Do-it-yourself capital refers to the numerous procedures homeowners use to money home improvements, fixes, or enhancements. When you find yourself protecting up and having to pay-of-pocket is perfect, it isn’t always you’ll be able to. In such instances, you can think solutions for example playing with a credit card, taking right out your own or do it yourself financing, otherwise making use of their home’s current collateral courtesy a HELOC.

Such capital selection provide the currency wanted to shelter the new reount such that suits the newest borrower’s finances. Put differently, they give you the citizen the ability to improve their property’s aesthetics and effectiveness on their terms, of course and nonetheless such as for instance.

not, it is essential to select the right capital choice considering your financial situation and you will recovery desires. This helps you prevent unnecessary debt and also many worth away from a financial investment.

In this article, we will walk-through the brand new ins and outs of funding domestic reine different types of home loans offered, and give you all the info you need to generate told conclusion during the this travel.

Just how Do it yourself Capital Performs

Having inflation at the high account, domestic home improvements are receiving more pricey than in the past. Of numerous property owners today show a passionate demand for do-it-yourself money to avoid it higher rate. Here is a straightforward run-down off just how do-it-yourself capital really works:

- Contrast the options: View additional marketing getting an improvement project. Get the best interest levels, charges, monthly installments, and you will total loan will set you back within your budget.

- Sign up for the borrowed funds: Due to the fact application is accepted, you begin choosing financing with the fix. If you are a preexisting customer, these financing age date given that acceptance.

- Make use of the Money: Use the lump sum payment to finance your residence improve strategies, that will enhance your liveable space and increase your residence well worth.

- Pay the mortgage: Pay the loan from inside the fixed monthly payments. You may want to pay-off the loan very early, however, look out for possible early cost charge that may use.

Best ways to Fund Your property Advancements

Do-it-yourself strategies go along with a hefty price, that renders finding the best capital deal crucial. Luckily, there are plenty of solutions to choose from predicated on the newest homeowner’s novel condition. These are typically:

1. Household Collateral Loans

House collateral financing are perfect for people that have more worthiness within home than simply it are obligated to pay on the mortgage loans.

Such financing are based on the house’s guarantee as they are considering since the a lump sum payment. They usually come with a predetermined rate of interest and generally are paid along side span of no checking account payday loans in Ensley 5 in order to thirty years. You could usually borrow around 85% of your own residence’s security.

You could potentially sign up for a property collateral mortgage as a result of banking companies, borrowing from the bank unions, otherwise on the internet lenders, having rates of interest and you will terms and conditions predicated on your credit rating. Because your home obtains these types of loans, they often times feature down rates to have renovations. Also, you can subtract the attention in your taxes if you use the money to own home improvements.

However, a major drawback is that if you do not pay-off the borrowed funds, you can face severe effects, like the danger of foreclosures.

Benefits

- Repaired monthly premiums

- Appeal can be tax-deductible getting home improvements

Cons

- Need good credit for the best prices

- Value of miss you will leave you due over your property will probably be worth

- Chance of foreclosure for many who standard

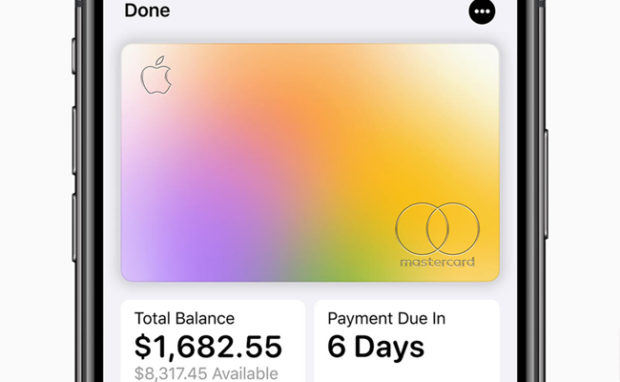

2. Household Equity Personal lines of credit (HELOC)

An effective HELOC is another choice for funding home improvements with your home’s guarantee. Instead of household equity financing, it works a lot more like a charge card, allowing you to withdraw loans as needed while in the a flat months, that have sometimes repaired otherwise variable interest levels.