Once you’ve home financing, you may be caught inside for a long time, right? Not. You are capable re-finance the financial that have terms and conditions you to definitely operate better to suit your condition.

Before you could jump within the, no matter if, it is vital to know how refinancing mortgage functions and you will just what it may cost your. Let’s check out the process.

Tips

- Refinancing a mortgage changes your current home loan with a new home loan.

- Less payments will be more straightforward to build, however, commonly prolong the amount of time you’re in debt.

- Refinancing to a smaller label could save you profit the new longer term, however you will make large payments.

What is mortgage refinancing?

Refinancing a mortgage functions by replacing your mortgage with a good new one. In lieu of changing the new terms of your current financial, you earn a totally the financing. Your loan-the financial refinance-takes care of your old home loan.

Once you’ve the new mortgage, you begin and work out costs thereon mortgage. Based on your role, your new home loan may possibly cover people 2nd mortgages otherwise family equity lines of credit (HELOCs). You will be capable link all of your current mortgage loans-and even combine almost every other a great personal debt-with the one to brand new mortgage owing to refinancing.

How come refinancing works?

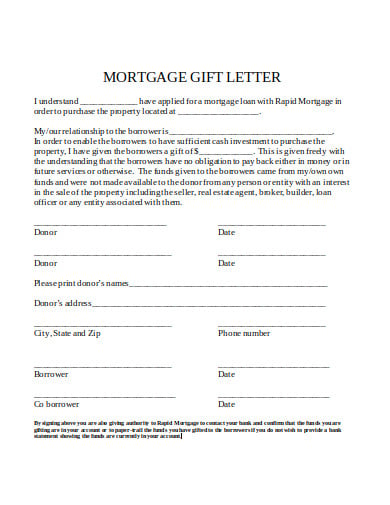

Refinancing needs something just like having your completely new home loan. You’re going to have to sign up and you may undergo a credit take a look at. As well as, you’ll want to bring proof earnings and identity, exactly like that which you given during your brand-new home loan app.

- A lesser interest rate, and thus all the way down monthly payments (all else being equal).

- A shorter loan title, if you choose.

- A chunk of money you need (if you get a cash-out re-finance-on you to less than).

Once you re-finance, you also need getting prepared for charge. Just as your own totally new financial was included with costs, their refinance might feature additional can cost you. (Note: Particular refinancing pitches will say to you it is complete free-of-charge to you personally, yet the costs was buried someplace else. Discover even more below.)

What is actually cash-out refinancing?

Cash-away refinancing is a type of home loan refinance that allows you so you’re able to use more your current mortgage equilibrium and sustain this new differences.

Such as for instance, guess you owe $250,000 in your current mortgage. Your residence appraises having $400,000. You decide on an earnings-aside refinance. In some instances, you should buy an earnings-away refinance one to makes you that have 20% equity of your home (80% loan-to-value, otherwise LTV).

And in case you’d like that restriction LTV mortgage, during the closure, $250,000 could be familiar with pay off the have a glimpse at this weblink first home loan, and the a lot more $70,000 will be given to you personally (once more, minus one settlement costs and you may charge recharged by the financial). You’ll then beginning to build costs thereon number.

You can make use of you to $70,000 for anything you wanted, should it be financing your infant’s college or university, reducing credit card debt, or paying for a wedding.

Discover, even when, that once you get a cash-away refinance, you happen to be with your where you can find secure any it is you only pay to possess. If you cannot generate repayments afterwards, you might eradicate your residence. Make sure to are able to afford the repayments and this the have fun with of money is practical for your economic goals one which just flow give.

Should i re-finance my domestic?

You’ll find additional conditions to adopt whenever deciding whether you should re-finance your residence. Refinancing mortgage has many advantages, however you need to make sure they make along with your desires. Listed below are some well-known reason why some body re-finance their homes.

Straight down interest. Among the best reasons why you should re-finance should be to lower your interest rate. When you yourself have a varying-rates mortgage, refinancing to a predetermined rates helps you avoid develops so you’re able to your own payment if the cost are on the rise.