuals.

Sign up for financing Today

When buying a home otherwise completing a task for the a property, it is very important get and make use of an educated mortgage getting your position. Construction fund and traditional finance may sound equivalent, but it is important to comprehend the variations and you can whatever they is be studied to own.

Arkansas Government also provides various mortgage choices to match most of the your house to buy otherwise building need. We try local, trusted, and you can supplied to help you due to each step of one’s procedure. Contact us at the or visit one of our local department workplaces to learn more about our house financing and you will what would really works most effective for you.

Ready to begin? We have been prepared to assist. Use on line getting home financing today it’s small, effortless, and all of which have an excellent $0 software fee.