Changing your budget to settle your residence collateral loan before was a proper disperse which can reduce the number of appeal your pay throughout the years, raise your household security less and provide savings fundamentally.

Because benefits associated with this strategy are clear, you need to take into account the risks. Changing your budget to possess very early fees requires mindful likely to make sure it will not adversely feeling your overall monetary stability. A balanced position is assist you, working for you generate an informed choice you to aligns with your financial specifications.

Attention Deals: Expenses the loan regarding very early can be significantly reduce the overall attract paid over the life of the borrowed funds.

Liquidity Limitations: Using dollars to repay the loan early you are going to restrict your readily available cash getting issues or any other opportunities.

Improved Home Security: Paying off the borrowed funds develops your own residence’s equity, that is beneficial if you intend to offer otherwise re-finance.

Settling your house guarantee loan very early can offer big monetary and mental experts. Yet not, weighing this type of up against potential drawbacks for example prepayment punishment and also the effect on your exchangeability and you may resource opportunities. Controlling this type of things allows you to create choices one align which have your current financial desires.

Wise Budget Customizations to own Early Family Guarantee Financing Installment

Deciding to pay-off your house guarantee mortgage early are a good good action towards financial liberty. Changing your financial allowance while making this possible demands proper transform, not merely wishful thought. Listed below are five actionable ideas to make it easier to spend some extra cash into the your house collateral loan repayments:

Opinion Recurring Subscriptions

Test out your month-to-month subscriptions and you can memberships meticulously. Terminate one that you rarely play with otherwise perform as opposed to. Redirecting these types of loans to the your loan repayments can be notably shorten your payment months.

Boost Earnings which have Front side Hustles

Believe using up self-employed work, a part-time loans Littleville employment otherwise attempting to sell empty items. The extra earnings made will likely be loyal completely so you’re able to reducing your financing harmony shorter.

Implement a spending Freeze

Temporarily halt using in one single discretionary group per month, for example activity, eating at restaurants or looking. Allocate the cash it can save you from this freeze on the loan fees.

Have fun with Bucks Windfalls Intelligently

Lead people unanticipated earnings towards your loan, including taxation statements, works bonuses otherwise monetary merchandise. These types of swelling figures can have a hefty impact on cutting your loan harmony.

Explore Various Budgeting Steps

Including additional cost management processes prioritizing financing installment, such as the Envelope Program, the place you spend some repaired cash number a variety of purchasing kinds, can help perform changeable expenditures. Zero-founded cost management is an additional active strategy, making sure all dollar you have made was tasked a certain mission, together with additional financing money.

Your actively progress into the very early financing payoff with these procedures, guaranteeing most of the dollar on your finances is actually working towards achieving the financial liberty. The brand new adjustments can be speed how you’re progressing towards repaying your home guarantee mortgage and you may foster models one to improve your full economic better-are.

Options to Paying off your house Equity Financing

Often, the first plan for your home security mortgage percentage may well not match your latest problem. Maybe debt factors has changed, otherwise you receive a more favorable interest rate somewhere else. In these cases, seeking to possibilities could possibly offer monetary rescue or best terms. These could make it easier to manage your payments better or conserve profit tomorrow.

Let us explore certain alternative fees choice. Each even offers a different method to dealing with the loan, probably aligning greatest with your latest economic requires and disease.

Refinancing Your property Security Loan

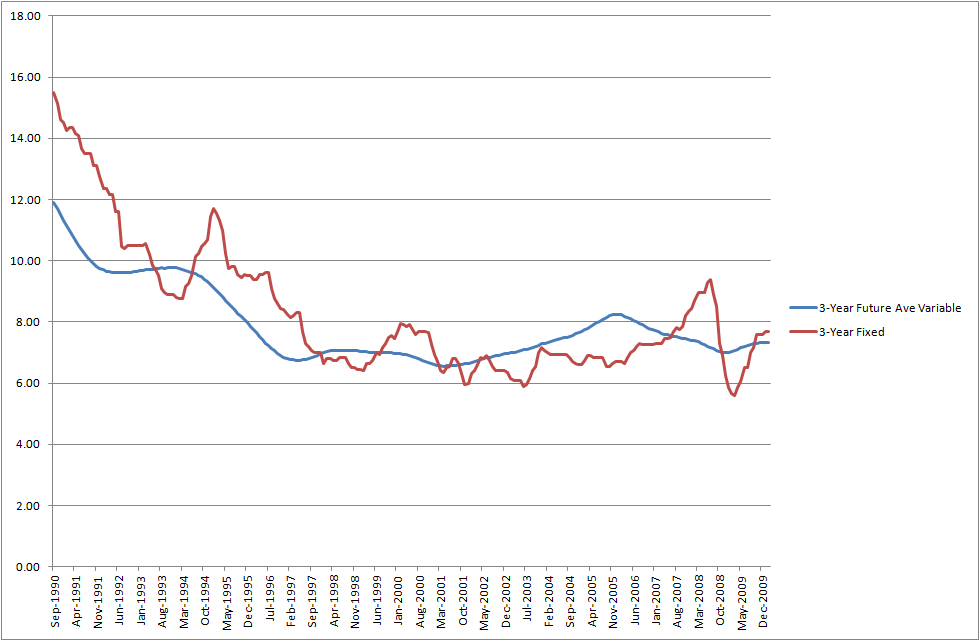

Refinancing a property collateral loan means replacement your mortgage with another type of you to, commonly with assorted words. It could be a sensible disperse when your financial situation has changed, particularly in the event the interest rates have decrease plus credit rating have increased because you grabbed your unique loan. Refinancing the loan can help you rating all the way down monthly premiums otherwise a shorter financing name.