With regards to the USDA, a way to obtain dilemma for the majority of prospective borrowers is the statement ‘Rural in character’ and you may what this implies. It consider elements having an inhabitants occurrence of or below 1,000 individuals for each rectangular distance outlying.

However, the newest USDA takes into account local issues when making their choices, so you may still meet the requirements although Yahoo tells you one the town drops away from area regarding qualifications.

There is certainly the newest company granting funds to consumers into the elements which might be an element of the MSA or has actually populations over thirty-five,000 should the urban area owners that have reduced to help you moderate profits deal with issues accessing mortgages or if the metropolis has a rural profile.

Note: After the day, it’s always well worth finding the time to ascertain whether our home you need to get is founded on an effective USDA-accredited town, since standards may well not always trigger obvious conclusions

Income Constraints

Among the overriding specifications of your own USDA should be to render consumers which have low so you can reasonable income the opportunity to very own its individual house.

As a result, the fresh USDA functions in a different way from other financing programs in this around are earnings limits otherwise constraints one decide how much a borrower can secure when you’re however are entitled to loans from their store.

Married borrowers are certain to get each other its profits scrutinized, but is always to one of those make application, upcoming merely its pointers otherwise credit rating would-be believed.

Qualification Earnings – An effective household’s total money including the amount of money of any college students who will be generating a full time income even though they are nevertheless dependents.

- Adjusted Qualification Income – This will be an excellent household’s income after one deductions are available.

Qualifying Money

Just as its for almost all home loan designs, this course of action requires the entry out of an applicant’s most recent income while the proof of their capability to expend straight back the bucks it would you like to so you can borrow.

Eligibility Money

This new USDA considers the fresh revenue of all somebody staying in a beneficial domestic, in spite of how dated he’s. For a wedded couple that have a working 20-year old youngster managing them, the qualifications would-be calculated just after including their earnings.

Adjusted Qualifications Income

This is the finally planning from potential loan providers while they glance at software. The fresh new USDA offers lenders the ability to deduct particular expenditures off borrowers’ home incomes.

$480 for each disabled adult otherwise slight youngster that is good co-borrower, non-borrower, which can be perhaps not the fresh partner of your borrower.

$eight hundred for borrowers or co-borrowers more than a couple of years old, even though this deduction may only be reproduced after for each and every home mortgage.

- Medical expenses that comes to around 3% of the full family money, costs connected with one home member’s handicap, or if brand new borrower is an elderly resident.

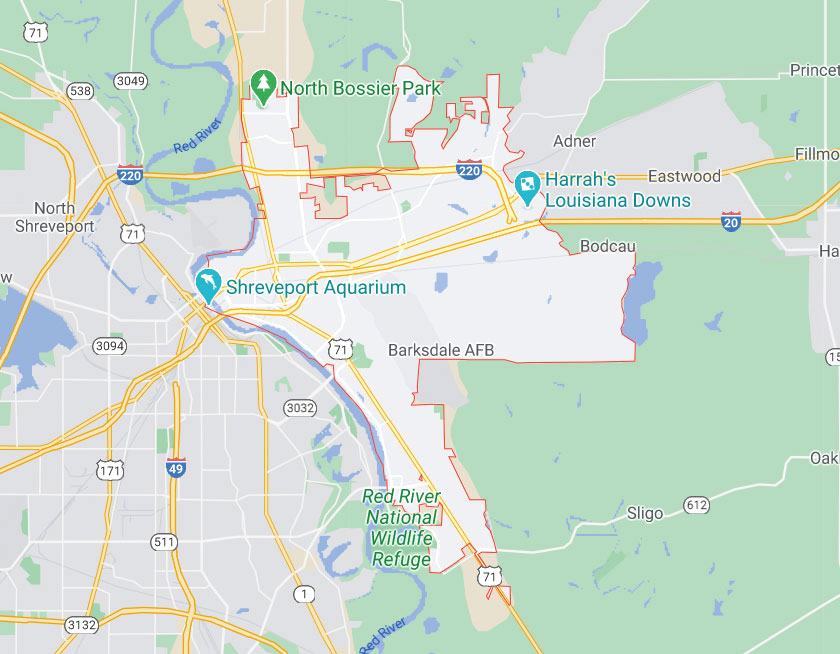

As the money limitations decided by geographical place, you may find that eligibility changes because you believe some other components for the property pick.

When the, instance, you wish to buy a house close to the City of Oklahoma utilizing a good USDA Protected Loan, you might face a living limitation out-of $91,000.

At exactly the same time, for people who check for a property near Irvine, California, this may significantly switch to $156,250 considering the highest homes will set you back.

To decide even when you qualify for USDA fund Hudson installment loans according on their domestic money standards, you can check out its condition-by-condition range of income criteria.

And also make one thing easier, simply click your particular county towards the chart so you’re able to diving in order to the relevant a portion of the checklist in place of scrolling from whole record.