When building an aspiration family or investment property when you look at the California, choosing the right loan title selection is crucial to guaranteeing an effective simple and you may effective investment, because directly impacts your money disperse and you can a lot of time-term financial commitments. Normally, design money in California possess an initial-term mortgage period of 6 in order to 12 months, letting you run finishing their structure venture ahead of changing in order to a permanent financial. One-big date personal build funds give you the advantage of securing for the a great fixed interest rate for the entire mortgage label, bringing balances and you may predictability for your requirements.

Inside the structure stage, you could go for appeal-just payments, that will help take control of your income and focus with the doing assembling your shed. Once build is finished, you might refinance otherwise convert to a long-term financial which have good loan label you to definitely range out-of 15 to thirty years, providing you with freedom on your home loan repayments. Particular lenders actually offer stretched loan terms of doing 24 weeks, taking more time accomplish assembling your project otherwise browse unexpected structure waits.

Obtaining a property Mortgage

If you find yourself obtaining a houses financing in the Ca, you’ll want to navigate a specific process that pertains to choosing the right loan choice, fulfilling lender requirements, and you can delivering outlined records. You should see the some other design loan possibilities to you, particularly USDA design funds or ADU funds, per the help of its book standards. By knowing what can be expected, you could get ready getting a smoother application for the loan techniques.

Loan application Process

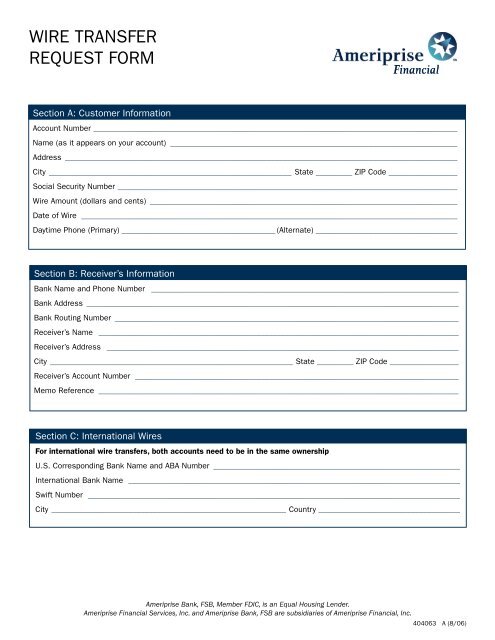

So you’re able to secure a property financing in the California, you should fill out an in depth app bundle detailed with requisite files and go through an extensive feedback procedure. This action generally relates to a credit score assessment, earnings verification, and you may a glance at your debt-to-earnings ratio, that have at least credit history from 620 commonly requisite. You will have to give an enthusiastic exhaustive policy for your framework investment, also a detailed funds, schedule, and range off works, to show your capability to do your panels punctually and you may within budget.

The lending company may also want an appraisal of the house so you can determine the worthy of, and that’s always influence the mortgage count and you will appeal rates. Once your loan application is eligible, the lending company tend to see here now disburse the income into the some brings, usually tied to particular milestones on framework techniques, like achievement of the base or creating. By providing a comprehensive application for the loan and you may meeting new lender’s conditions, you could boost your odds of mortgage approval and get the fresh new financial support you need to take your framework enterprise alive.

