I will be 56 so it day. My month-to-month earnings doesn’t satisfy my personal personal debt. We lease a from condition possessions, that have the next financial, that’s getting a lot to uncovered. I can not refinance because the my debt so you’re able to earnings ratio is just too large. Can i withdraw money from 403bs to repay some of the debt, thus minimizing my personal DTI proportion, making me an applicant for refinancing? I wanted all the recommendations you might render.

A taxation-Sheltered Annuity Arrangements (403(b) Plan) was a pension policy for specific personnel out of social schools, personnel regarding income tax-excused communities, and ministers. It’s got income tax cures just like a great 401(k) bundle, really the only important distinctions towards the participant are several additional indicates that they’ll withdraw employer currency, perhaps not paycheck-deferral currency, before the typical 59? age limitation, however, only when the plan is actually financed which have annuities and not common fund. Consult your plan officer to have specific laws and regulations of distributions less than the plan.

Refinance Certification

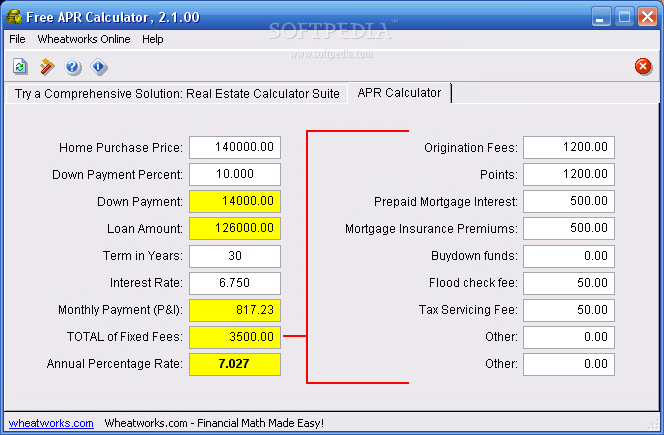

Even although you reduce your DTI, a mortgage refinance is not always a sure situation. Because you without doubt recall, a home loan company desires three one thing away from a possibility: Regular money, a fairly clean recent credit rating, and you will an obligations-to-income ratio regarding thirty-five% otherwise smaller. Users exactly who be eligible for home financing or a mortgage re-finance keeps most of the three ones features, together with an all the way down-fee when it comes to a home loan.

A good refinance is practically exactly the same. You should do specific research to find out if your meet the requirements. Start by the fresh new Expense blog post How to Rating home financing Home mortgage refinance loan? Next, I will suggest you down load a good Consistent Home-based Loan application (Means 1003), done it, and commence the refinance mortgage mortgage shopping. Up coming, go to the Bills mortgage refinance preserving cardio with no-cost, pre-processed estimates away from financial refinance loan providers.

Other Financial obligation Resolution Choice

That you do not discuss if for example the second home loan is ultimately causing their worry, or you possess most other expense that will be pull you not as much as liquid. You really have other choices to consider in the event that a mortgage re-finance really does perhaps not work for you. Because there are different personal debt quality possibilities, in addition to borrowing from the bank guidance, debt consolidation/credit card debt relief, a debt settlement mortgage, personal bankruptcy, or any other financial obligation quality choices, it is vital to grasp for each and every choice immediately after which get a hold of the answer that’s right to you personally.

Credit Counseling

Borrowing from the bank counseling, or signing up for a debt management bundle, is a common particular debt consolidation. There are numerous enterprises giving borrowing counseling, that is essentially a method to make you to payment right to the credit guidance agencies, which then directs one to commission for the creditors. Normally, a credit counseling agency can reduce your monthly money through getting interest concessions from the lenders or financial institutions.

It is vital to remember that during the a card counseling program, youre still settling 100% of the debts — but with down monthly installments. An average of, most borrowing counseling programs take to 5 years. Although many borrowing from the bank guidance software dont perception the FICO rating, getting enrolled in a credit counseling obligations government package does reveal on your credit report, and you will, regrettably, many lenders take a look at enrollment within the credit counseling similar to submitting having Chapter thirteen Bankruptcy proceeding — or having fun with a third party to help you re also-organize your financial situation.

Debt relief

Credit card debt relief, often referred to as debt settlement, was a type of debt consolidating one incisions your complete financial obligation, possibly more than 50%, with straight down monthly obligations. Debt settlement programs usually run around 36 months. It is important to remember, not, you to definitely when you look at the lifetime of your debt payment system, you aren’t purchasing creditors. Consequently a debt relief services out of debt consolidation reduction tend to adversely feeling your credit rating. Your credit score will never be a, at the very least, towards identity of debt settlement system. not, debt relief is usually the fastest and most affordable treatment for loans freedom, which have a low payment per month, if you’re to stop Chapter 7 Personal bankruptcy. The brand new trade-from we have found an awful credit history versus saving money.

Bankruptcy

Bankruptcy may solve the debt troubles. A section eight bankruptcy proceeding is actually a classic liquidation off possessions and you may liabilities, and that is usually noticed a history resorts. Since the personal bankruptcy change ran to your perception, its more challenging so you’re able to seek bankruptcy relief. If you are considering personal bankruptcy, I encourage one to speak with a qualified bankruptcy proceeding lawyer in the your neighborhood.

Recommendation

Even though there are many forms of debt consolidating, people having advisable that you prime credit which individual land would be to explore debt consolidating fund, when you find yourself users with a high credit debt and you can less than perfect credit will get need to mention credit card debt relief or debt consolidation. not, for each and every user is different, thus get the debt consolidating option that meets for you.

dos. Whenever you afford a wholesome payment (throughout the step three percent of the total personal debt every month) and also you should protect oneself regarding range and of going outstanding — consider Credit Counseling.

step 3. If you prefer a low payment per month and would like to get loans free for an inexpensive and you may little time, And you are clearly ready to manage adverse borrowing impacts and you will collections — after that look at Debt settlement.

cuatro. If you cannot pay for things inside a payment (lower than step one.5 percent of your own total personal debt per https://cashadvanceamerica.net/2500-dollar-payday-loan/ month) — imagine Case of bankruptcy to find out if A bankruptcy proceeding could well be suitable for you.