Build Financing Possibilities

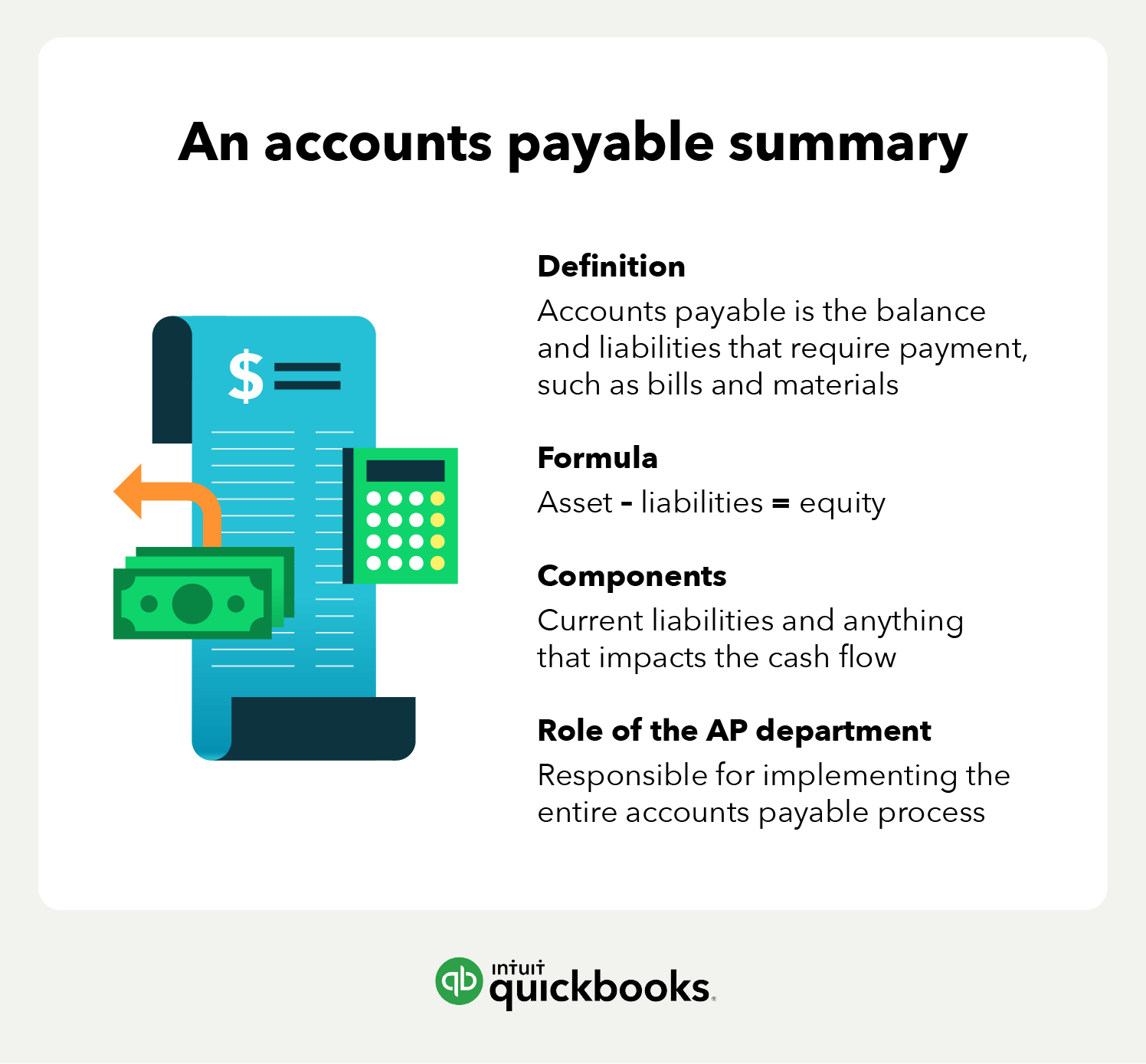

You’ll find that Ca has the benefit of multiple structure mortgage alternatives, each providing to several demands and you will preferences, and gripping these types of selection is vital to making an informed choice. When building a house, that have an intensive knowledge is needed to favor a loan that aligns along with your financial predicament and you can enterprise conditions.

- Construction-to-Permanent Money: This type of money combine the development and you will long lasting financial support stages toward one to loan, helping you save money and time.

- Construction-Just Financing: This type of money promote quick-identity funding into the framework phase, and you may need safe a separate home loan because the investment is done.

- Repair Fund: These types of loans are capable of home owners who would like to upgrade their existing possessions, and tend to incorporate way more versatile conditions minimizing focus rates.

When trying to get a houses mortgage, remember that lenders usually evaluate your credit rating, debt-to-income ratio, and you may loan amount to determine your own eligibility. Expect you’ll offer a detailed construction package, and additionally a task timeline, funds, and you can builder advice. Of the gripping your loan solutions and requires, you could make a more advised house.